-

Lenders that offer streamlined refinances in the future shouldn't be required to consider the borrower's income or employment status, according to the Mortgage Bankers Association. The trade group's comments were part of its response to a request for information on mortgage products that would support the financial stability of households.

November 29 -

In the face of a growing number in home-equity products, HECM endorsements dropped nationwide by over 43% on a monthly basis to its lowest point in more than two years.

October 4 -

Average purchase-loan amounts shrank for the second week in a row and are currently 12% below their record size in March.

July 6 -

Purchase lending grew despite headwinds in mortgage rates and rising home values.

March 14 -

But rising rates and tightening affordability are slowing appreciation rates, Black Knight found in its latest Mortgage Monitor report.

December 6 -

Rising debt-to-income ratios were behind almost a third of refinance rejections among those 65 and older, according to an analysis from the Urban Institute.

October 27 -

The GSE forecasts $4 trillion in production this year because refinance activity is stronger than expected.

July 16 -

The agency’s new chief said eliminating the “adverse market fee” — in place since December — will make it easier for families to refinance while mortgage rates are still low.

July 16 -

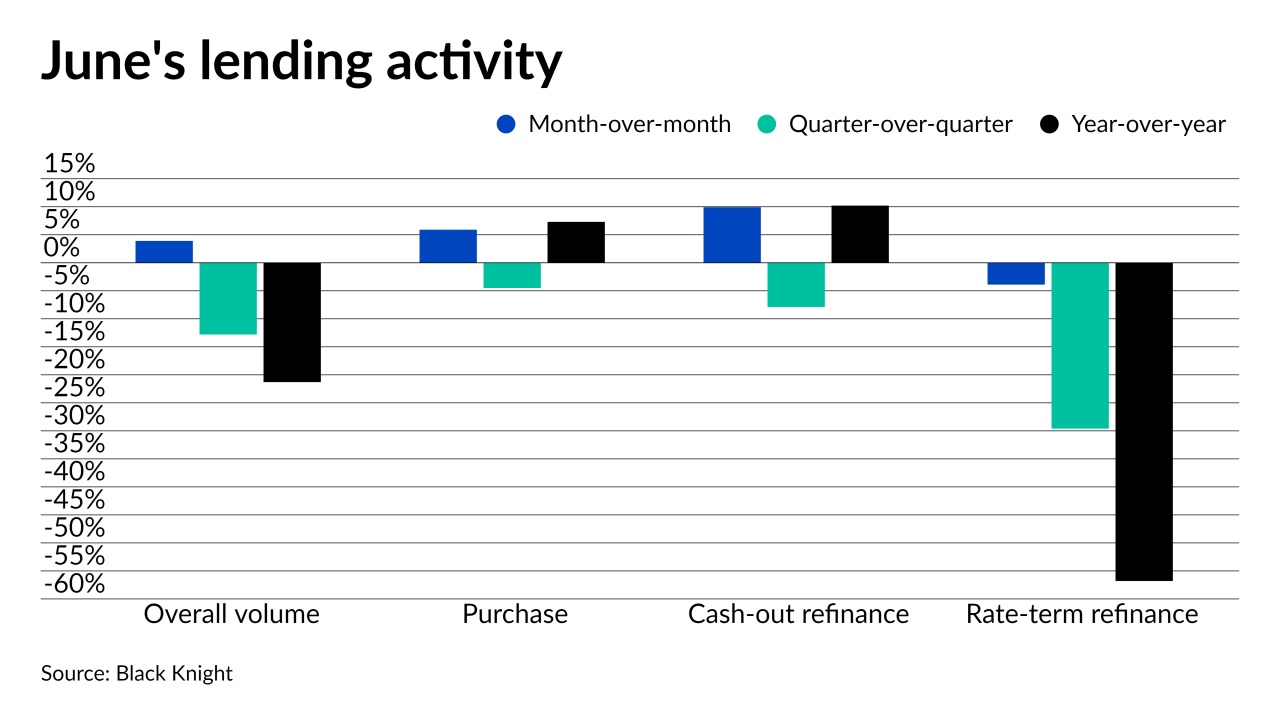

Boosts in purchases and cash-out refinances drove the summer turnaround, according to Black Knight.

