-

The city is folding together separate syndicate and advisor teams on $1.2 billion of general obligation and Sales Tax Securitization Corp. refunding deals.

December 10 -

The more than $44 billion in new Ginnie Mae mortgage-backed securities that came to market in June marked the strongest month for the government bond insurer in more than two years.

July 11 -

Rating criteria changes and a ruling in the Puerto Rico III case have undermined some investors' and analysts' confidence in revenue pledges.

June 10 -

The comptroller, now a year and a half on the job, discusses his attempts to revamp the supervision process for national banks and make the agency run more efficiently.

May 19 -

Assured Guaranty indicated it is interested in reaching a deal on PREPA bonds rather than continuing its quest for a PREPA receiver.

April 10 -

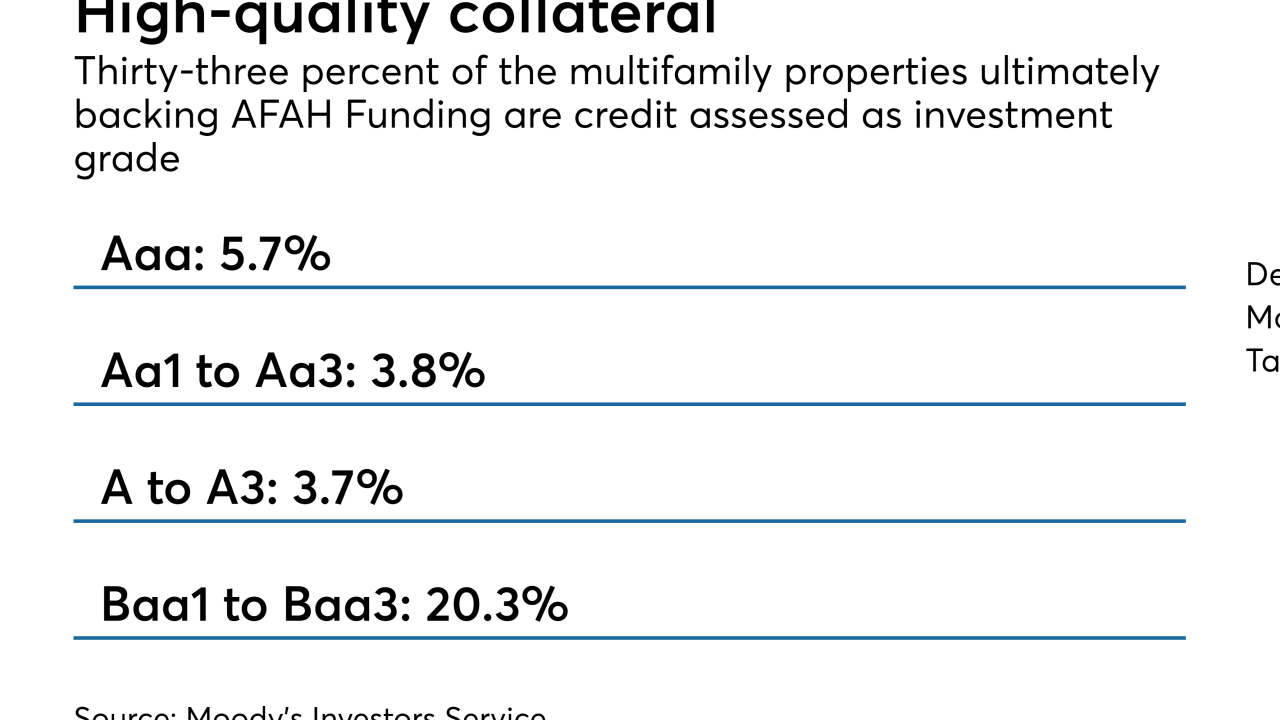

AFAH Funding is not your typical CRE CLO: It is backed by entirely by long-dated mezzanine interests in multifamily properties that are eligible for low-income housing tax credits.

December 24 -

Chicago officials say the city will complete its $3 billion securitization program with a $600 million deal as soon as January.

November 19 -

The backloaded maturity schedule of the debt brings comparisons to the city's supposedly abandoned "scoop-and-toss" practices.

October 29 -

PACE Funding Group, based in Los Gatos, Calif., recently obtained a $55 million line of credit from SunTrust Bank and Rosemawr Management and is gearing up for its second securitization later this year.

August 21 -

New securitizations backed by reverse mortgages are now at a low not seen in two years, signaling that higher volumes seen in recent months may be tapering off.

June 18 -

Issuance of Ginnie Mae securities backed by reverse mortgages rose above $1 billion for the second time in two years, according to the government agency's latest monthly report.

March 20 -

The New York State Energy Research and Development Authority is marketing its fifth transaction financing local residential solar-panel installations; all of the notes carry an A rating from Kroll.

March 6 -

The single-B rated company is facing a large cash requirement as it ramps up production of its Model 3; but leases backed by electric vehicles pose additional risks for investors in asset-backeds.

January 26 -

A pre-marketing wire on the Sales Tax Securitization Corp.'s $366.2 million of tax-exempts indicates the Chicago deal may see wider spreads than in its bond sale last month.

January 22 -

Bridgeview, Illinois is the second Illinois home rule community to take advantage of new borrowing program.

December 20 -

The Railsplitter Tobacco Settlement Authority will price a $679 million current and advance refunding of tobacco bonds.

December 18 -

The council is exploring legislation to collect around $492 million in delinquent real estate taxes that could aid the city’s school district.

December 14 -

HUD's decision to stop endorsing Property Assessed Clean Energy will have little impact; the widest segment of FHA borrowers "would not qualify anyway."

December 11 -

The new deal is smaller, at $130.1 million, and the collateral is almost entirely of PV systems financed through third-party loan agreements.

December 5 -

Strong legal and structural protections earned the debt top grades from Kroll and Fitch. S&P wasn't as bullish.

November 2