New requirements for counterparties to post margins on uncleared swaps were designed to reduce risk in the financial system.

Yet they are having an unintended effect on bonds backed by financial assets such as loans and leases, prompting credit rating agencies to rethink their criteria for assessing the risk in these transactions.

Swaps are agreements to exchange one set of cash flows for another; in asset-backeds, they are used to protect against a mismatch in interest rates or currencies of bonds and the assets used as collateral.

Asset-backeds issued before March 1 are grandfathered from the requirement, sparing counterparties the added complexity and expense.

There’s a downside to grandfathering, however. It creates a disincentive for one party in a swap to replace the other party, even if that counterparty’s finances deteriorate, putting it at increased risk of default. That’s because entering into a swap with a new counterparty would trigger the need for both parties to post margins.

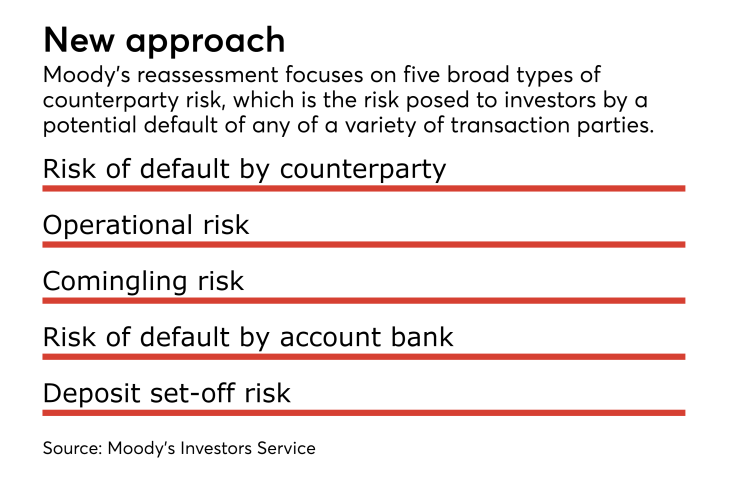

This has prompted Moody’s Investors Service to update its approach to assessing counterparty risks in structured finance transactions, and to take rating actions on hundreds of tranches across dozens of mortgage bonds and other asset-backeds, primarily in Europe.

The new approach to assessing counterparty risk also impact some bonds backed by U.S. federally guaranteed student loans.

“We now assume that certain swaps are less likely to be replaced,” the rating agency said in a press release published Wednesday.

Moody’s also gives less benefit for certain features that would otherwise serve to increase the probability of counterparty replacement.

Moody’s isn’t alone. Fitch Ratings is also reviewing its U.S. structured finance portfolio to determine which transactions could be exposed to increased risk and potentially negative rating actions as a result of the two-way margin posting requirement, Kevin Duignan, managing director and global head of structured finance and covered bonds, said in an emailed statement.

And in June Standard & Poor's put out a request for comment on proposed changes to its methodology for assessing special-purpose vehicle margin requirements for swaps.

To date, neither Fitch nor S&P has announce any ratings actions or reviews, however.

Not all of the actions that Moody’s announced are downgrades. The rating agency has upgraded 211 notes and put another 85 notes under review for a possible downgrade across 114 residential mortgage securitizations and 12 deals backed by non-mortgage assets in the Europe, Middle East and Africa.

In addition, Moody's has upgraded the national scale ratings of 12 notes in South Africa.

In the U.S., Moody’s has placed 38 tranches of 14 securitizations of Federal Family Education Loan Program loans under review for downgrade; another two tranches from these same deals are under review for a possible upgrade. Twelve of the securitizations have outstanding currency swaps and two securitization have outstanding fixed floating swaps.

In Australia, Moody's upgraded its fixed-rate swap agreement counterparty instrument rating for Progress 2013-1 Trust, a securitization of prime residential mortgages by AMP Bank.

In a press release, the rating agency said it now gives the same value to swap triggers that are subject to the condition that Moody's continues to rate the subject structured finance securities as to triggers that are not subject to such a condition.

In Japan, Moody's placed the ratings on 10 classes of notes from four transactions backed by auto loans under review for downgrade. The notes are issued by OSCAR US Funding Trust, OSCAR US Funding Trust II, OSCAR US Funding Trust IV, and OSCAR US Funding Trust V.

The auto loans are denominated in Japanese yen, while the notes are denominated in U.S. dollars. The issuers have entered into currency and/or interest rate swap agreements with the swap counterparty for each class of note to hedge both foreign exchange and interest rate mismatch risks.

In its ratings report, Moody’s noted that the issuers are considering amending the transactions to avoid potential losses to the investors from having no replacement swap under the margining requirements. At the same time, the seller, Orient Corp., has requested a no action relief letter from the US Commodity Futures Trading Commission, with respect to the issuers of these transactions being permitted to not post margin with their swap counterparty.