-

The net share of mortgages in Ginnie Mae securitizations with suspended payments appears to be stabilizing, but the number of new requests creates doubt about whether it will subside.

September 29 -

The percentage of borrowers who have asked to temporarily suspend payments due to coronavirus-related hardships is down overall, but in the Ginnie Mae market, they're still inching up.

September 21 -

Also the Federal Housing Administration, which is a key contributor of government-insured loans to Ginnie securitizations, recently set new conditions on mortgage applicants that have been in forbearance.

September 14 -

Ginnie Mae helped to fund more than $70 billion in loans aimed at helping low- and moderate-income borrowers in July.

August 10 -

After receiving a third-party stamp of approval, Fannie Mae announced July 27 completing the latest two issuances of a single-family green mortgage backed security as part of an ongoing program that started in April and expands its long-time multi-family green MBS program.

July 28 -

Recent good fortunes for lenders such as Loanpal and Sunnova reflect what will could be a solid year for solar-panel loan originations and securitizations, despite the economic impact of the coraonvirus pandemic on markets and consumer spending.

June 3 -

Ginnie Mae will begin taking requests for assistance from issuers who, having exhausted all other options, are having trouble advancing borrowers' principal-and-interest payments to investors amid the pandemic.

April 11 -

Businesses are struggling to adapt to remote work, according to a new survey by Arizent, the parent company of Employee Benefit News.

March 30 -

The Trump administration proposes cutting personnel and other budgetary items at the bureau, while the agency’s director — who controls the purse strings and was hand-picked by the administration — aims to boost spending and hire more employees.

February 20 -

The city is folding together separate syndicate and advisor teams on $1.2 billion of general obligation and Sales Tax Securitization Corp. refunding deals.

December 10 -

The more than $44 billion in new Ginnie Mae mortgage-backed securities that came to market in June marked the strongest month for the government bond insurer in more than two years.

July 11 -

Rating criteria changes and a ruling in the Puerto Rico III case have undermined some investors' and analysts' confidence in revenue pledges.

June 10 -

The comptroller, now a year and a half on the job, discusses his attempts to revamp the supervision process for national banks and make the agency run more efficiently.

May 19 -

Assured Guaranty indicated it is interested in reaching a deal on PREPA bonds rather than continuing its quest for a PREPA receiver.

April 10 -

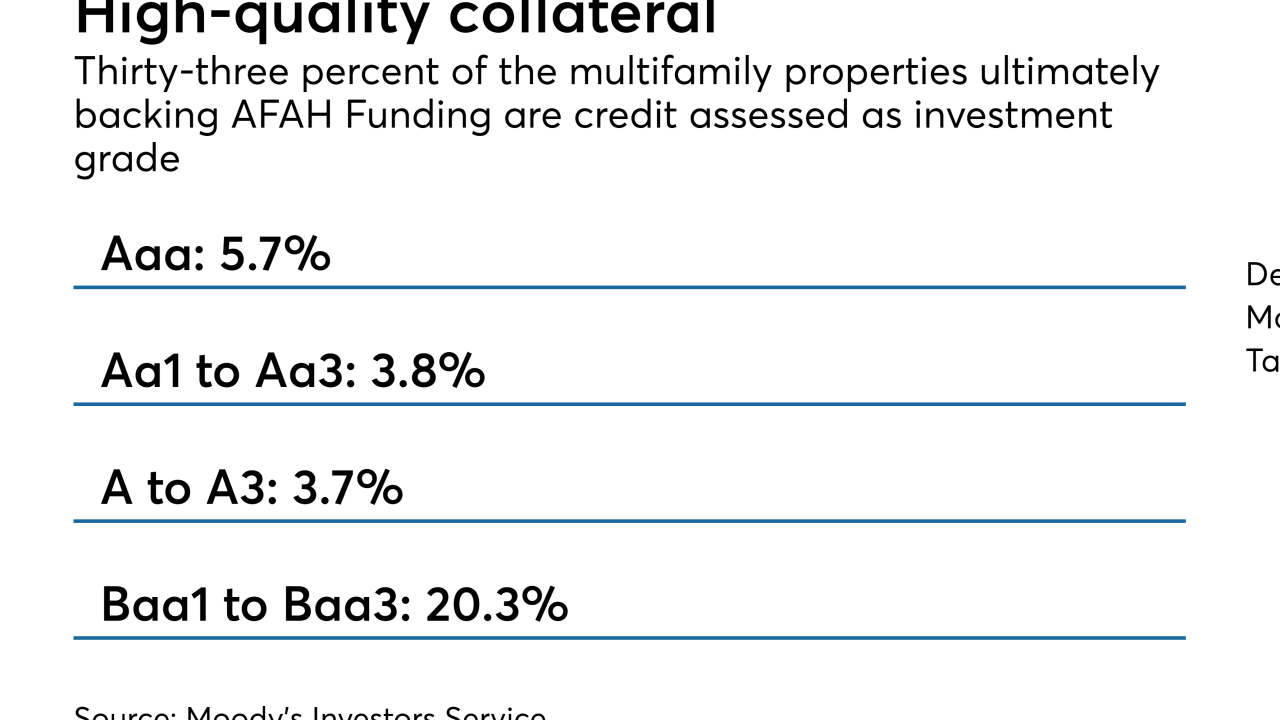

AFAH Funding is not your typical CRE CLO: It is backed by entirely by long-dated mezzanine interests in multifamily properties that are eligible for low-income housing tax credits.

December 24 -

Chicago officials say the city will complete its $3 billion securitization program with a $600 million deal as soon as January.

November 19 -

The backloaded maturity schedule of the debt brings comparisons to the city's supposedly abandoned "scoop-and-toss" practices.

October 29 -

PACE Funding Group, based in Los Gatos, Calif., recently obtained a $55 million line of credit from SunTrust Bank and Rosemawr Management and is gearing up for its second securitization later this year.

August 21 -

New securitizations backed by reverse mortgages are now at a low not seen in two years, signaling that higher volumes seen in recent months may be tapering off.

June 18 -

Issuance of Ginnie Mae securities backed by reverse mortgages rose above $1 billion for the second time in two years, according to the government agency's latest monthly report.

March 20