July 12 -

Even though the channel helped the bank do over $2 billion in business last year, going forward it will produce loans through the traditional retail business.

July 2 -

Consumer advocates and mortgage industry officials are urging Sandra Thompson, the new acting director of the Federal Housing Finance Agency, to undo many policies that her predecessor, Mark Calabria, put in place over the past year.

July 1 -

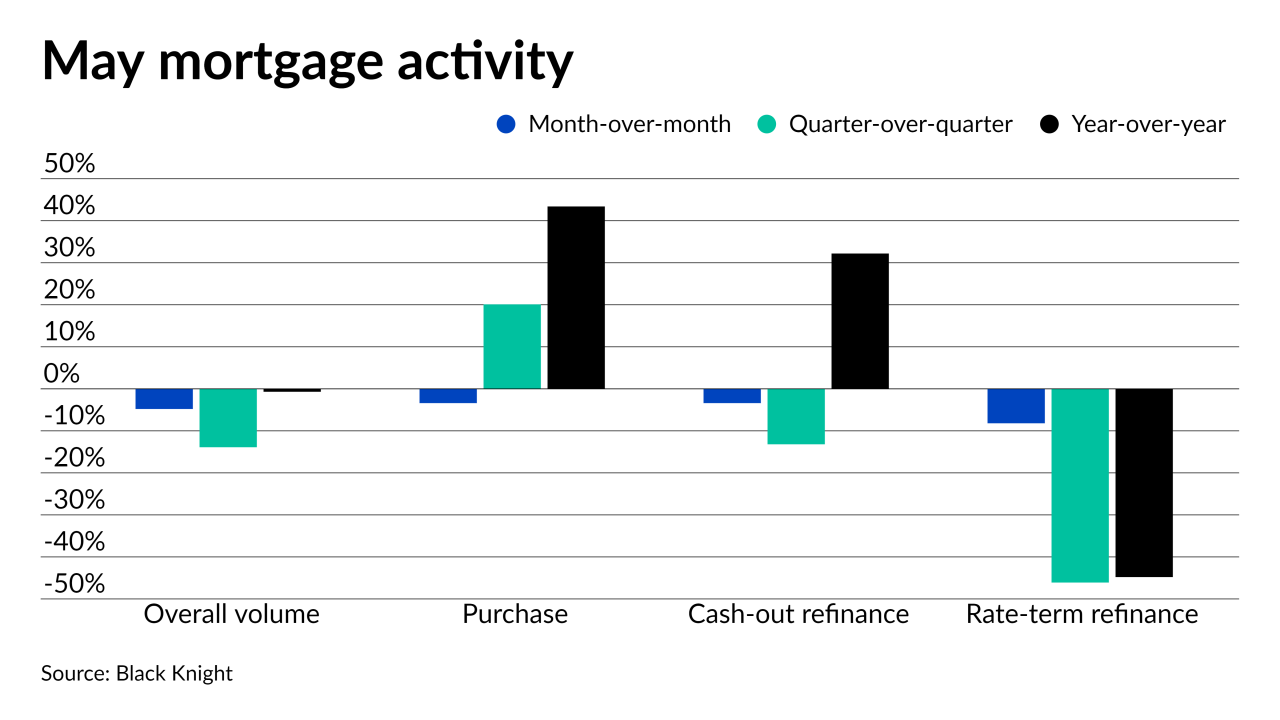

Increases in refinances, both in applications and average size, help lead overall numbers higher

June 23 -

A spike in government-sponsored applications helped lead indexes to their largest gains in several weeks.

June 16 -

Changed borrower psychology and the severe housing inventory shortage dropped lending activity across the board, according to Black Knight.

