-

Robert G. Cameron, a former official at the Pennsylvania Higher Education Assistance Agency, will succeed Seth Frotman as the bureau's point person on student lending complaints.

August 16 -

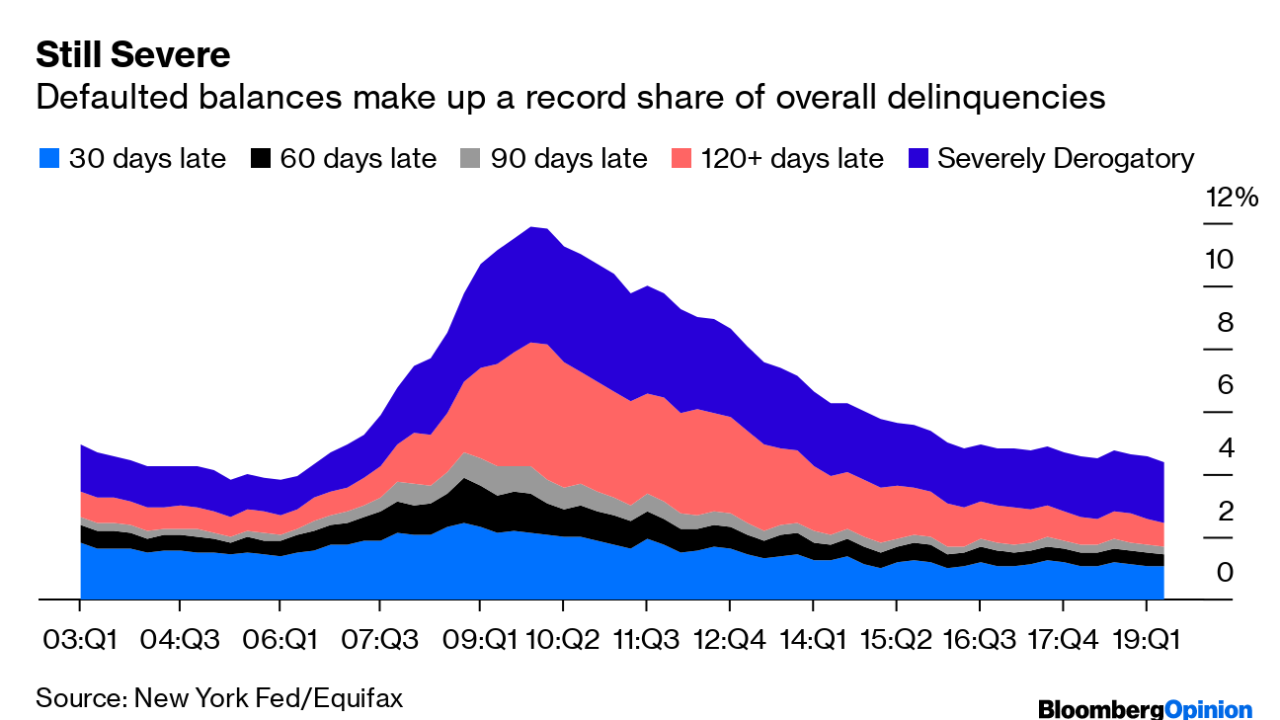

Of the roughly $250 billion severely derogatory outstanding balance, defaulted student loans make up 35%, a New York Fed report found. That’s a new phenomenon.

August 14 -

Borrower debt continues to rise, late payments are up and interest rates are at their highest levels since at least 1994. A new report raises questions about the sustainability of the card industry's boom.

August 13 -

The Democratic presidential candidate argued in a blog post that the U.S. could avoid a recession by canceling most student debt and authorizing regulators to more aggressively monitor leveraged lending.

July 22 -

The executives were hired for their focus on loan origination, portfolio management and securitization.

June 17 -

The collateral will include $147.3 million in well-seasoned loans that were part of HESAA’s 2009 issuance, as well as up to $155 million in new loans that the trust will originate through an Oct. 31, 2020 prefunding and recycling period for the next academic calendar year.

May 28 -

It’s no coincidence that with more than half of consumers ages 20 to 29 now holding credit cards — up from 41% in 2012 — 90-day delinquency rates are at a seven-year high, according to the New York Fed.

May 14 -

Navient Corp. is returning to all fixed-rate collateral for its next securitization of refinanced private student loans issued via its Earnest affiliate to high-earning college graduate professionals.

