The high loan-to-value refinance programs replacing the Home Affordable Refinance Program will require a change to the structure of Fannie Mae and Freddie Mac's credit-risk transfer deals.

The new high LTV refinance programs will be available on loans originated on or after Oct. 1, 2017. If the original loan was included in the reference pool of a risk-sharing deal, the newly refinanced loan will take its place.

Currently, a loan must have been originated on or before May 31, 2009 to be eligible for HARP and new loans originated in the program aren't included in the government-sponsored enterprises'

"This will help preserve credit loss protection on the loans without unwinding the protection paid for through CRT transactions," the Federal Housing Finance Agency said in a statement when it announced the change and

The new Fannie Mae and Freddie Mac refinance programs should provide incremental support if

"The new refinance programs should help improve the payment status for performing borrowers with little or no equity in future home price decline scenarios," wrote Grant Bailey, Fitch managing director. "Additionally, unlike loan modifications, the reduction in interest is not passed through to the investor as a credit loss."

Some market participants may need to restructure their loan-loss models depending on how they previously managed loans in the historical dataset refinanced through HARP.

"The original GSE dataset reported high LTV refinances through HARP as terminal events that paid the loans off in full," Bailey wrote. "Once the new refi programs go into effect, investors will remain exposed to default risk following a high LTV refinance."

The addition of HARP data into the existing historical dataset raises the historical default rates by 5%-7% for the vintages most dependent on the program. This could potentially signify a modest increase in losses in future stressed environments.

Because the

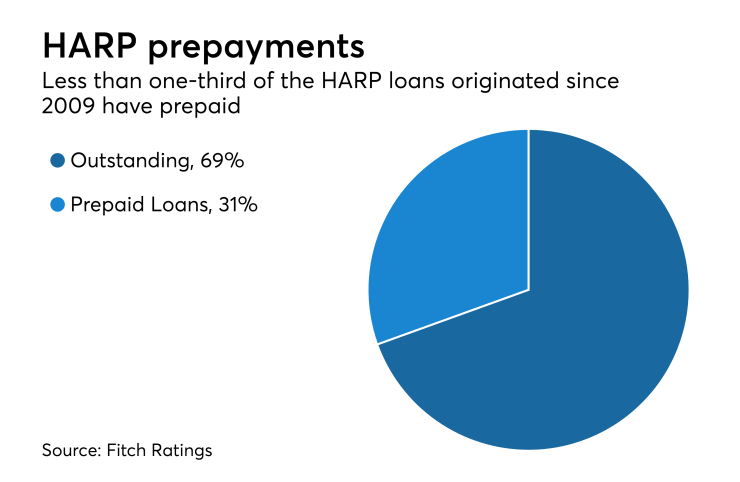

More than 3.4 million borrowers have refinanced their loans under HARP, the FHFA estimates.