-

GoodLeap 2023-2 has loans with fewer 25-year terms and higher FICO scores generally. Together, they'll have lower expected loss rates than those with longer terms and lower FICO scores.

May 5 -

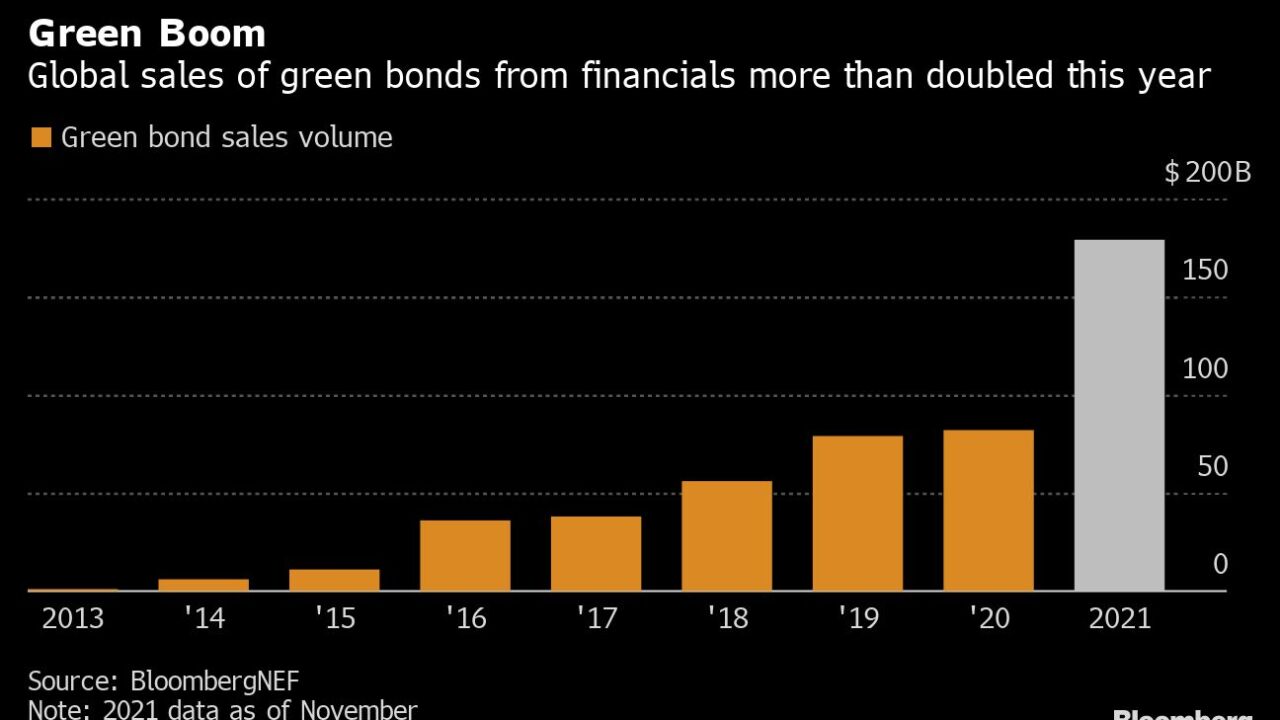

Arrangers and analysts aren't predicting a return to the exponential growth of the past decade that turned a fringe concept into a $5.6 trillion asset class.

December 21 -

The single-family rental industry is slowly making its homes more energy-efficient. About 21% of total US energy consumption last year came from residential energy use.

October 4 -

A growing chorus of auditors, researchers and climate activists warn that the numbers provided by bankers offer an exaggerated picture of their role in fighting climate change.

December 22 -

Citigroup Global Markets is lead underwriter on the fourth issuance through Toyota’s ABS Green Bond program. The deal references two potential pools to be securitized.

June 4 -

JPMorgan Chase and Loop Capital Markets have submitted pitches suggesting ways to structure $1 billion of bonds that Governor Gavin Newsom proposed to build vehicle charging stations

March 24 -

Issuance of securitizations backed by these loans is becoming more dependable, and Fannie will need more mortgages that finance newly-built energy-efficient homes to keep it going.

February 1 -

The volume of Ginnie securities issued in December marked the first time more than $80 billion has been issued in a month.

January 11 -

The European Union's first social bond sale, totaling 17 billion euros, was 14 times oversubscribed, meaning the EU could have sold 200 billion euros worth of bonds. That indicates a market that’s structurally underserved.

October 22 -

The net share of mortgages in Ginnie Mae securitizations with suspended payments appears to be stabilizing, but the number of new requests creates doubt about whether it will subside.

September 29