May 1 -

Democratic presidential candidate Elizabeth Warren proposed eliminating student-loan debt for an estimated 42 million Americans with a wealth tax

April 22 -

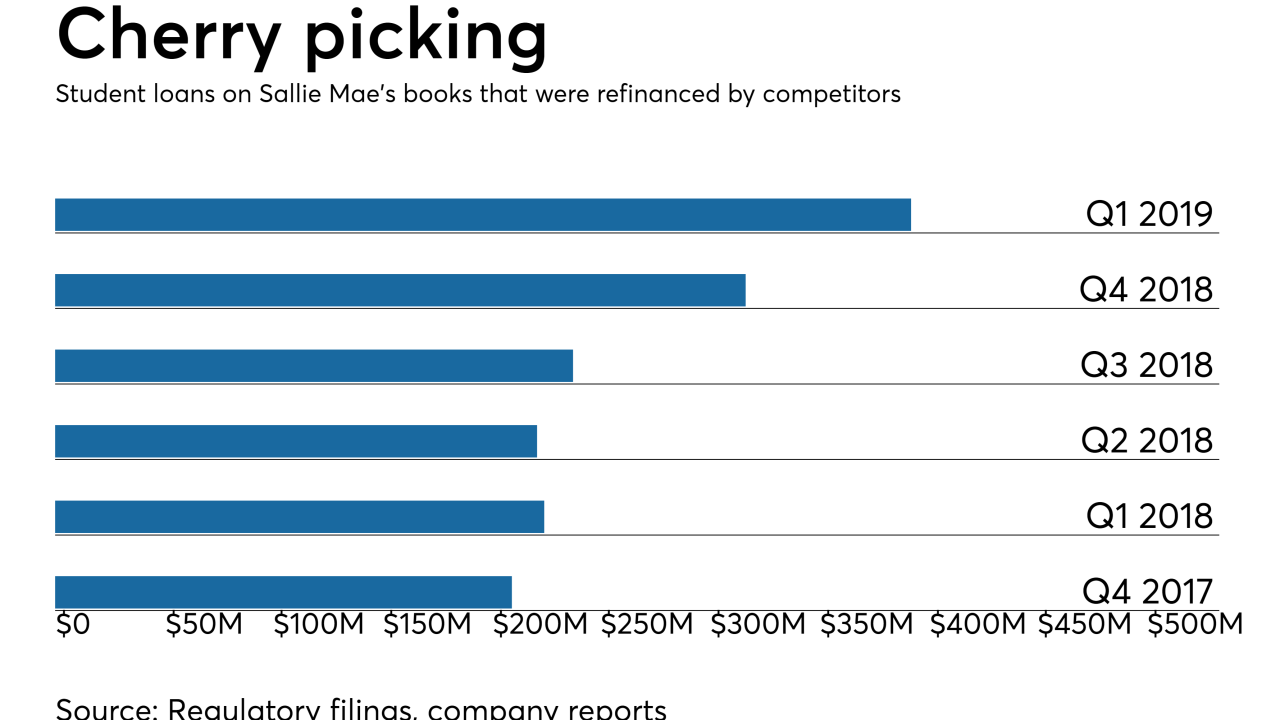

SLM Corp. wants to "target the people our competitors are targeting and bring on their federal balances" CFO Steven McGarry said during an earnings call.

April 18 -

Measures of loan performance were generally better than expected at Ally, American Express, Synchrony and Sallie Mae. Their 1Q reports suggest that consumers remain able to meet their obligations despite a long run-up in debt.

April 18 -

The lawmakers are questioning the agency about its oversight of student loan servicers involved in a federal loan forgiveness program.

April 5 -

Susan Ehrlich, the fintech lender's new chief, discusses what she learned working at Amazon and Simple and how her firm is approaching consumer loans differently.

March 22 -

The bureau's director, Kathy Kraninger, faced a barrage of criticism from Senate Democrats on the agency's lack of enforcement actions, a reversal on Military Lending Act examinations and changes to the payday loans rule.

March 12 -

Since most U.S. securities transactions are subject to New York law, it could be expedient to pass legislation defining Libor as SOFR plus a spread, says David Bowman, special adviser to the Fed.

February 26 -

Libor’s demise poses significant problems for outstanding floating-rate securities that are pegged to the benchmark; SFIG wants to make it easier to amend deals.

February 26 -

While student, auto and credit card balances are at or near record levels, housing debt is shrinking, credit quality is weakening a bit and lending standards, at least in some sectors, are tightening.

February 19 -

Navient Corp. shares surged after Canyon Capital Advisors said it could boost a $3.1 billion takeover offer that was rejected by the student-loan servicer.

February 19 -

Barclays, BMO, Citibank, Goldman Sachs and ING contributed to the online student lender, which last year made over $1 billion in loans.

February 14 -

Now that the noncompete has expired, Navient plans to market private student loans to borrowers in school; the servicing giant is also free from restrictions on marketing refinance loans through Earnest.

January 23