-

The four-week high in forbearance exits also helped drive the considerable drop in plans, according to Black Knight.

June 4 -

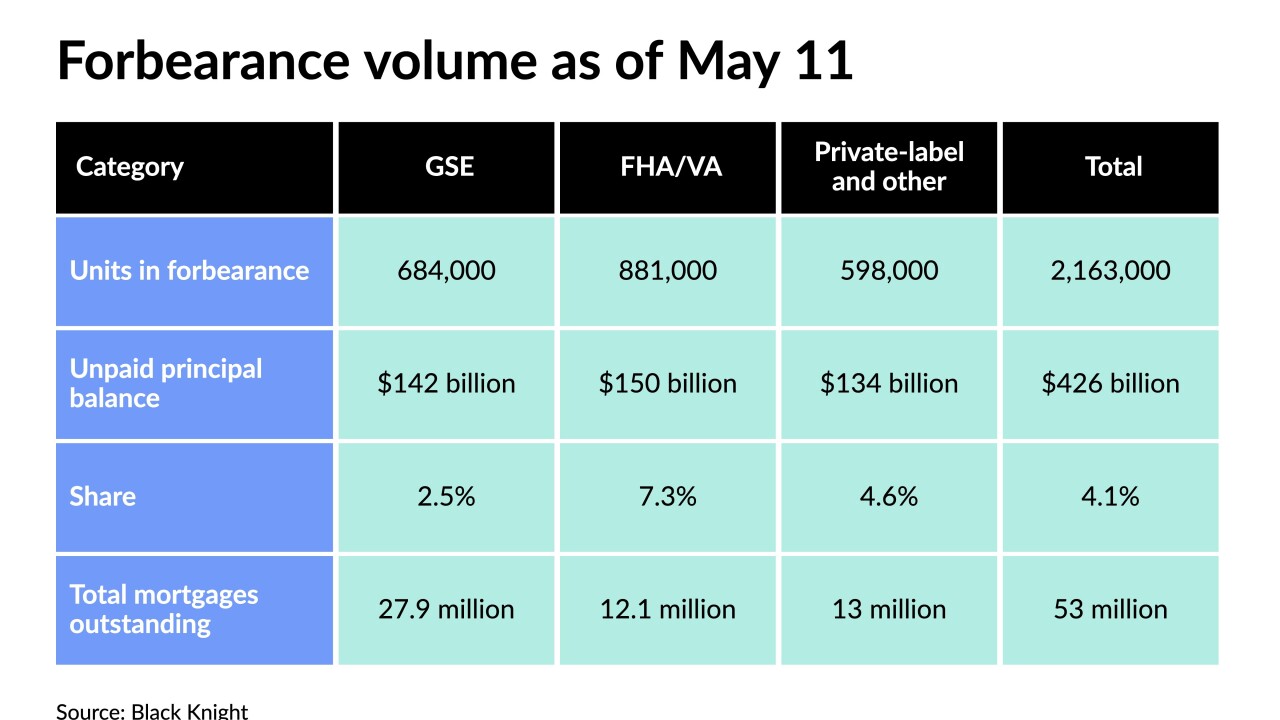

Numbers fell across the board, with private-label and portfolio loans declining most.

May 14 -

Most of the activity covered vacant and abandoned properties or commercial loans, according to Attom Data Solutions.

