After years of downplaying the threat of refinance student lenders, SLM Corp. is developing its own product targeting borrowers who have advanced degrees and high-paying jobs. And the company plans to sell these loans, rather than keep them on balance sheet.

On a conference call to discuss first quarter financial results, Chief Financial Officer Steven McGarry said SLM, better known as Sallie Mae, intends to roll out a “more defensive strategy” in the second half of the year. “What we would like to do is build a real high-quality and accurate targeting model, and our goal will be to target the people that our competitors are targeting and to bring on their federal balances,” McGarry said.

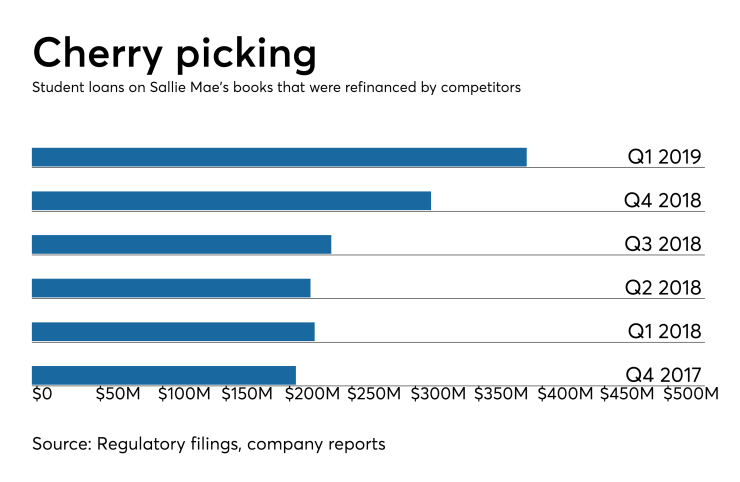

The move comes as refinance lenders, including Navient Corp., which was spun out of Sallie Mae in 2014, are taking an increasingly bigger bite out of Sallie Mae’s student loan portfolio. Loans on the company’s balance sheet that were “consolidated” by other lenders rose 23% in the first quarter to $392 million from $317.5 million in the fourth quarter of 2018. And the fourth quarter figure was up 34% from the third quarter of 2018. The figures include both private student loans and federally guaranteed student loans.

Sallie Mae’s portfolio continues to grow as it makes new loans to student still in school. Originations rose to $2.1 billion in the first quarter, up 8% on the first quarter of 2018. Its total private student loan portfolio now stands at $21.6 billion, up 16% on the year. The company puts its own share of the private student loan market at over 50%.

Nevertheless, refinance lenders are cherry picking some of Sallie Mae’s most creditworthy borrowers. By underwriting loans to the borrowers’ current income and assets, they are able to offer lower interest rates than the borrowers could get when they were still in school.

The competition includes both nonbanks such as Social Finance and CommonBond and banks including Citizens and KeyCorp (which acquired Laurel Road last year). And since a noncompete expired on Jan. 1, Navient has also been able to offer refinance loans to Sallie Mae’s borrowers through its Earnest unit.

Participants on the conference call were, naturally, curious whether Navient was responsible for the latest jump

Sallie Mae CEO Raymond Quinlan acknowledged that consolidations were higher than the company anticipated. But he reiterated his view that many refinance lenders are not making money at it. “We don't see this threatening and we think that the participants are highly variant as well as highly transient from what we can see over the past couple of years,” the CEO said. He added that consolidations were down from January to February and from February to March.

McGarry also declined to say which refinance lenders were taking the most business from Sallie Mae. He noted that borrowers being targeted would probably have paid their loans off early had they not consolidated.

“These are typically people that whether or not they get consolidated by one of the fintech players, these are people that are getting jobs at the accounting firms and the investment bankers that is where they are marketed to,” the CFO said. “And quite frankly, these people are going to repay in year two or three if they don't repay in year one. So defensive strategies have to be built with that in mind.”

He said Sallie Mae would likely fund the refinance loans it plans to roll out the same way that several of the nonbanks do, by “selling them into the marketplace,” rather than retaining them on balance sheet, which he said would dilute the company’s return on equity.