WASHINGTON — Following last week’s ouster of the Trump appointee atop the Federal Housing Finance Agency, mortgage industry officials and community advocates alike are hoping new leadership will rethink many of the policies the agency put in place last year that they say run counter to the missions of Fannie Mae and Freddie Mac.

Acting FHFA Director Sandra Thompson — who was appointed by the Biden administration to run the agency last Wednesday after

“I do hope there's a chance for course correction with new leadership,” said Doug Ryan, a senior fellow at Prosperity Now, a nonprofit consumer advocacy group. “I think there's an opportunity for this to support the larger housing goals of the Biden administration.”

After the high court ruled last week that the management structure of the FHFA impinged on executive power, President Biden moved swiftly to remove Calabria and install Thompson, who

Chief among those policies are changes Calabria and former Treasury Secretary Steven Mnuchin made in the waning days of the Trump administration to the so-called preferred stock purchase agreements, or PSPAs, which dictate the terms of the federal conservatorship of Fannie and Freddie.

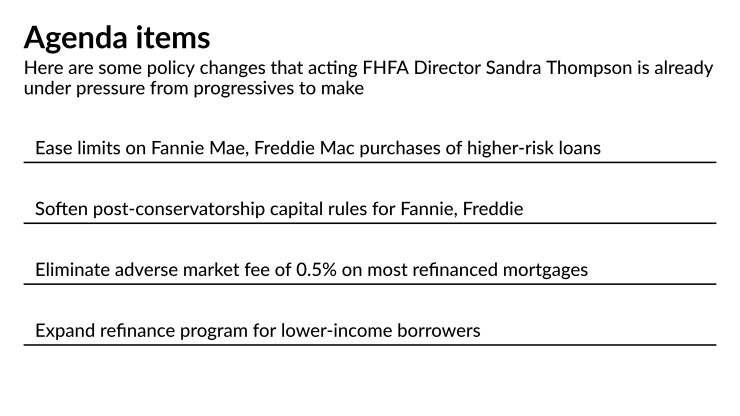

Those changes allowed Fannie and Freddie to retain more of their earnings, but came with restrictions on the amount of “high risk” loans the GSEs could purchase.

“We just think that these [restrictions] go in the face of what we would assume to be the kinds of policies we ought to be pursuing at this point,” said Scott Olson, executive director of the Community Home Lenders Association. “So we're ... somewhere between optimistic and hopeful that this stuff will get overturned fairly quickly.”

Olson’s group sent a letter to Thompson and Treasury Secretary Janet Yellen on June 24, requesting that they “immediately suspend” the restrictions.

“Hopefully, there will be a fresh look, since, as we pointed out in our letter, the two parties that put this in place in the first place, Mnuchin and Calabria, are both gone,” Olson said. “Hopefully now this is ripe for revisiting.”

Addressing the restrictions codified in the PSPAs “would be a signal about the priorities of the new leadership, and by default, the Biden administration,” said Ryan.

“It’s overly impactful on borrowers of color and communities of color, and [low- to moderate-income] families and communities,” he said. “Those caps are just too low and too restrictive.”

Many are also hoping that FHFA will also now do away with an “adverse market fee” of 0.5% that Fannie and Freddie imposed on most refinanced mortgages starting in December. That fee was meant to shield the GSEs from economic uncertainty resulting from the coronavirus pandemic, but lenders in particular argued that the move would raise costs for consumers looking to refinance.

“I think we can see that the GSEs’ experience with forbearance has been much more benign than, say, the [Federal Housing Administration's] has been," said Robert Broeksmit, president and CEO of the Mortgage Bankers Association, referring to the lower percentage of mortgages in forbearance backed by Fannie and Freddie as opposed to other entities. "I don't think that there is a current legitimate rationale to continue the 50-basis-point adverse market refinance fee."

“They got a lot of pushback on that, rightfully so,” agreed Ryan. “I think that needs to be looked at.”

Melissa Stegman, senior policy counsel at the Center for Responsible Lending, said she is now looking for the FHFA to go a step further and expand access to refinancing to more borrowers. The agency

“What the FHFA announced a month ago will not reach communities that would benefit from being able to refinance their mortgage, even though we've had this enormous refi boom,” said Stegman. “We are encouraged by [Thompson’s statement], but I think the real test will be the policies that the GSEs implement, to make sure that lives up to those statements.”

Lower on the priority list for Thompson or a permanent FHFA director could be a review of the post-conservatorship capital framework that the agency

“You don't need to have bank-like capital for Fannie and Freddie. I don't think anybody sees that as reasonable,” said Ryan. “Most people do not see that as reasonable, but they also see it as a constraint on future activities if and when conservatorship ends. … So I do think that's reasonable to look at that.”

Stegman also said she is eager to see how new FHFA leadership can go beyond reviews of the previous director's policies and “fundamentally reorient the focus of the GSEs” to expand access to housing, especially for minority borrowers.

“There are a lot of ideas out there I think that could really move the needle to open up access in a responsible way, so we are hoping that FHFA and the GSEs will explore these possibilities more and pursue pilot programs,” she said.

The change could be an opportunity to explore “how we can imagine the housing finance world differently,” said Ryan.

“There are meaningful programs and policy actions that Fannie and Freddie with their regulator can do now that they wouldn't have been able to do just two weeks ago, and I think that's a really big deal,” he said.