-

The share of underwater mortgages also grew for the first time in almost two years during the third quarter, Corelogic found.

December 6 -

Total insured wind and flood losses are predicted to be between $10.5 billion and $17.5 billion, according to CoreLogic. Earlier estimates placed the cost of insured damages between $3 billion and $5 billion.

October 7 -

Housing costs increased at the slowest pace in over a decade nationwide, even while monthly growth now exceeds its pre-pandemic level.

May 2 -

But late borrower payments slightly grew in November, with 18 metro areas reporting an increase, up from six metro areas in October, CoreLogic's report found.

January 26 -

The overall share of distressed mortgages fell in every state, but the effects of Hurricane Ian led to a small uptick in early-stage late payments compared to one year ago, CoreLogic said.

December 28 -

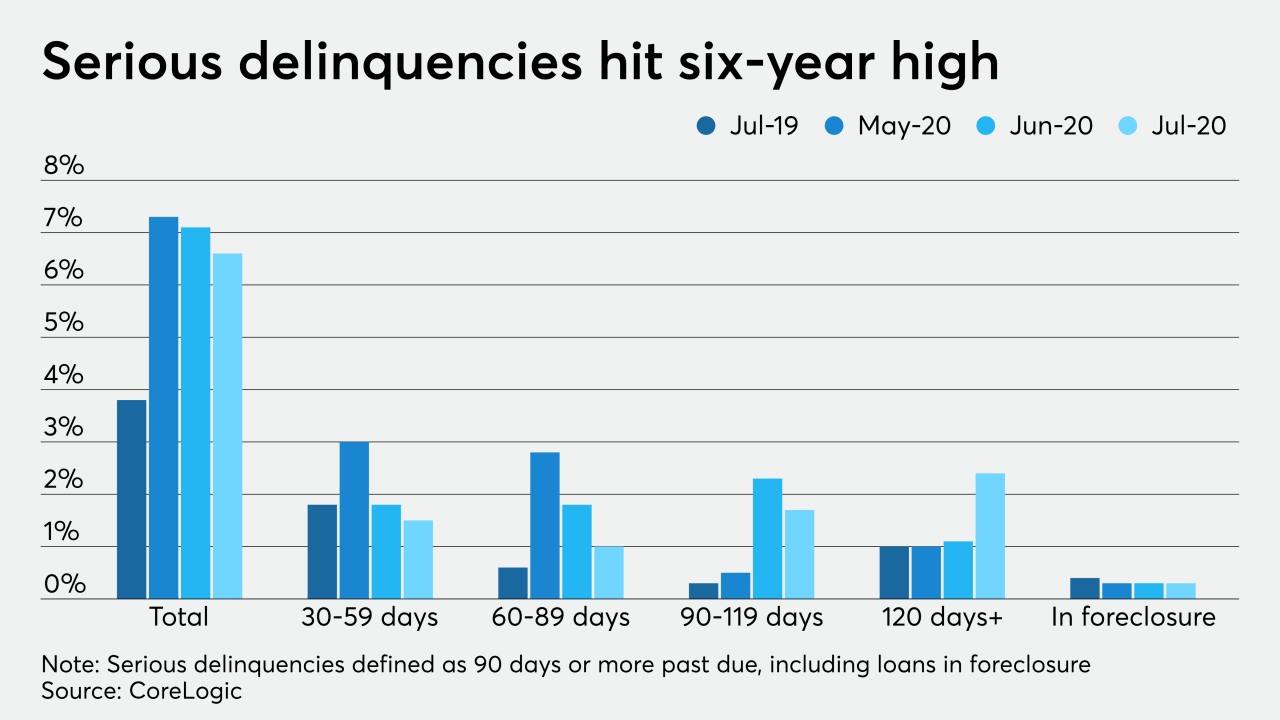

But March's overall late payment rate was 1.3 percentage points higher than one year ago, while the 90-day-plus rate was 2.3 percentage points higher.

June 8 -

Despite CoreLogic’s recent agreement to be acquired by funds managed by Stone Point Capital and Insight Partners, CoStar increased its offer to $95.76 a share.

February 16 -

The deal definitively ends a monthslong war of words between the data provider and stakeholders who attempted a hostile takeover.

February 4 -

With a dearth of inventory, September generated the largest price growth in the housing market since May 2014, according to CoreLogic.

November 3 -

While overall mortgage delinquency rates slowly descend, serious delinquencies — especially loans past 120 days due — jumped in July, according to CoreLogic.

October 13 -

Low mortgage rates and strained supply drove the housing market price growth to a 26-month high in August, according to CoreLogic.

