The whole business securitization of Five Guys Enterprises, LLC, a casual burger fast casual restaurant concept, is continuing with the Five Guys Funding, LLC Series 2021-1, which will raise $250 million this time around.

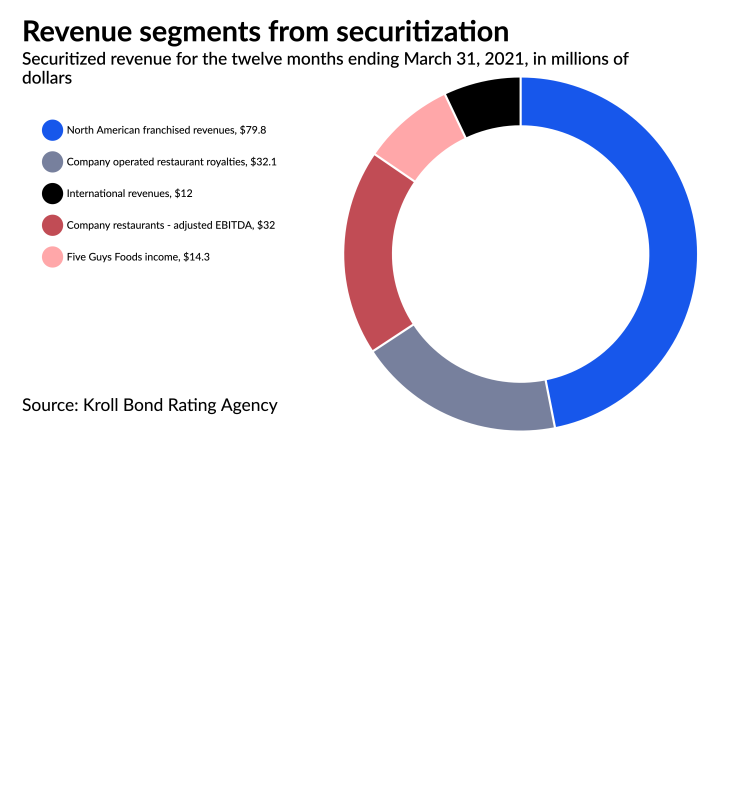

Collateral for the trust includes revenues attached to several company assets, including intellectual property and related license agreements based in the U.S. and Canada, plus collections from company-operated restaurants and bakery sales, and certain international collections, according to Kroll Bond Rating Agency.

Existing and future domestic franchise agreements and royalties on company-operated restaurants are also pledged to the 2021-1 trust, and confer to the deal one of the many positive credit aspects of the deal. Royalties from 1,017 franchise locations and 441 company-operated restaurants as of March 31, 2021, support the transaction.

In another plus for the deal, Five Guys is highly geographically diverse, and operates in 49 U.S. states, Canada and 18 foreign countries. Aside from California, which accounts for 9.5% of North American restaurant locations, no single state has more than 8% of the company’s restaurant locations.

Guggenheim Securities is the sole structuring advisor and sol book running manager on the trust. The trust has just two tranches, the $50 million A-1 notes, and the $200 million A-2 notes. Both are rated ‘BBB,’ and have an anticipated repayment date of July 2026 and July 2028, respectively.

Although relatively simple at first glance, the trust has several structural features that act as powerful protections. A cash-trapping debt service coverage ratio is in place. If, on any quarterly payment date, the principal and interest DSCR is between 1.5x and 1.75x, then 50% of all excess cash flows will be deposited into the cash trap reserve account. Another feature stipulates that the principal and interest DSCR is less than 1.2x the notes will be subject to a Rapid Amortization event if certain other triggers or events are breached.

For the 12-month period ending on March 31, 2021, Five Guys’ store count and system-wide sales had increased steadily in recent years as well. For the twelve months leading up to March 2021, system wide sales were $2.3 billion, up from $1.6 billion for the twelve months leading up to March in 2016. Franchised and company-owned restaurants totaled just over 1,400 in 2021, a slight uptick from slightly fewer than 1,400 in 2016.