While the recent rate-driven boom in production is heartening for lenders, the limited response when it comes to home purchases is a concern.

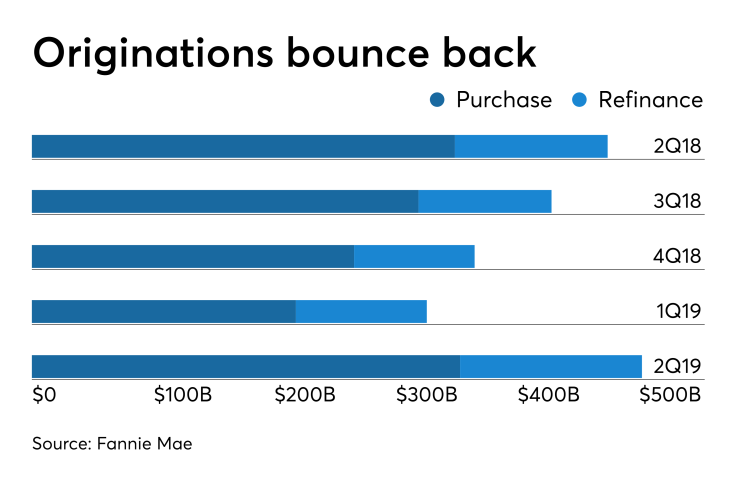

On a year-over-year basis, refinances were up by 19% in the second quarter but purchase loans were up by only 1%, according to Fannie Mae.

"We estimate that 35% of outstanding mortgages are now 'in the money,' meaning borrowers may realize significant cost savings by refinancing; as such, we expect the share of refinance originations to grow through the remainder of the year," Doug Duncan, Fannie's chief economist, said in a press release. "However, while existing homeowners may be able to enjoy the benefits of lower interest rates, many would-be homeowners, and the purchase mortgage market, generally, remain unable to capitalize on the favorable rate environment due to the chronically limited supply of homes."

Yet purchase mortgages continue to account for the bulk of originations in the market. Purchase loans totaled $353 billion during the second quarter, compared to $150 billion in refinancing, according to Fannie Mae.

The lower rates are providing some housing market stimulus in that they help counter affordability concerns, but they also reflect growing worries about economic weakness that could affect consumers' decision to purchase a home.

"The persistent trade tensions between the U.S. and China threat to further reduce business investment, disrupt equity markets, degrade household wealth and diminish consumer spending," Duncan said.

However, if lower rates work as intended, they could help offset these alarms.

The purchase market isn't entirely unresponsive to them. Gains seen during the second-quarter home buying season were relatively stronger than those in the first quarter.

Fannie's numbers suggest the increase in overall origination between the two quarters was nearly 54%, and second-quarter calculations by accounting and advisory firm Richey May show the average increase was 65%.

Third-quarter originations will likely at least match or be a little higher than second-quarter originations, based on Fannie Mae's forecast and Richey May's analysis of unfunded loans in lenders' pipelines. Fannie is forecasting a more than 12% increase in year-over-year volume for 2019.

Another benefit of interest rate reductions, increased refinancing and more volume is a lower cost to originate, according to Richey May. Relative to the first quarter, this dropped by more than $1,700 per loan. However, given higher costs in the weaker first quarter, expenses during the first half of the year were about the same as they were a year ago.

Lenders' profit margins are improved compared to a year ago, but aren't as strong as they were in earlier years, due in part to lower secondary market gain-on-sale and servicing portfolio values, Richey May finds.

The