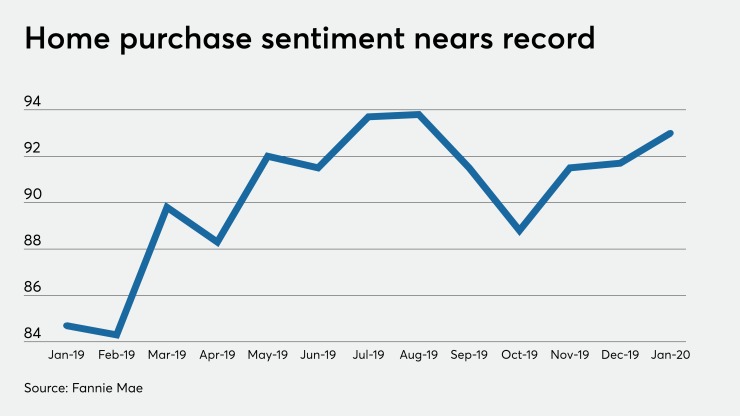

Consumer sentiment about purchasing a home nears its record high as almost half of those surveyed said mortgage rates will stay at the current low levels, according to Fannie Mae.

That marks a big change from a year ago, when the vast majority of consumers said rates would rise in the coming months.

The Fannie Mae Home Purchase Sentiment Index increased to 93 in January, from 91.7 for the prior month and 83.7 for

"Low rates continue to be a key driver of consumer optimism about both current homebuying and home-selling conditions," Fannie Mae chief economist Doug Duncan said in a press release. "Favorable views on job security and personal financial expectations reflect the strength of the labor market, which we believe will continue to bolster housing demand.

"With much-needed inventory set to come online this year, offering a modicum of

January's HPSI value is the third highest ever, topped only in July and

The survey found 48% of respondents believe mortgage rates will remain the same over the next 12 months, up two percentage points from

On the other hand, one-third of consumers said rates would rise, down from 39% in December and 59% in January 2019.

Only 7% said rates would actually move lower, unchanged from December and up one percentage point from January 2019.

However, the survey was conducted between Jan. 2 and Jan. 23; so it might not capture any sentiment from the end of that period, when mortgage rates

The percentage of those that said now is a good time to buy a home was unchanged from December at 59%, with the share that said it was a bad time falling to 30%.

Meanwhile, 66% of those surveyed said now is a good time to sell, up one percentage point from December, while 21% said it was a bad time, down by a percentage point.

Slightly fewer consumers are concerned about home prices rising in the next year, with 48% anticipating an increase, compared with 50% in December and 45% in January 2019.

But the number of people who feel prices will decrease fell to 7% from 10% in December and 15% a year ago.

The percentage of those consider their employment situation secure for the next 12 months remained unchanged month-to-month and year-over-year at 86%.

However, when it came to income over the past year, 61% said they made about the same, while 27% said significantly higher and 11% said significantly lower.