The number of junk-rated companies downgrades by S&P Global Ratings fell sharply in July. But upgrades fell by roughly half, as well.

In its monthly U.S. speculative-grade report, issued Wednesday, S&P said that 19 companies carrying corporate ratings of BB+ or lower were hit with downgrades for weakened liquidity, deteriorating or expected declines in performance and defaults.

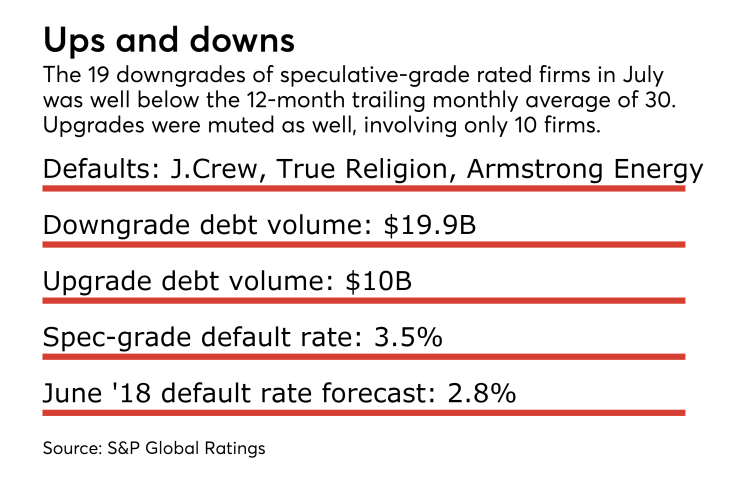

The 19 downgrades was a decline from the 28 in June, which was nearly the trailing-12 month average of 30 downgrades a month S&P has been recording.

Retailers J.Crew Group and True Religion Apparel were among three defaults in July. Also defaulting on a leveraged loan was Armstrong Energy Inc. The trailing monthly default rate fell to 3.5% from 3.8% in June.

The 10 upgrades recorded in July was down from 19 in June, involving $10 billion in debt - far below the $60 billion impacted the prior month.

None of defaulted or downgraded companies have loans that are among the top 50 loan holdings in U.S. collateralized loan obligation portfolios, according to data from Thomson Reuters LPC.

J. Crew actually made both the upgrade and downgrade lists for the month. Its current CCC+ was installed after a short-lived SD (selective default) rating following the mid-July completion of its $566 million distressed exchange of payment-in-kind notes (distressed exchanges are considered selective defaults by ratings agencies). S&P still has a negative outlook for the retailer, judging the resulting capital structure as unsustainable.

True Religion (now unrated by S&P, and rated SD by Moody’s Investors Service) filed for Chapter 11 bankruptcy on July 5, defaulting on a $386 million balance of a first-lien term loan and an $85 million second-lien facility. Armstrong defaulted after missing a June interest payment.

Non-default ratings downgrades were assigned to APX Group holdings, Revlon Inc. (NYSE: REV) and Walter Investment Management Corp. (NYSE:WAC) – the largest debtholders among the downgraded group, making up 41% of all downgraded debt during the month.

Revlon was lowered to ‘B’ from ‘B+’ after S&P reduced net cash flow expectations due to integration issues with its $870 million acquisition of Elizabeth Arden last year. APX, parent firm of the country’s No.3 home monitoring alarm company Vivint, and was downgraded to B- after the company took out a $400 million senior unsecured notes offering to refinance debt and fund a partnership deal with retailer Best Buy.

Walter Investment, a long-timeTampa, Fla.-based mortgage bank lender, was downgraded to CCC-, just three notches above default status. The company reported a second-quarter net loss of $94.3 million and recently entered into a debt restructuring agreement.

The total value of downgraded debt was $19.9 billion, down from $53 billion in June.

In the upgrades recorded by S&P last month, most of the affected debt involved Regal Entertainment Group, NGPL PipeCO and Cornerstone Chemical Co. Six of the 10 upgrades came via improved operating performance; three were due to a merger, acquisition or asset sale; and one because of improved liquidity.

Regal’s upgrade to BB- from B+ was delivered as the No.2 theater chain followed through on plans to shift it financial policy to debt reduction (Regal has ceased making dividend payments since 2014), while committing excess cash flow to capital improvements such as more luxury chairs in its theaters.

NGL PipeCo was raised to BB+ from BB- after proposing a $1.4 billion notes offering to refinance $1.25 billion in existing debt for the Houston-based energy firm.

Cornerstone Chemical was raised to B from B- following an agreement to be acquired by private equity firm Littlejohn & Co.