Issuance of Ginnie Mae securities backed by reverse mortgages rose above $1 billion for the second time in two years, according to the government agency's latest monthly report.

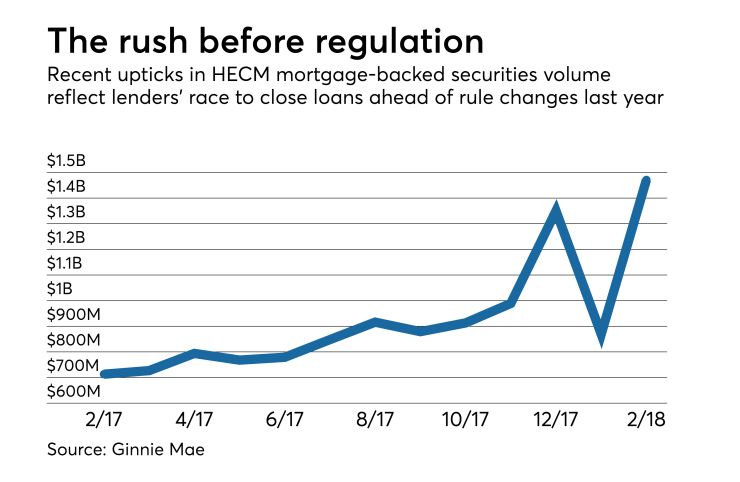

Ginnie Mae mortgage-backed securities backed by Home Equity Conversion Mortgages totaled $1.47 billion during February, up from $869 million the previous month and up from $713 million in February 2017. HMBS issuance last rose above $1 billion in December 2017, when it totaled $1.35 billion.

The recent spikes in HMBS volume reflect a

"There was a run-up in applications prior to Oct. 2 with the reg changes. Any time there's a major change, we see a spike in applications, which means a spike in closings and a spike in endorsements. That's exactly what you're seeing," she said.

HMBS issuance could lapse in subsequent months, reflecting the period when the new rules took effect and loan volumes waned, said Peel. But originations and issuance in the reverse mortgage market is likely to bounce back at some point after lenders and investors become more accustomed to new rules.

In addition to recent originations, seasoned collateral that has become available also is contributing to the recent increases in HMBS volume, said Michael McCully, partner at consultancy New View Advisors.

Total Ginnie Mae issuance in February was more than $33.2 billion, down slightly from $34.4 billion during the same month in 2017 and more than $36.4 billion in January of this year.

Overall, Ginnie Mae issuance is fairly stable but hasn't risen above $45 billion since December 2016, when it totaled $46.3 billion.