-

Defaults have been milder than expected thanks to government relief and stricter underwriting. But with the crisis dragging on and policymakers unable to agree on a stimulus plan, loans to highly indebted companies remain at risk.

October 15 -

Credit portfolio manager’s outlook on corporate borrower defaults and spreads on their loans, while still gloomy, has improved somewhat as the pandemic continues.

October 15 -

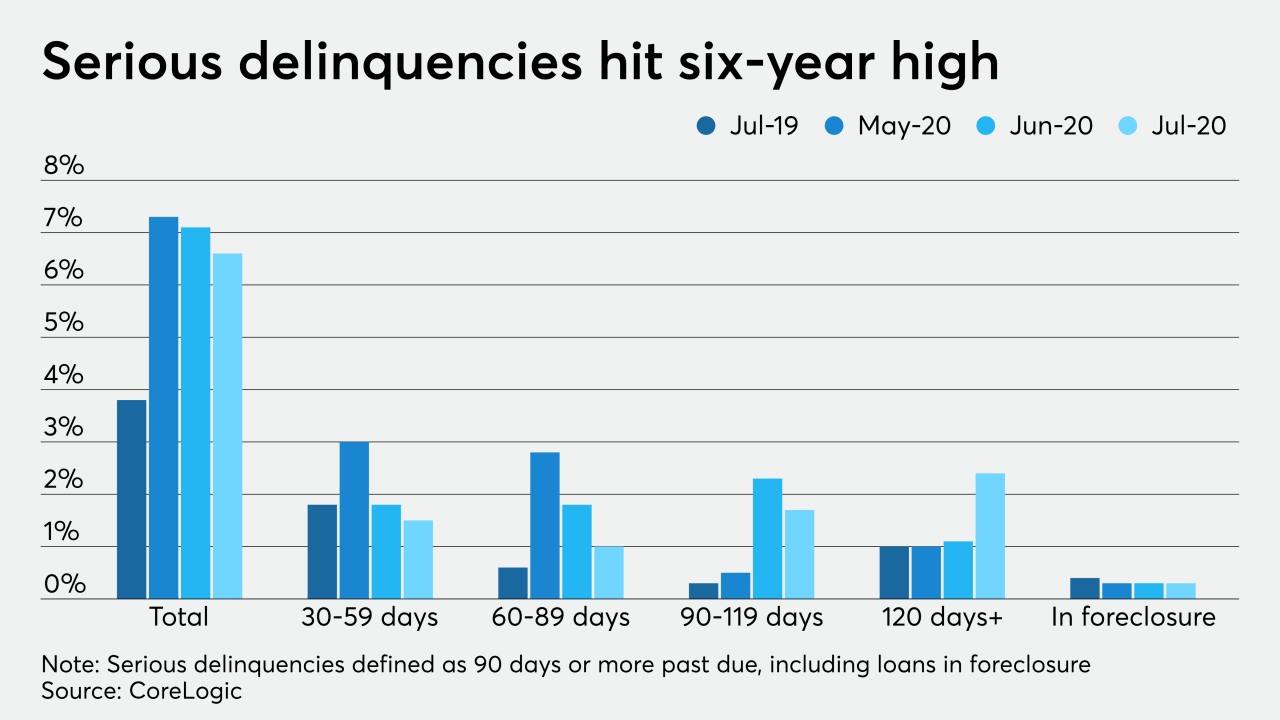

While overall mortgage delinquency rates slowly descend, serious delinquencies — especially loans past 120 days due — jumped in July, according to CoreLogic.

October 13 -

Money managers bargained away legal rights in exchange for higher returns in an ultra-low interest rate environment. Now they find themselves with precious little protection for their investments just as the pandemic is causing a wave of corporate bankruptcies across the country.

October 12 -

Deals, trends and research in structured finance and asset-backed securities for the week of Oct. 2-8

October 9 -

Prestige's new $377M securitization has a collateral pool in which over 44% of the loans are from borrowers with recent Chapter 7/13 discharges.

October 9 -

The Consumer Financial Protection Bureau's overhaul of its Qualified Mortgage standard is alarming free-market advocates who say it will precipitate a return to easy credit and higher defaults and could disproportionately harm minorities.

October 8 -

The San Francisco fintech, which is buying Radius Bancorp, will discontinue peer-to-peer lending and instead offer new products, like high-yield savings accounts, to its retail investors.

October 8 -

Morgan Stanley agreed to purchase Eaton Vance for about $7 billion in CEO James Gorman's second major acquisition this year, both of which tilt the investment bank further toward the steadier business of money management.

October 8 -

Money managers bargained away legal rights in exchange for higher returns in an ultra-low interest rate environment. Now they find themselves with precious little protection for their investments just as the pandemic is causing a wave of corporate bankruptcies across the country.

October 7 -

The ratings agency reported that the average percentage share of triple-C rated loans in CLO portfolios fell below 10% for the first time since March.

October 6 -

HSBC, Bank of the West and Fannie Mae are among those offering green mortgage bonds, financing commercial clients’ efforts to rein in carbon emissions and developing other novel products that help customers tackle environmental challenges.

October 6 -

Kathy Kraninger’s job status would be in question if Joe Biden wins the White House. If the president is reelected, she may continue balancing a deregulatory agenda with her unexpectedly tough stance on enforcement.

October 2 -

Over 3.6 million borrowers sit in coronavirus-related forbearance with portfolio and private-label securitized loans driving the week's increase, according to Black Knight.

October 2 -

The quarterly numbers were boosted by $11.3 billion in new deals last month, the most active month for CLOs since April 2019.

October 2 -

Credit research analysts cite a "significant" drop in defaults since the 2Q and improving macroeconomic indicators.

October 2 -

Deals, trends and research in structured finance and asset-backed securities for the week of Sept. 25-Oct. 1

October 1 -

Overall debt outstanding for delinquent commercial and multifamily mortgages cut down in September as more of the economy opens further with lodging and retail far behind, according to the Mortgage Bankers Association.

October 1 -

Delinquencies will rise due to the severe effects of the pandemic on the commercial property sector, Fitch said.

September 30 -

Spreads and investor demand make conditions ripe for a surge in CLO deals before the election, but a strain on loan supply may complicate the picture.

September 29