-

Consumers are booking rooms at levels not seen since early 2020 and loan delinquencies have fallen sharply as a result. Still, business travel remains sluggish and new COVID variants are spreading, threatening the hotel industry’s recovery.

July 19 -

Income share agreements, which allow college graduates to repay tuition financing as a percentage of their future income, have come under fire lately from consumer advocates for questionable marketing and other potential legal violations. Some hope a partnership between a Virginia bank and an ISA provider will give the product more legitimacy, while others worry it just masks risks for borrowers.

July 12 -

The Spanish bank’s U.S. holding company said it will pay a premium to purchase the publicly traded shares in Santander Consumer Holdings. The proposal is subject to the approval of the auto lender’s board of directors.

July 2 -

The number of grievances about evictions and federal student loans declined between January 2020 and May 2021. Nonetheless, the Consumer Financial Protection Bureau warned financial firms that poor customer service can undermine government efforts to provide aid.

July 2 -

A congressional resolution that invalidates the regulation issued last fall by the Office of the Comptroller of the Currency would help regulators crack down on so-called rent-a-bank schemes that promote predatory lending, the president said before signing the measure.

July 1 -

Meanwhile, National MI has been increasing its new insurance written by slightly widening its credit standards.

June 11 -

The deal for the Salt Lake City-based home improvement lender, which Home Depot tried to acquire more than a decade ago, is part of a larger effort by Regions Financial to diversify its home lending business.

June 8 -

But March's overall late payment rate was 1.3 percentage points higher than one year ago, while the 90-day-plus rate was 2.3 percentage points higher.

June 8 -

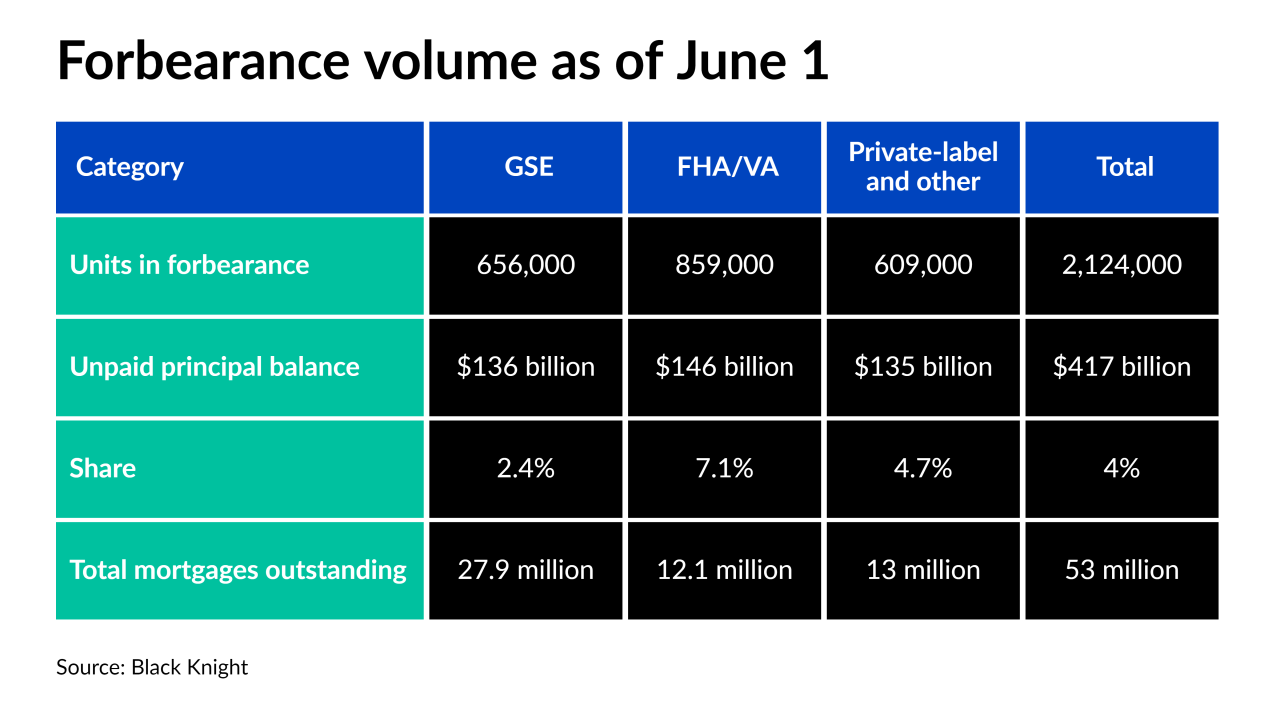

The four-week high in forbearance exits also helped drive the considerable drop in plans, according to Black Knight.

June 4 -

A pool of subprime auto loans, new and used, and approved with a heavily automated, technology driven and multi-step process underpin a $559 million deal.

June 3 -

For the first time since the pandemic began, the share of borrowers who are 30 days or more late on their payment is below 5%, Black Knight found.

May 20 -

Carvana Auto Receivables Trust 2021-N2 is the used-car retailer's ninth securitization since 2019, and the third to include a pool exclusively made of non-prime loans.

May 19 -

DMB Financial, a debt-settlement firm near Boston that operates in 24 states, agreed to pay $5.4 million in restitution to consumers for allegedly charging upfront fees before providing any service, the CFPB said.

May 17 -

This week, Moody’s Investors Service projected elevated credit-loss expectations for a new subprime auto-loan securitization from Veros Credit, even though the new deal has several improved credit metrics compared to the company’s prior ABS offering in March 2020.

May 14 -

The legislation, which the chamber passed Thursday, would ban collectors from making threatening statements to military service members and prevent credit bureaus from including debt arising from certain medical procedures.

May 13 -

If the lender's trust opts to upsize its second bond offering of 2021, the $2 billion-plus transaction would be Santander's biggest in the post-crisis era.

May 12 -

The total number of loans in this category dropped 11 basis points from week to week according to the Mortgage Bankers Association. Meanwhile, the amount of unpaid balance in forbearance dropped almost 23% since the start of the year, a separate report from Black Knight found.

May 10 -

Deals, trends and research in structured finance and asset-backed securities for the week of April 30-May 6

May 6 -

The digital-only bank has adopted machine learning to process loans faster, more accurately and with better fraud detection than in the past.

May 5 -

Cordray, named this week to lead the Education Department's office of federal student aid, cracked down on banks, student loan servicers and for-profit colleges when he was director of the Consumer Financial Protection Bureau.

May 4