Data and analytics provider CoreLogic ended a monthslong battle with two of its shareholders after reaching a definitive merger agreement with outside entities.

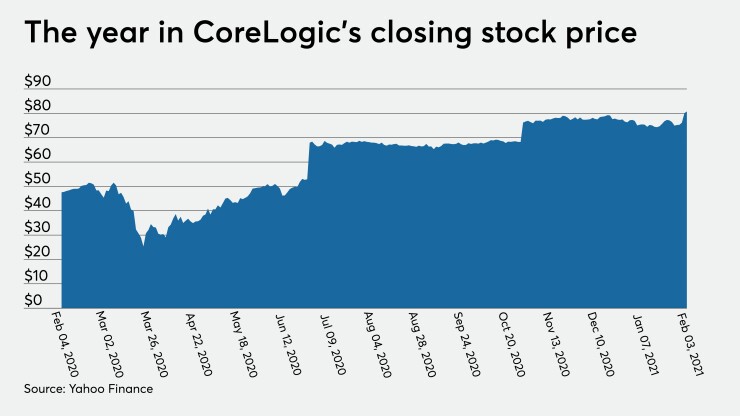

The company’s board of directors approved an ageement by private equity firms Stone Point Capital and Insight Partners to buy the company for $80 per share or $6 billion. The price is a premium of 51% to CoreLogic’s share price on June 25, 2020. The winning offer beat out competing bids of $6.7 billion from real estate analytics firm CoStar Group and an undisclosed all-cash offer from another private equity giant, Warburg Pincus.

CoreLogic chose the Stone Point and Insight bid because they “recognize the value and potential” of its offerings, according to CEO Frank Martell’s press release comments. Meanwhile, the new acquirers confirmed as much, pointing to CoreLogic’s “proprietary” and “powerful” data technology.

The deal — still subject to shareholder and regulatory approval — is expected to close in the second quarter. If it does, it should be the final chapter in

The company has been at war with stakeholders Senator Investments and Cannae Holdings

Neither Senator or Cannae returned calls to confirm the current status of their stakes in CoreLogic. The most recent public filings from December 2020 and January 2021 show the pair collectively owns about 15% of CoreLogic’s outstanding shares.

Today’s announcement marks the latest in a recent string of related investments by CoreLogic’s new majority owners. Stone Point invested in