-

The number of properties in limbo is up 10.3% from the same time last year, according to Attom Data Solutions.

February 24 -

An uptick in pandemic-related payment suspensions reflecting new or restarted plan activity previously occurred as the omicron variant spread, but activity has since subsided.

February 7 -

However, the seven institutions in the Office of the Comptroller of the Currency study service 13% fewer loans compared with the third quarter of last year.

December 10 -

While over 112,000 loans exited plans in the past week, there is only a modest opportunity for continued improvement in the near term, Black Knight said.

December 10 -

Axylyum, which recently released information about its first named client, offers an alternative to other forms of risk sharing for private companies originating income-producing mortgages.

December 2 -

Like the stock market rout around news of the Omicron variant, the recent increase in payment suspensions suggests financial troubles associated with the pandemic may not be over.

November 29 -

The decline in late payments recorded in a trade group survey raise hope that many servicers will bear up under a wave of tighter enforcement coming from regulators.

November 10 -

Following the federal moratorium’s end, the number jumped, marking the highest quarterly growth on record, according to Attom Data Solutions.

October 14 -

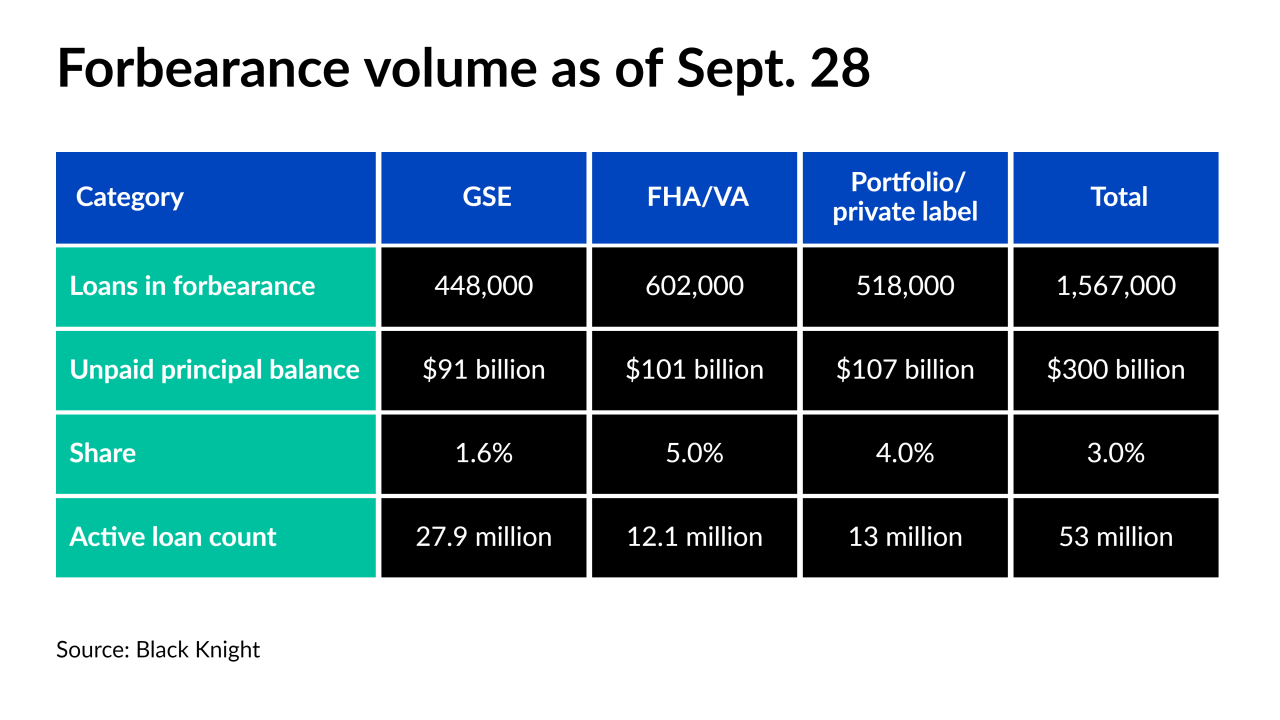

Although over 1.5 million forborne borrowers remain, a fifth could exit their plan in the next week, according to Black Knight.

October 1 -

The end of many COVID relief plans in September have the industry holding its breath, with outcomes potentially foreshadowing the months to come.

August 27 -

The overall pace of both entries and exits slowed, even as the private-label securities and portfolio loan segment saw a spike in its numbers.

August 23 -

Late payments on office loans have trended upward recently, but longer lease periods may mitigate the potential for distress in that sector, the Mortgage Bankers Association said.

August 5 -

The number of people exiting pandemic-related payment suspensions starting in September will be daunting to process, according to a Black Knight report published Monday.

August 2 -

Concerns about foreclosure and a crowded market led to an increase in listings at lower price points in the second quarter.

July 30 -

The relatively low share of borrowers who were distressed in June adds to signs that the offramp from government relief measures may not lead to an overwhelming wave of foreclosures.

July 22 -

The meager increase suggests the largest boost in inventory possible would likely still leave the backlog of homes on the market at historic lows.

July 21 -

The return of more normalized numbers for two key players in the home loan market could be the lead-up to a wave that’s been anticipated since the coronavirus arrived.

July 14 -

Those handling loan modifications anticipate a growing secondary market for loans in forbearance as they budget cautiously for additional alterations of regulations down the road.

July 14 -

The change makes it easier for borrowers exiting forbearance to get access to home retention options that might otherwise be out of reach due to skyrocketing home prices.

June 30 -

Fewer borrowers are suspending payments for pandemic hardships but some who got back on track are having trouble again, and deadlines could spur a final round of new requests.

June 28