-

Fannie Mae and Freddie Mac will adjust their risk-sharing deals so that they can accommodate high loan-to-value loans refinanced under the programs replacing the Home Affordable Refinance Program.

August 28 -

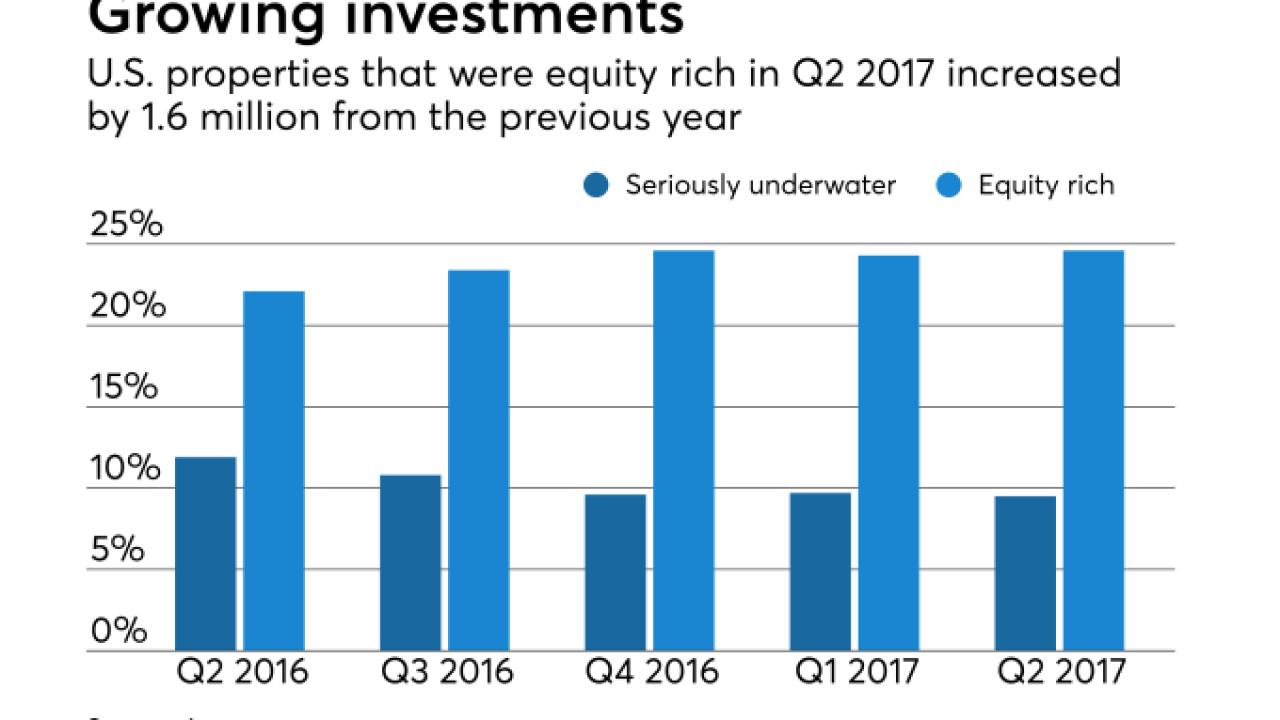

The number of U.S. properties that were equity rich in the second quarter grew by 1.6 million properties from a year ago.

August 21 -

The real estate investment trust acquired or aggregated $4.7B in prime jumbo loans in 2016, and has fed the securitization market with six deals this year with a collective pool balance of $2.22B.

August 10 -

The transaction's pool is a blend of conforming loans from Chase and non-conforming loans from various originators, including EverBank, Social Finance, Quicken Loans and United Shore Financial Services.

August 9 -

The bonds are supported by the monthly income stream and underlying property values of 3,480 single-family rentals, most of which Tricon acquired from Silver Bay Realty Trust in a February merger.

August 8 -

A higher proportion of borrowers have a “spotty pay history,” and the loans are more geographically concentrated than recent deals, but this is somewhat mitigated by higher borrower equity, says Fitch Ratings.

August 2 -

Moody's believes that rules grandfathering existing transactions increase the risk that these deals could be left unhedged; it may downgrades some European RMBS and U.S. student loan-backed securities.

July 27 -

The Federal Reserve was not an economic buyer; it accumulated its vast holdings of mortgage bonds for policy reasons; Fannie Mae's chief economist, Douglas Duncan, looks at who might step up, and at what yield.

July 27 -

The senior tranche of triple-A rated notes to be issued benefits from 38.65% credit enhancement, up over 10 percentage points from 27.25% for the comparable tranche of the sponsor's previous deal.

July 26 -

The senior, triple-A rated tranche of notes to be issued benefits from 38.65% credit enhancement; that's up over 10 percentage points from 27.25% for the comparable tranche of the sponsor's previous deal.

July 26