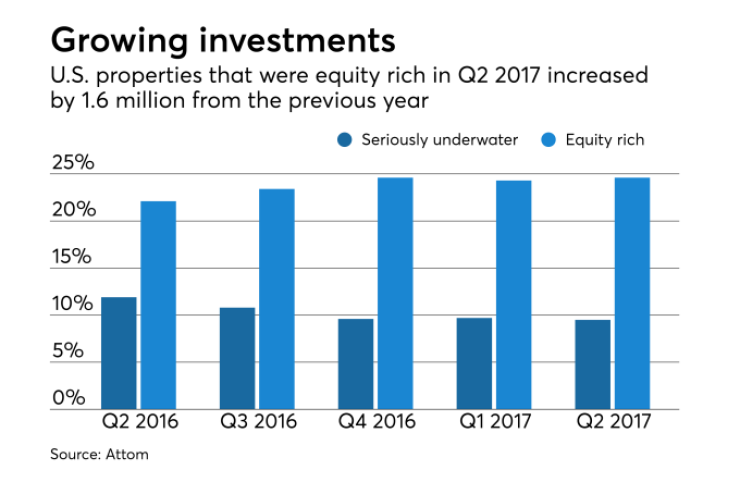

As home prices continued rising, the number of U.S. properties that were equity rich — where the combined loan amount secured by the property was 50% or less of the estimated market value — grew to 14 million in the second quarter, according to Attom Data Solutions.

This marks an increase of 320,000 properties from the first quarter and by over 1.6 million properties from a year ago.

The 14 million equity-rich properties represented 24.6% of all U.S. properties with a mortgage, up from 24.3% in the previous quarter and from 22.1% the previous year.

Over 5.4 million U.S. properties were seriously underwater in the second quarter, a decline of about 64,000 properties from the first quarter of 2017 and 1.2 million properties from the second quarter of 2016.

"An increasing number of U.S. homeowners are amassing impressive stockpiles of home equity wealth, enjoying the benefits of rapidly rising home prices while staying conservative when it comes to cashing out on their equity," Daren Blomquist, senior vice president at Attom, said in a press release.

"Homeowners are staying in their homes nearly twice as long before selling as they were prior to the Great Recession and the volume of home equity lines of credit are running about one-third of the level they were at during the last housing boom."

"However, this home equity wealth is unevenly distributed across different geographies, value ranges, occupancy statuses and lengths of ownership, with a disproportionately high equity rich share among high-end properties, investor-owned properties and properties owned for more than 20 years," said Blomquist.

Of all states, Hawaii had the highest share of equity rich properties at the end of the second quarter, with 38.3%, California came in second, with a share of 36.6%, and New York in third with 34.2%.

Nevada had the highest share of seriously underwater borrowers at 17.4%, followed by Louisiana with 17.1% and Illinois with 16.8%.

In the first quarter, the