May 12 -

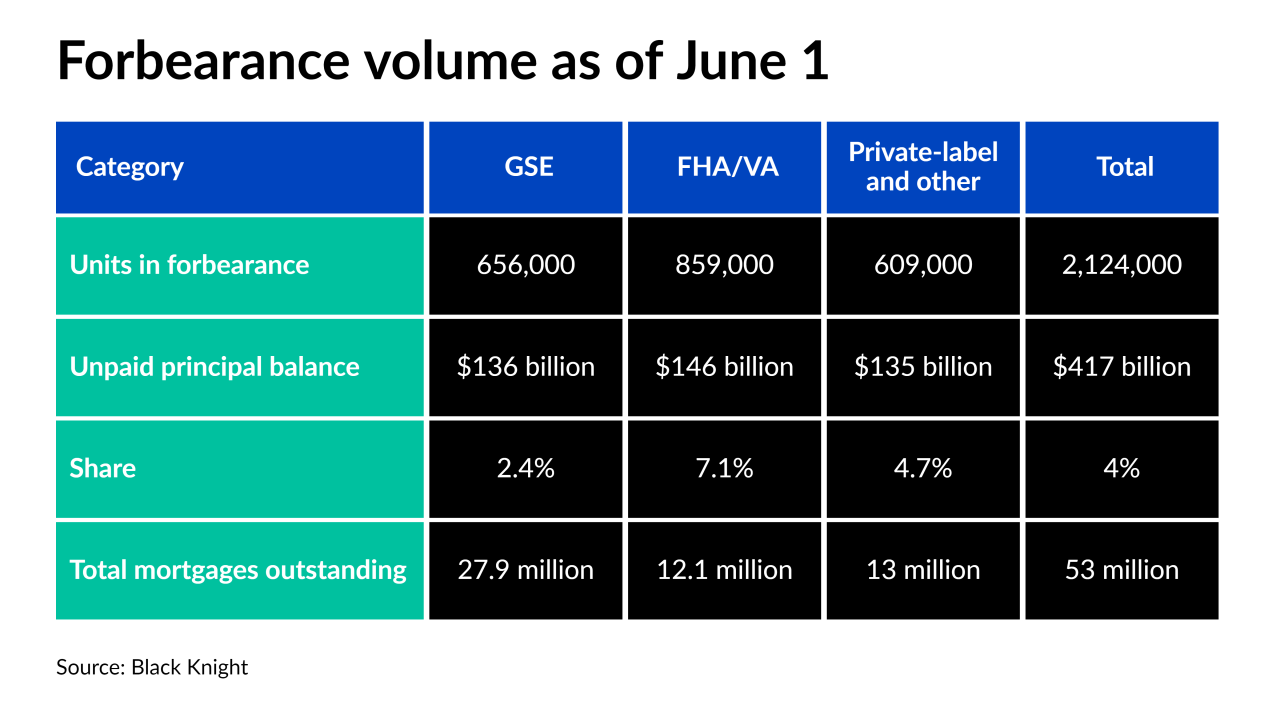

The total number of loans in this category dropped 11 basis points from week to week according to the Mortgage Bankers Association. Meanwhile, the amount of unpaid balance in forbearance dropped almost 23% since the start of the year, a separate report from Black Knight found.

May 10 -

The company aims to use the additional capacity to get its non-qualified mortgage business back to producing $125 million per month, and anticipates more purchases of mortgage servicing rights, representatives said in its Q1 earnings call.

May 5 -

The West Palm Beach, Fla.-based lender sees an opportunity for even more growth after its deal to acquire a servicing portfolio from Texas Capital Bank.

April 29 - LIBOR

The modifiable templates are a follow-up to a similar notification the organization created in 2019 for lender use.

April 27 -

Though the government-sponsored enterprises have some of the lowest forbearance rates in the market, they expect to contend with a significant population of borrowers who face steep financial setbacks after the pandemic ends.

April 22 -

The Consumer Financial Protection Bureau disputes a district court ruling that misconduct claims against the company were already covered by a previous settlement.

April 22 -

The persistently slow reduction in the number of borrowers at risk of default indicates that while loan performance overall is improving, a substantial pool of mortgages will need workouts when forbearance ends.

April 22 -

Also, even with bans in place, the total number of filings keeps inching up due to actions taken on vacant properties.

April 15 -

The diverse group of loans in the servicing rights portfolio offers a potentially attractive recapture opportunity and would be a sizable transaction for their era.

April 12 -

However, the decline in Black Knight’s numbers may stem from a previous deadline that policymakers have since extended.

April 9 -

The consumer bureau is proposing to give companies until January 2022 to comply with one rule regarding communications from collectors and another clarifying disclosure requirements.

April 7 -

One official at the bureau said this fall could be an “unusual point in history” for the mortgage market as delinquent borrowers exit forbearance plans. The agency proposed new steps for servicers to help consumers stay in their homes.

April 5 -

Deals, trends and research in structured finance and asset-backed securities for the week of March 26-April 1

April 1 -

The agency announced it was rescinding seven policy statements issued last year meant to help companies combat fallout from COVID-19 but that the bureau's current chief said came at the expense of consumers.

March 31 -

About 3.4 million renters believe themselves to be at risk of eviction, but when the moratorium ends, the actual number may be between 130,000 and 660,000, according to a Zillow report published Monday.

March 29 -

The development bodes well for outcomes on distressed loans backed by major government-related mortgage investors Fannie Mae and Freddie Mac.

March 26 -

The FHFA’s forbearance extension to September is forcing nonbank servicers to buy out more delinquent loans. It's also upended loss estimates for investors and made racial and income disparities in the mortgage market worse.

March 25