Mortgage rates slid for a third week, down a scant two basis points a full week following

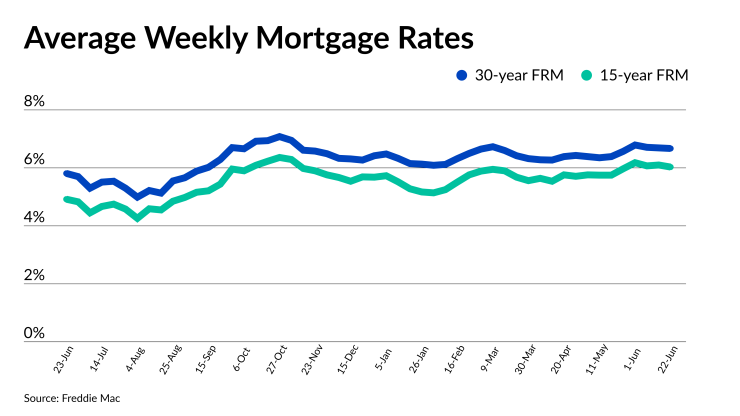

The Freddie Mac Primary Mortgage Market Survey found the 30-year fixed rate mortgage averaged 6.67% for the period ended June 22, compared to

The 15-year FRM had a steeper week-to-week drop, 7 basis points to 6.03% from 6.1%. For the

"Potential homebuyers have been watching rates closely and are waiting to come off the sidelines," Sam Khater, Freddie Mac chief economist, said in a press release. Last week, Freddie Mac projected

The benchmark 10-year Treasury bounced up and down during the week. It closed at 3.73% on June 15, but rose to 3.77% the next day. The next trading day was June 20 (because of Juneteenth), the yield slipped back to 3.73%.

At 11:30 a.m. eastern time on June 22, the yield was back up to 3.78%, up 6 basis points on the day from the previous close of 3.72%.

Zillow's rate tracker put the 30-year FRM at 6.45% on Thursday morning, up 4 basis points from the prior day, but down from 6.47% one week ago. The prior week's average was 6.45%.

"Mortgage rates edged down only slightly this week as investors considered somewhat contradictory reports on inflation and await new data," said Orphe Divounguy, senior macroeconomist at Zillow Home Loans, in a statement issued Wednesday night.

While the Consumer Price Index remains elevated, the Producer Price Index declined in May.

"In addition, housing data, especially the

The economy is showing signs of cooling, although Fed Chairman Jerome Powell made it clear

"Bond yields — and the mortgage rates that tend to follow them — depend on current and expected inflation as well as the economic outlook and the path of interest rates," Divounguy said. "Cooling inflation and a general economic slowdown would put downward pressure on long-term interest rates like the 10-year Treasury yield and in turn, mortgage rates."

Going forward, the mortgage market will be hindered as "inventory challenges persist as the number of

Although First American's Chief Economist noted the lock-in effect from high mortgage rates still is in place and that will hold back existing home sales, there are other reasons for sellers to act. For example, some people that have a mortgage may decide to act because of lifestyle reasons.

Fleming also cited 2021 research that said 42% own their home free and clear.

"Finally, existing homeowners are sitting on near historic levels of equity," he said. "For some of those equity-rich homeowners, moving and taking on a higher interest rate may not hinder their decision to sell."

Still, the "new normal" for existing home sales will be well below the activity during the pandemic, Fleming said.