-

Property debt funds, including at Blackstone Group Inc., raised $14.1 billion from April through September, compared with $15.7 billion a year earlier, according to research firm Preqin Ltd. Yet the expected flood of deals has so far been just a trickle.

October 28 -

The subprime lender cited low odds that Washington will deliver further economic relief, and the fact that $1.5 billion of loans whose deferral period expired are now more than 30 days behind.

October 28 -

A 2019 decision by Amy Coney Barrett, then a 7th Circuit judge, cited an earlier Supreme Court ruling suggesting a high bar for plaintiffs to claim harm. But other jurists have favored a less onerous standard.

October 27 -

Wells Fargo is exploring a sale of its corporate-trust unit that could fetch more than $1 billion and is considering whether to find a buyer for its student loan portfolio, according to people familiar with the matter.

October 26 -

Bankruptcy filings are surging due to the economic fallout of Covid-19, and many lenders are coming to the realization that their claims are almost completely worthless. Instead of recouping, say, 40 cents for every dollar owed, as has been the norm for years, unsecured creditors now face the unenviable prospect of walking away with just pennies - if that.

October 26 -

With the COVID-19 pandemic creating unprecedented challenges for small businesses, American Express has increasingly targeted its investments in that niche.

October 23 -

According to ratings agency presale reports, Flagship will sell $303 million in bonds from a $314.8 million of loan originations by Flagship as well as its CarFinance.com subsidiary.

October 22 -

investors need to remember that speculative-grade companies aren’t immune from going bust, no matter how wide open the debt markets might be.

October 21 -

Pagaya Investments, which purchases loans from MPL platforms using AI-driven technology, is sponsoring a $423.9 million transaction, according to a ratings agency presale report.

October 21 -

As financial distress mounted, 12.4% of mortgagors missed payments across the second and third quarters of 2020 — and it could get worse, according to a study from the Mortgage Bankers Association.

October 16 -

Defaults have been milder than expected thanks to government relief and stricter underwriting. But with the crisis dragging on and policymakers unable to agree on a stimulus plan, loans to highly indebted companies remain at risk.

October 15 -

Credit portfolio manager’s outlook on corporate borrower defaults and spreads on their loans, while still gloomy, has improved somewhat as the pandemic continues.

October 15 -

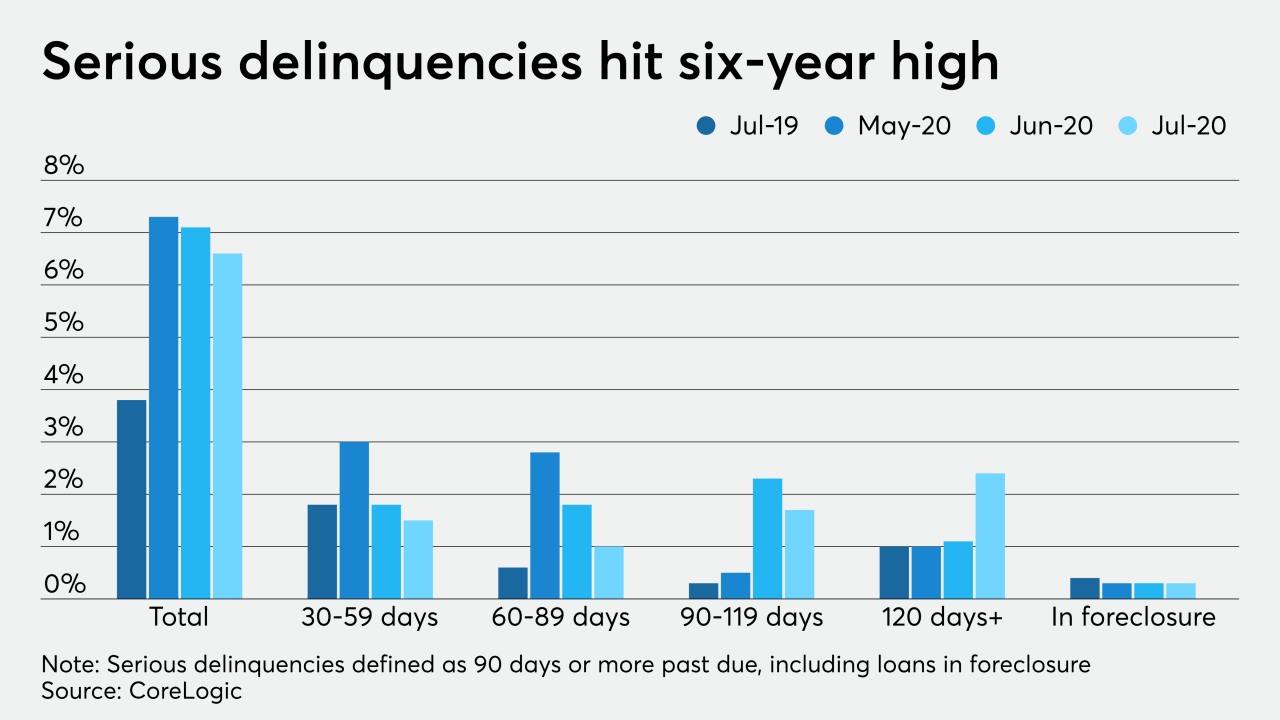

While overall mortgage delinquency rates slowly descend, serious delinquencies — especially loans past 120 days due — jumped in July, according to CoreLogic.

October 13 -

Money managers bargained away legal rights in exchange for higher returns in an ultra-low interest rate environment. Now they find themselves with precious little protection for their investments just as the pandemic is causing a wave of corporate bankruptcies across the country.

October 12 -

Deals, trends and research in structured finance and asset-backed securities for the week of Oct. 2-8

October 9 -

Prestige's new $377M securitization has a collateral pool in which over 44% of the loans are from borrowers with recent Chapter 7/13 discharges.

October 9 -

The Consumer Financial Protection Bureau's overhaul of its Qualified Mortgage standard is alarming free-market advocates who say it will precipitate a return to easy credit and higher defaults and could disproportionately harm minorities.

October 8 -

The San Francisco fintech, which is buying Radius Bancorp, will discontinue peer-to-peer lending and instead offer new products, like high-yield savings accounts, to its retail investors.

October 8 -

Morgan Stanley agreed to purchase Eaton Vance for about $7 billion in CEO James Gorman's second major acquisition this year, both of which tilt the investment bank further toward the steadier business of money management.

October 8 -

Money managers bargained away legal rights in exchange for higher returns in an ultra-low interest rate environment. Now they find themselves with precious little protection for their investments just as the pandemic is causing a wave of corporate bankruptcies across the country.

October 7