Lenders are concerned about a risk requirement imposed by

The FHA is temporarily willing to insure mortgages that go into forbearance due to COVID-19 hardships. But in exchange, lenders must agree to be on the hook for 20% of the original loan value if those mortgages go into foreclosure in the next couple of years.

Therein lies the rub, according to a letter sent to the FHA by several housing industry trade groups on Wednesday.

The move may not open the market up much if providing that indemnification discourages mortgage companies from taking on the risk and funding loans, according to the letter, which was sent in response to the agency's request for feedback. As a result, they're calling for the obligation to be removed.

"The excessive indemnification requirements in ML 2020-16 will effectively force lenders to impose higher credit and financial overlays to protect against risks that they cannot control during the underwriting process," a coalition of business, consumer and minority trade groups said in the letter.

"We have seen a similar response to the GSEs' recent policy to charge

But in some ways the stakes are higher for mortgages insured by the FHA than for single-family loans purchased by the government-sponsored enterprises.

Under the terms of

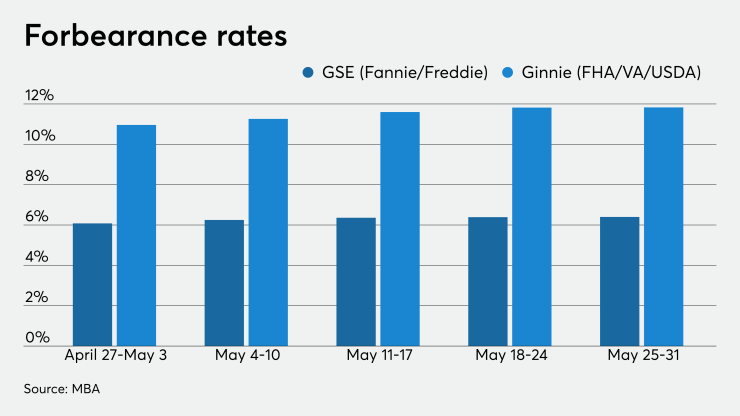

And FHA loans generally serve a lower-income and more financially vulnerable population than home mortgages purchased by the government-sponsored enterprises do. The share of loans with forbearance in mortgage-backed securities Ginnie Mae insures, many of which are FHA loans, is much higher than it is in the GSE conforming loan market.

The Biden administration once again extended the pause on student loan payments enacted to help borrowers during the COVID-19 pandemic, this time through the end of August.

The two states' combined plans amount to over $1.5 billion of the Homeowner Assistance Fund included within the American Rescue Plan Act , which was passed a year ago.

An uptick in pandemic-related payment suspensions reflecting new or restarted plan activity previously occurred as the omicron variant spread, but activity has since subsided.

"These overlays will severely limit access to FHA-insured financing for the borrowers who need it the most, disproportionately impacting low- and moderate-income families, first-time homebuyers and borrowers of color," the trade groups said.

Among the housing industry signatories to the letter are the National Association of Realtors, the Mortgage Bankers Association and the National Association Home Builders. Other examples of organizations that signed the letter include the nonprofit Center for Responsible Lending and minority trade groups like the National Association of Real Estate Brokers and the National Association of Hispanic Real Estate Professionals.

The letter acknowledges that the indemnification is aimed at addressing financial risks from the coronavirus that everyone involved is affected by and trying to mitigate.

Specifically, the FHA wanted to address heightened risk that distressed loans will hurt the finances of its mortgage insurance fund in the event that forbearance fails to prevent broader loan performance issues.

"While we understand FHA's desire to limit risk and exposure during uncertain times, we believe the resulting burden on the lender will have the effect of severely limiting access to FHA-insured loans for homebuyers," the trade groups said in their letter.