The asset-backed securities industry completed $83.2 billion in originations during the third quarter, a number that surpassed business done in the same period of 2022, according to preliminary numbers from Asset Securitization Report's deal database.

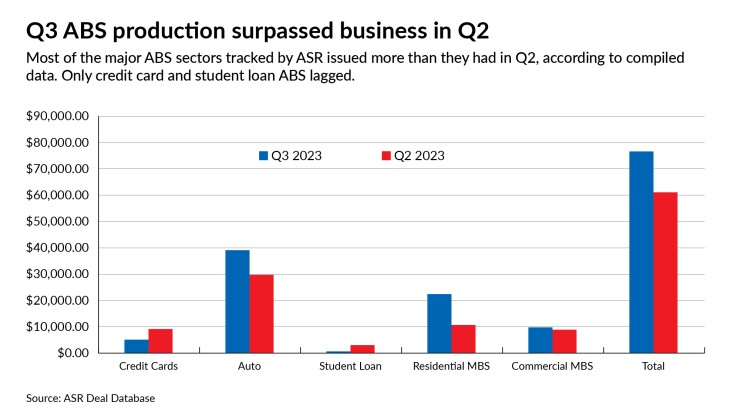

New securitization business from credit card, auto and student loan asset-backed securities, plus residential- and commercial mortgage-backed securities increased by 25.41% in Q3 2023, over the $66.4 billion done in the second quarter of 2023, according to ASR's deal database's latest tally.

This quarterly increase was unexpected, considering geopolitical and economic challenges facing the ABS industry, as well as monetary policy that continued to raise questions about how much demand for securitization business still existed.

Yet after the second quarter, conditions seemed to improve dramatically, and the tally showed that issuance only lagged among the credit card and student loan ABS sectors. Student loan ABS fell behind the most, with issuers turning out just $568 million in new securitization business, a far drop from the $3.1 billion that the sector produced in Q3 2023.

The auto ABS and residential MBS sectors surged ahead in issuance in the third quarter, according to the database. Auto issuance was $42.4 billion, an increase of 31.69% over the $32.2 billion done in Q2 2023, according to the database.

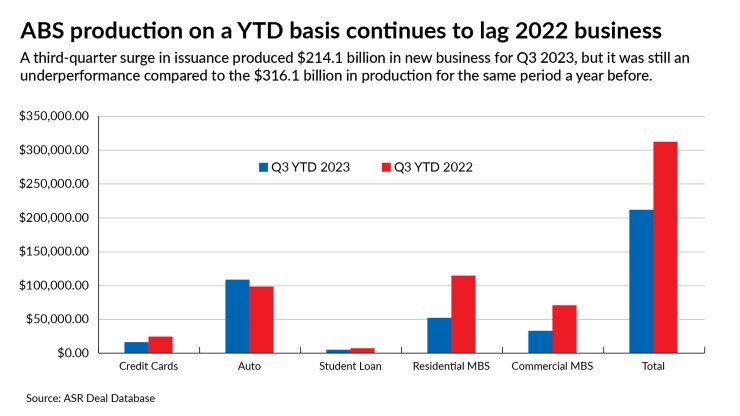

Market participants generally expected production to lag that of 2022, especially on a year-to-date basis. In fact, YTD originations through September 29 did follow industry expectations, producing $214.1 billion in new business and trailing the $316.1 billion done in the same nine-month period in 2022, a 32.26% drop.

The leaders

The Bank of America Merrill Lynch was the busiest manager in this period, with $35.7 billion in new securitization, as tallied by the ASR database. Following BofA is a familiar lineup, including J.P.Morgan Securities which brought $32.7 billion in new business to market; Goldman Sachs with $20.6 billion in new issuance; Morgan Stanley with $16.2 billion in new ABS and Wells Fargo Securities with $14.9 billion in new issuance.