October 6 -

More defaults will lead to an increase in distressed sales, and that will drive down prices, CoreLogic said.

September 21 -

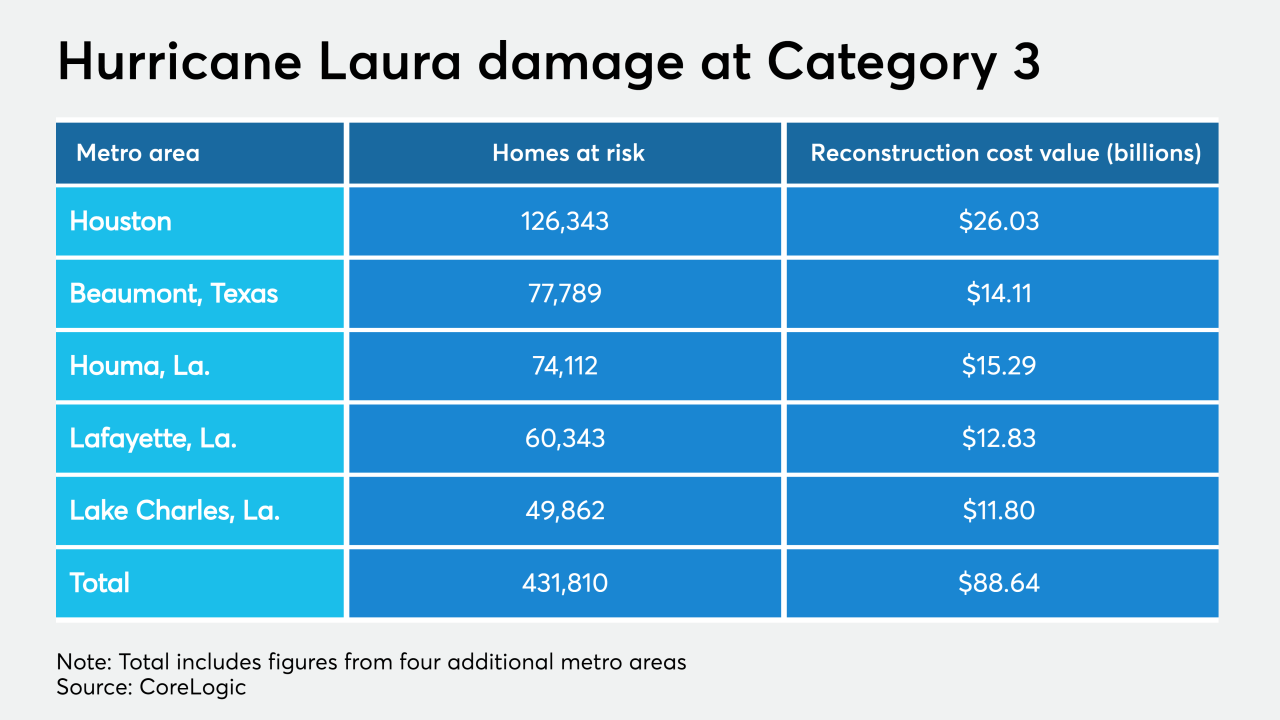

If it makes landfall as a Category 3 storm as was initially projected, damage from Hurricane Laura's surge could potentially devastate 432,810 residential properties in Texas and Louisiana, according to CoreLogic.

August 25 -

The S&P CoreLogic Case-Shiller home price index hasn't yet reflected the impact of the coronavirus, but an independent market maker has some thoughts on how it might.

April 30 -

Despite a lower rate of increase, 2019 equity gains could pull 350,000 households from being underwater on mortgages, according to CoreLogic.

March 7 -

As home value appreciation slowed, gains in home equity for the third quarter fell to the lowest level in two years, according to CoreLogic's homeowner equity report.

December 6 -

Destruction from Michael's storm surge and flooding has potential to affect 57,000 homes, with a worst-case total of $13.4 billion in reconstruction cost value, according to CoreLogic's latest estimates.

October 9 -

Florence's flooding and wind destruction affected about 700,000 residential and commercial properties across North Carolina, South Carolina and Virginia, according to CoreLogic's latest estimates.

September 25 -

While the severity of Florence was reduced prior to Friday morning's landfall, mortgage servicers are taking proactive steps in addressing the emergency situation.

September 14 -

There are almost 7 million coastal homes facing more than $1.6 trillion in potential storm-surge reconstruction expenses this year, representing a 6.6% cost increase from last year's hurricane season.

May 31