-

The COVID-19 pandemic’s longer-term impact on residential mortgage-backed securities remains uncertain, but for now DBRS Morningstar’s outlook for the residential property assessed clean energy asset-backed securities sector remains stable.

June 25 -

For banks with assets between $10 billion and $100 billion, the average exposure is 165% of capital.

June 24 -

A new CFPB rule will expedite the forbearance and loss-mitigation process for consumers suffering financial hardship from the pandemic.

June 23 -

Activity in the Paycheck Protection Program has waned, but some argue that many small businesses, especially those owned by minorities, will miss out if the June 30 application deadline isn't extended.

June 19 -

Compared with the week prior, approximately 57,000 fewer loans from all investor types were forborne.

June 19 -

Potential sales last month rose compared with April as homes became more affordable due to low mortgage rates.

June 18 -

The inability of Democrats and Republicans to agree on a chairperson and lack of sufficient personnel have made it harder for the commission to do its job — hold Treasury and the Fed accountable for implementing the coronavirus relief law, observers say.

June 18 -

The FHFA and FHA both announced for the second time that they were delaying the freeze to protect borrowers and renters during the coronavirus pandemic.

June 17 -

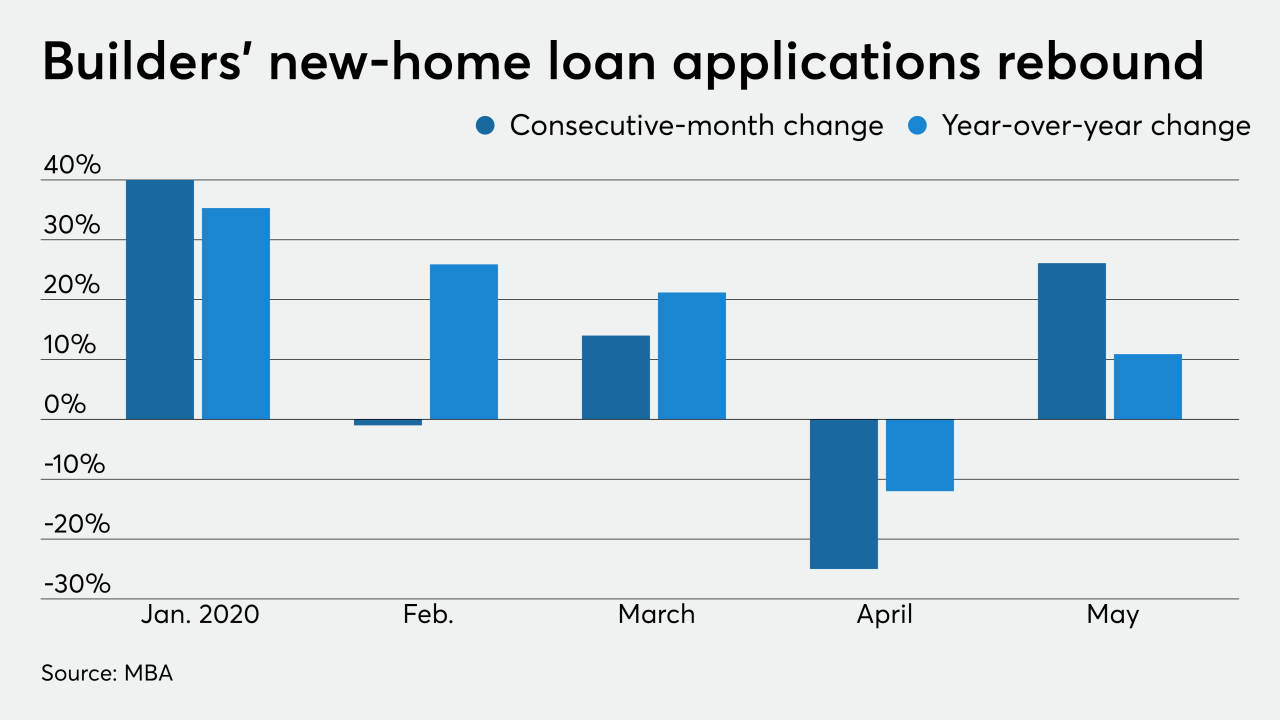

The availability of some loans used to build homes dried up due to the coronavirus. Opening up the economy may help if it doesn't lead to a spike in infections, and if consumer demand persists.

June 16 -

The Fed chairman updated senators about the agency's new credit facility for midsize firms struggling in the pandemic. He also left open the possibility of additional stress tests to gauge the industry’s coronavirus response.

June 16 -

The number of loans going into coronavirus-related forbearance ground down to a growth rate of 2 basis points between June 1 and June 7, according to the Mortgage Bankers Association.

June 15 -

A Clever Real Estate survey found a significant share of new borrowers are not making their full payment.

June 15 -

Evidence suggests some minority-owned businesses can’t access loans, and the Trump administration is under pressure to report borrower demographics. The issue is gaining attention against the backdrop of protests over the George Floyd killing.

June 14 -

But deal sponsors are primarily restricting property assets to the lower risk multifamily and office buildings that lenders are more confident will weather the economic strains brought by the coronavirus pandemic.

June 12 -

The measures extended by the Federal Housing Finance Agency include alternative methods used for certain appraisals and for verification of employment.

June 11 -

The expected rise in refinance volume overrides pessimism about purchase activity for their businesses.

June 11 -

A budget item establishing a new agency to protect consumers from predatory lenders has been put on hold as state officials deal with the coronavirus response and other priorities. But it could be revived in legislative talks later this summer.

June 11 -

As revenue-starved retailers fall further behind on rent payments, landlords' cash flow will be strained, and defaults on commercial real estate loans could rise.

June 10 -

The Federal Housing Administration's move to insure loans with forbearance could help support homeownership opportunities constrained by the coronavirus if one change was made to it, trade groups said.

June 10 -

The central bank is only now nearing the launch of the credit facilities after the effort was announced in April. But Chairman Jerome Powell said loans have been available through other means.

June 10

!["Lots and lots of companies are getting financed, the banks are lending, the markets are open [and] you have a much easier lending climate certainly than we had in February and March,” said Fed Chairman Jerome Powell.](https://arizent.brightspotcdn.com/dims4/default/fbc1bc2/2147483647/strip/true/crop/5000x2813+0+260/resize/1280x720!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2F83%2F6e%2F85f1644b4882ba60928b3af2d61b%2Fpowell-jerome-bl-061020.jpg)