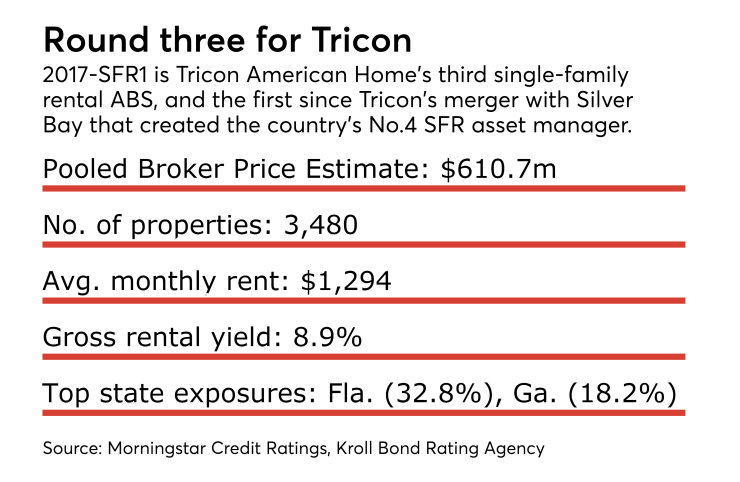

Tricon American Homes is marketing its third single-family home rental securitization in a $496.6 million deal consisting mostly of assets acquired in a $1.4 billion merger in February with another SFR operator, Silver Bay Realty Corp.

Tricon American Homes 2017-SFR1 will offer $462.6 million in bonds that include a $200 million senior tranche rated triple-A by Kroll Bond Rating Agency and Morningstar Credit Ratings, as well as $298.6 million in subordinate tranches. Not included in the offering is a $36 million class-G tranche to be retained by the company to comply with U.S. risk retention standards.

The bonds are supported by the monthly income streets and underlying property values of the 3,480 rental properties, of which 3,143 were previously held by Silver Bay, a former real estate investment trust. The properties are concentrated in the Sun Belt, with Florida (32.8%), Georgia (18.2%) and Arizona (13.5) comprising more than 60% of the valuation (by aggregate broker price opinion) of the pooled properties.

Of the properties that were previously managed by Silver Bay, 960 are being rolled over from a prior securitization, Silver Bay Realty 2014-1.

The pool represents about one-sixth of the combined firms' estimated managed portfolio of nearly 17,000 SFR properties in 18 MSA markets, making it the fourth-largest publicly traded single-family rental operator in the country.

The collateral backing the notes is an interest-only, first-lien mortgage loan originated by German American Capital Corp. for Tricon American Homes, a subsidiary of Toronto-based Tricon Capital, a US$4.6 billion asset firm which focuses on North American residential real estate.

The properties in the pool have an average BPO value of $175,484 with an average rental price of $1,294 per month.

Tricon's issuing trust estimated that level of income will produce an annual net cash flow of $29.3 million, after deducting expenses for maintenance, repair and vacancy coverage. Both Morningstar and KBRA estimated higher expenses and applied haircuts for their own net cash flow projections of $18.6 million (Morningstar) and $20.1 million (KBRA).

The homes in the pool average 27 years of age and a size of 1,625 square feet. (The vintage is actually newer compared to Tricon’s two prior securitizations that featured homes with an average age of 31 and 35, respectively). Older, smaller homes are less marketable in the event of a default on the securing mortgage, but Morningstar pointed out that over 40% of the pool’s properties (again, measured by BPO valuation) are tied to a homeowners association and meet local covenants on maintenance, conditions and restrictions.

Concentration levels of the transaction include the lowest geographic diversity of any SFR deal since 2015, according to Kroll. The top three states in the pool account for just under 65% of the whole pool, consisting of homes in Florida (32.8%), Georgia (18.2%), and Arizona (13.5%), plus higher than the average top-three state concentration in the last 17 deals rated by KBRA (approximately 60%).

With such a substantial portion of the total pool concentrated in just three states, the transaction is exposed to risk from regional economic downturns and regional home price declines.

The loan-to-value ratio (LTV) for the entire deal is approximately 81.6%, based on the BPO value of the pool. KBRA noted that is higher than in other recent SFR deals it has rated.

This is the first rated single-family rental (SFR) transaction to include a voluntary substitution feature, meaning Triton can replace up to 5% (174 properties) of the homes in the portfolio by the closing date. That could expose the deal to homes with higher risk factors such as additional vacancies or lower BPO values.

Tricon American Homes is a subsidiary of Tricon Capital, headquartered in Ontario, Canada.