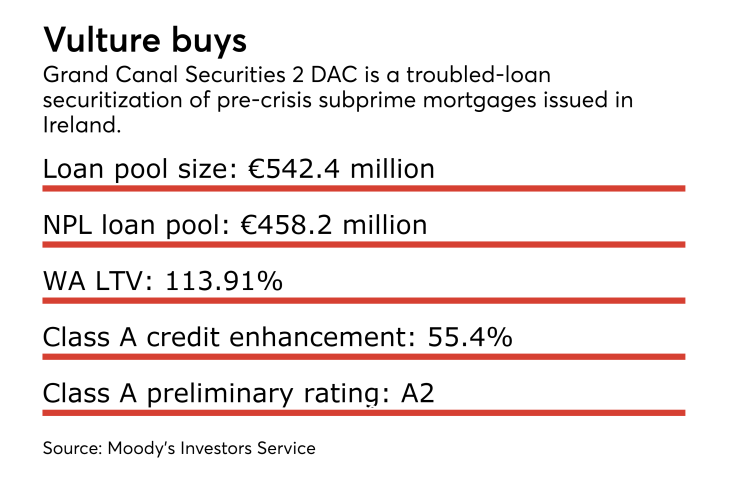

UK-based Mars Capital, a vulture-fund subsidiary of Oaktree Capital, is securitizing a round of mostly non-performing Irish personal loans and mortgages totaling €542.4 million.

The NPL mortgages were all acquired in a 2014 bad-asset liquidation of pre-crisis mortgages originated by two defunct entities: the Irish Nationwide Building Society and Springboard Mortgages Ltd.

Nearly 85% of the loans Grand Canal Securities 2 DAC (designated activity company) are non-performing loans in which the primary available cash flows are from recoveries rather than regular principal and interest payments from borrowers.

The notes being issued include a Class A note series that will comprise 44.6% of the final note balance; the senior notes will be supported by 55.5% credit enhancement.

Part of that CE is a reserve account totaling 3% of the Class A balance that has enough adequate funding to cover about 15 months of interest on the Class notes, according to a pre-sale report from Moody’s Investors Service.

Moody’s has assigned a preliminary A2 rating to the Class A notes, a sharp drop from the triple-A afforded Mars’ first sponsored securitization of

About 51.8% of the loans in the pool were originated by the former INBS; the remainder were from Springboard. The loans average more than 10 years in seasoning, and most lack equity: the average current loan-to-value ratio in the pool is 113.91%. This pool of loans are also primarily either loans originated to self-employed (43.6%) or self-declared income (49.91%) borrowers.

The portfolio includes a small portion(15.5%) of performing loans, which will help bridge the gap in irregular cash flow available from the NPL loans following foreclosures or other recoveries from the defaulted loans, according to the Moody's report stated. The loans classified as non-performing were at least three months behind and payments amounted to less than 75% of the amount due.

Mars Capital acquired the loans in 2014 from the Irish Bank Resolution Corp. that was assigned the task of unwinding the assets of Irish Nationwide as well as subprime loans originated by Springboard. Mars’ acquisitions were part of a €1.8 billion liquidation by Irish banking authorities involving 12,702 mortgages.