The approval deadline for Paycheck Protection Program loans is nearing, but some lenders and legislators remain hopeful about an extension.

The Small Business Administration is legally barred from accepting applications after June 30. A recent law that made changes to key provisions of the program did not allow for an extension past the end of this month.

So participants such as Lendistry are making a final push to keep the origination window open longer. The Los Angeles fintech, which has made nearly 2,600 PPP loans totaling $167 million, is also lobbying for an increase in lender fees and automatic forgiveness for smaller loans.

An extension would “allow more borrowers an opportunity to hire and reopen” and would give more businesses "a better chance at success," said Everett Sands, Lendistry's CEO.

Efforts to push the deadline further into the summer are gaining traction

A group of legislators led by Sen. Ben Cardin, D-Md., introduced a bill Thursday to allow approvals to continue through the end of this year.

The bill prioritizes smaller companies for the remaining $145 billion in PPP funding by narrowing the threshold for eligible businesses from 500 employees to 100. It would also require applicants to demonstrate a pandemic-related revenue loss of at least 50%.

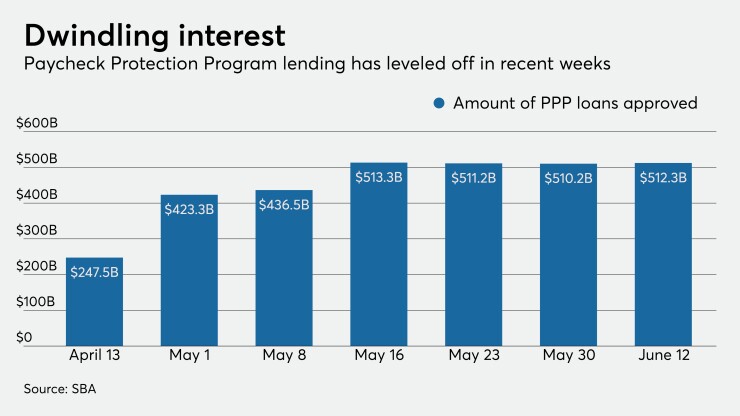

To be sure, activity in the program has waned in recent weeks. Total PPP funds allocated rose by only 0.4% over the two-week period that ended June 12, and a number of lenders have stopped making the loans after hitting internal liquidity and capital caps.

But some financial institutions argue that scores of small businesses still need the funds.

Goldman Sachs on Monday added $250 million to its original $500 million commitment to fund PPP loans originated by community development financial institutions and other mission-driven lenders, such as Lendistry.

“Our lenders will be ready to go and already have capital available” if the deadline is moved, said Margaret Anadu, head of the $1.1 trillion-asset investment bank’s urban investment group.

An extension “would be fantastic,” said Ryan Metcalf, head of U.S. regulatory affairs and social impact at Funding Circle.

While the SBA has not commented on Cardin’s proposal, it unveiled a lender match tool on Friday to link prospective borrowers with mission-driven and small-asset PPP lenders.

“As communities begin to carefully reopen across the country, there are still many more opportunities to provide this assistance to businesses who have yet to access these forgivable loans,” Administrator Jovita Carranza said in a press release.

Goldman’s expanded commitment along, with the Cardin-led bill, comes as lawmakers are

The Biden administration once again extended the pause on student loan payments enacted to help borrowers during the COVID-19 pandemic, this time through the end of August.

The two states' combined plans amount to over $1.5 billion of the Homeowner Assistance Fund included within the American Rescue Plan Act , which was passed a year ago.

An uptick in pandemic-related payment suspensions reflecting new or restarted plan activity previously occurred as the omicron variant spread, but activity has since subsided.

“Only by aggressively targeting aid can we save our small businesses, the jobs they provide, and the Main Streets that make our communities proud,” Sen. Chris Coons, D-Del., who is co-sponsoring the bill with Cardin, said in a press release.

Through Thursday, more than 4.6 million loans totaling $514 billion have been made under PPP, according to the SBA, which is administering program with the Treasury Department. Still, about 4.5 million eligible small businesses, many owned by minorities, have yet to receive funding, Sands said.

To reach them, Lendistry, the only minority-owned fintech CDFI, has marketed heavily in urban cores such as Philadelphia, Baltimore and Atlanta. It is offering a white-label solution to banks and credit unions that allows them to make PPP loans available to their customers.

Lendistry is working with nine institutions, the largest with about $2 billion of assets, Sands said. He declined to identify the lenders.

An extension could create a “golden moment” for banks and credit unions that initially passed on the program, Sands said.

While Goldman has partnered with dozens of lenders, Lendistry is among the most active, Anadu said.

“We talk to Everett and the team over there probably two or three times a day,” she said. “They’ve been impressive for a relatively young organization. To expand into new markets in this short a time frame — with a brand-new product in the middle of a pandemic where borrowers are by definition in distress — that’s no small feat.”