-

The agency said property owners can enter into new or modified forbearance plans if they have a hardship due to the coronavirus, but the landlords must agree not to kick out renters solely for nonpayment of rent.

August 6 -

The global pandemic and stalled trade negotiations have discouraged farmers and ranchers from taking on more debt and made banks uneasy about extending more credit.

August 4 -

Avis is sponsoring its next $500 million securitization financing its rental fleet amid the continued economic impact of the COVID-19 pandemic on the travel industry.

August 4 -

Besides reauthorizing the Paycheck Protection Program, Congress should upgrade the loan forgiveness process, offer businesses the chance to take out a second loan and ensure the pricing satisfies lenders, bankers say.

August 4 -

Community bank earnings are usually easy to understand, but loan deferrals and modifications as well as the complexities of the Paycheck Protection Program are skewing financial statements.

August 4 -

The mortgage servicing rights package going up for bid adds to signs that the market for large offerings is becoming more active.

August 3 -

The number of loans going into coronavirus-related forbearance fell for the seventh straight week, but the Mortgage Bankers Association predicts the rate will increase if the number of coronavirus cases continues to rise.

August 3 -

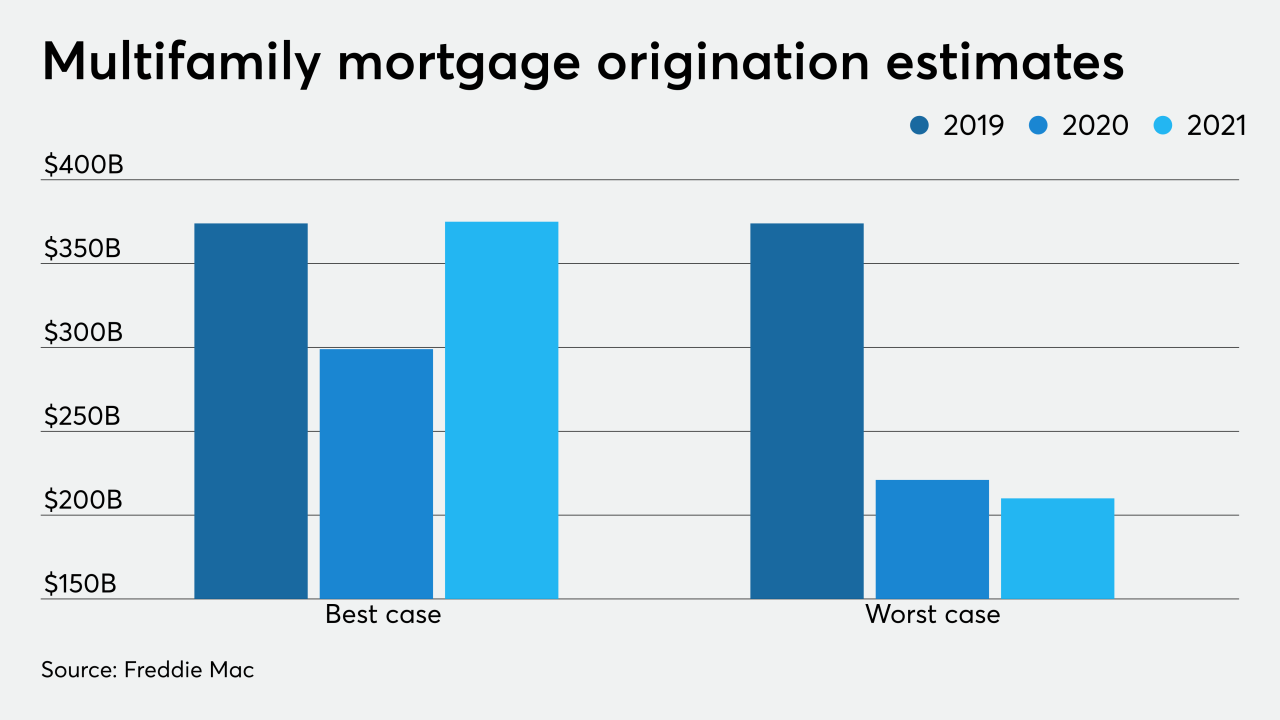

The size of the decline depends on how bad the economy sinks and if the coronavirus spread is halted.

August 3 -

No two properties are alike, so lenders are tailoring their approaches for modification, forbearance and repayment of loans to a sector devastated by the pandemic.

August 2 -

From guidelines for remote appraisal alternatives to the ways that forbearance affects borrowers' ability to get new loans, here are five examples of mortgage requirements that have been in flux since the coronavirus outbreak in the United States.

July 29 -

The enhanced jobless benefits in the coronavirus relief law enacted in March helped limit delinquencies and maintain consumer spending, analysts say. In their follow-up stimulus plan, Senate Republicans want to cut those benefits from $600 to $200 a week.

July 28 -

A likely weathervane for how single-family rentals are being affected by the pandemic, the $826.2 million securitization by FirstKey Homes is ultimately secured by income stemming from home rentals located in current COVID-19 hotspots including Florida and Arizona.

July 27 -

The number of loans going into coronavirus-related forbearance dropped for the sixth consecutive week, as the growth rate fell 6 basis points between July 13 and July 19, according to the Mortgage Bankers Association.

July 27 -

As home loans surge and lenders look to expand, they're doing a cost-benefit analysis on the possibility of opening more commercial locations.

July 24 -

The CEOs of the credit card lenders Discover and Synchrony are urging Congress to come through with another round of government stimulus so that struggling households can continue paying their bills.

July 23 -

Many commercial property owners are locked out of existing coronavirus relief by financing terms that bar them from taking new loans. Under a House bill, they would receive government-backed equity investments.

July 22 -

Delinquencies have been ticking up since the start of the coronavirus pandemic and Capital One is warning of more pain unless the government provides additional relief to tenants and landlords.

July 22 -

Fannie Mae and Freddie Mac have imposed heavy price adjustments for loans that were granted relief under the pandemic relief law enacted in March.

July 22 -

The measures currently ensuring mortgage companies have sufficient cash to cover advances aren't necessarily sustainable, warns Ted Tozer, a senior fellow at the Milken Institute and a former government official.

July 21