The biggest U.S. CLO managers don’t have quite as much weight to throw around as they did six months ago.

Moody’s Investors Service’s rankings of the U.S. collateralized loan obligations shows that the market share of the top 10 declined slightly between January and July as other, slightly less large managers grew their market share.

Moody's defines large managers as those with 10 or more CLOs under management, medium-sized managers as those with between five and 10 deals, and small managers as those with between one and four deals.

"In the U.S., the top 10 managers' market share has declined to 29% from 32% a year ago, while medium-sized managers have increased their market share to 28% from 22% through strong issuance and acquisitions, bumping them into the large-manager group," Yvonne Fu, managing director, structured finance, said in a report published this week.

"Meanwhile, the market share of small managers, half of which entered the CLO market after the financial crisis, has shrunk to 16% from 21% in the past year."

Moody’s rated 96 U.S. CLOs from 67 managers with total par of $49 billion in the first half of 2015, surpassing the first half 2014 mark by $4 billion. The top 10 managers by AUM contributed 23% of new issuance. Other large and medium-sized managers accounted for 47% of new issuance, and managers that entered the CLO market post-crisis accounted for a quarter of new issuance.

In addition, two first-time U.S. managers issued deals: York CLO Managed Holdings and Fifth Street Management.

U.S. risk-retention rules continue to reshape the manager landscape by spurring consolidation; in January, Man Group, which is the parent of the new manager GLG Ore Hill, acquired the established CLO manager Silvermine Capital.

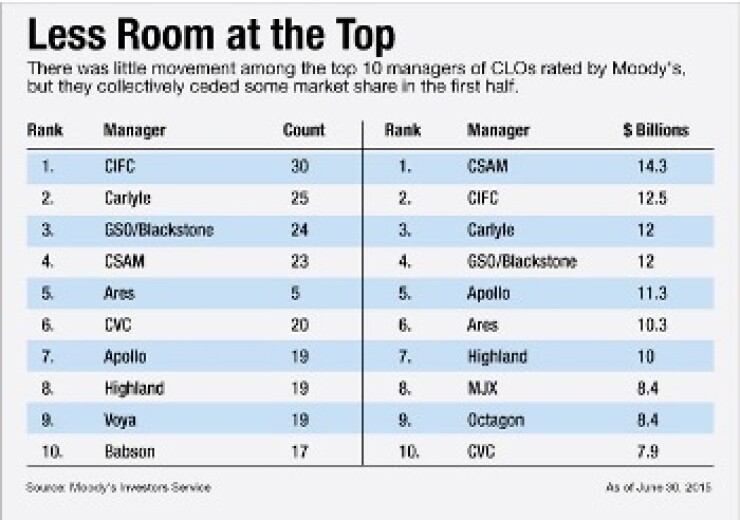

CIFC Asset Management remains the U.S. leader by number of deals, with 30 CLOs under management, and Ares has moved into fifth place from ninth place in the first half of 2014.

Credit Suisse Asset Management tops the league table by total assets under management, at $14.3 billion; followed by CIFC, while Carlyle and GSO/Blackstone are tied for the third spot.

Notably, GSO/Blackstone moved up the scale after issuing several deals this year, while Highland fell to seventh place due to low new issuance and the amortization of existing deals.

In Europe, the story is quite different: the 10 largest managers have gotten much bigger. They now control about 60% of the European market up from 10% in the first half of 2015.

Moody’s rated 18 European CLOs from 12 different managers that closed in the first half with total par of 6.5 billion, including deals from all of the top 10 managers. GSO/Blackstone issued three new deals, the most among European managers.

By comparison, Moody’s rated just 4.6 billion of European CLOs in the first half of 2014.

Alcentra moved up into a tie with GSO/Blackstone for the most European deals at 15, but GSO/Blackstone maintained a slight edge in assets under management over Alcentra at 4.8 billion to 4.7 billion.

Spire was the only new manager to enter the European market in the first half of this year. Another new manager, Tikehau, priced its first CLO in the first half, but the deal did not close until July.