June 14 -

More than two-thirds surveyed said they expect to make less money over the next three months as price reductions ramp up along with a market shift to purchases.

June 10 -

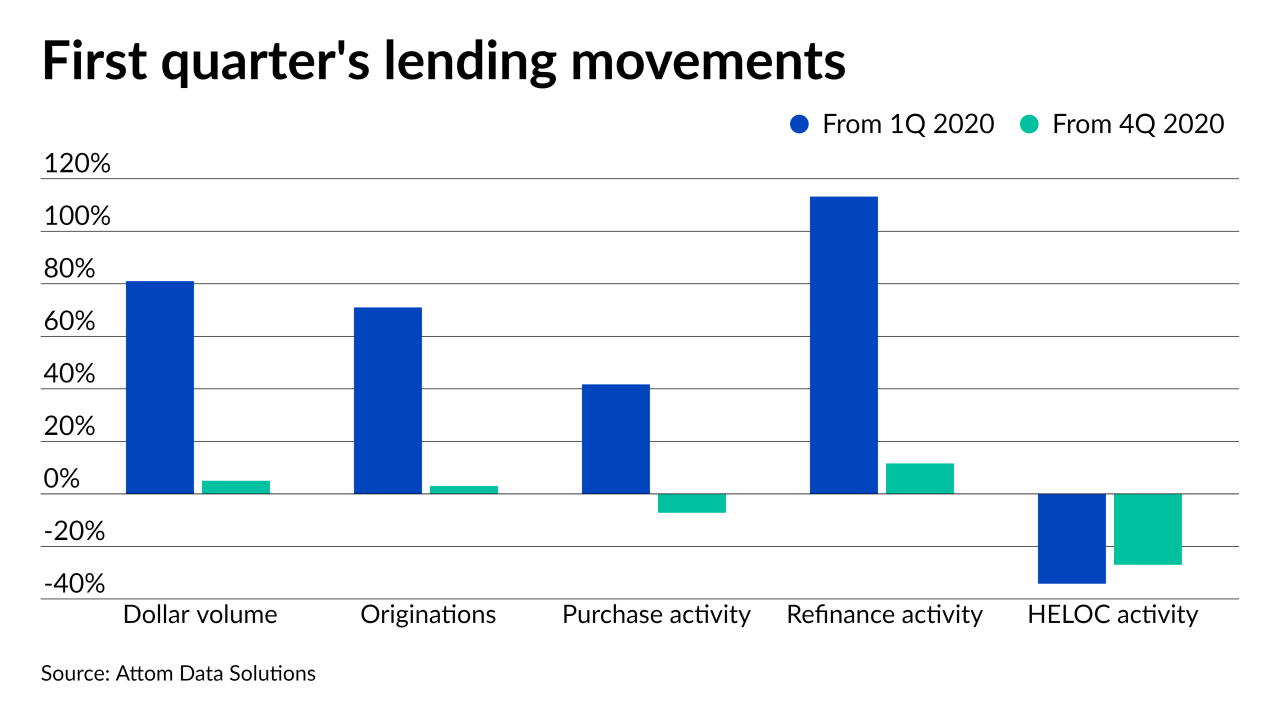

Refinancings more than doubled the year-ago amount and made up for the slowed purchase activity, according to Attom Data Solutions.

June 3 -

Average loan size also continues to increase, as demand remains high and costs in homebuilding materials rise this year.

May 19 -

Economic recovery should soar into the summer as vaccination rates climb and restrictions loosen up, but low inventory is likely to limit mortgage activity into the next year, according to Fannie Mae.

May 19 -

Hedge accounting will align Fannie’s reporting with competitor Freddie Mac, and will address a mismatch between the recorded value of financial instruments used to offset interest-rate volatility on mortgages and the loans themselves.

April 30 -

Only $89 billion of the $362 billion in new single-family volume came from purchase mortgages.

April 29