Subprime originations are climbing in multiple consumer loan categories, including mortgages, but the increase is much smaller in the home loan sector than it is in other markets, according to TransUnion.

"Origination growth is taking place most notably in subprime," Matt Komos, TransUnion's vice president of financial services, research and consulting, said in a press release.

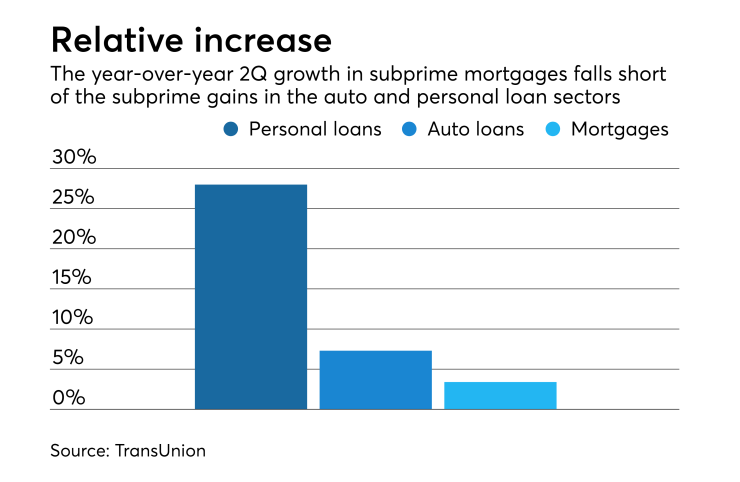

Subprime mortgage originations were up just 3.4% year-over-year, according to TransUnion, a credit-reporting company that calculates origination data with a one-quarter lag.

In comparison, originations to borrowers with credit scores between 300 and 600 were up 28% in the personal loan sector during the second quarter, and subprime auto originations were up 7.3%.

While subprime origination rates are higher in other consumer-debt sectors, the loan balances involved in the mortgage sector tend to be higher.

TransUnion analyzed the data using VantageScore Solutions' scores rather than the FICO scores the mortgage industry

When credit scores fall, concerns about strain on underwriting increase. This cyclically tends to occur when rates rise, as they have been. Higher rates make it tougher to originate loans, putting more pressure on originators to loosen underwriting in order to bring in more borrowers.

There is particular concern that this trend could emerge in the subprime mortgage sector, where loose underwriting is considered a key contributor to the bursting of the housing bubble and the Great Recession in the mid-2000s.

The increase in the subprime mortgage sector did contrast a 0.43% decline in mortgage originations overall, but so far, mortgage performance continues to

The 60-plus-day delinquency rate dropped another 26 to 32 basis points year-over-year in the third quarter, depending on whether it was measured on an account-, consumer- or a balance-level basis.