Among the opportunities that New Residential Investment is looking forward to taking advantage of following completion of the

"As the competitive landscape gets more difficult on the operating side, the environment will play into our strengths with our capital base, balance sheet and great leadership team," New Residential Chairman, CEO and President Michael Nierenberg said on the company’s first quarter earnings call Wednesday. "We will be focused on growing out other products to our homeowners and build on the great retail presence that Caliber has created."

New Residential reported net income of $277.6 million in the first quarter, up from $68.6 million in the fourth quarter and a loss of $1.6 billion

That pushed New Residential's focus into the mortgage originations and servicing businesses.

On the originations side, the company had net earnings of $151.3 million, which was down from $169.8 million in the fourth quarter. One year ago, New Residential had $47 million in income from originations.

However, first quarter origination volume was the highest ever for its NewRez business at $27.2 billion, up from the previous record of $23.9 billion in the fourth quarter and $11.4 billion in the first quarter of 2020.

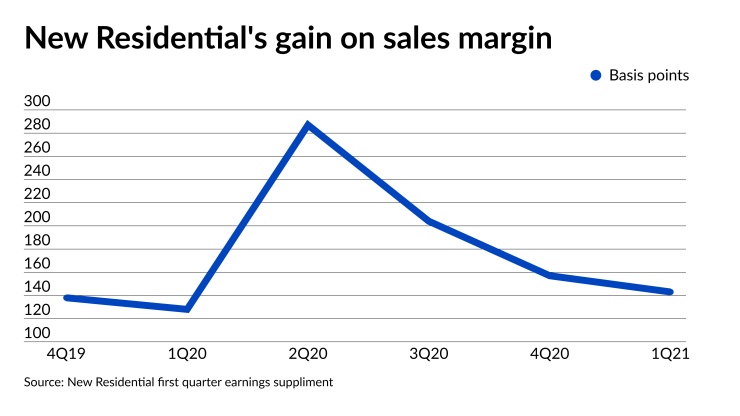

Like other lenders, the company had lower gain on sale margins during the quarter, Baron Silverstein, president of the NewRez business, said during the call. Since peaking at 287 basis points in the second quarter of 2020, gain on sale has continued to decline and averaged 147 bps for the first quarter, down 14 bps from the fourth quarter.

In April, gain on sales margins stabilized, except in the wholesale channel, where they continued to fall because of competitive pressure from some of the larger players, he said.

However, NewRez sees an opportunity in the non-qualified mortgage market. The company has relaunched non-QM products in the wholesale channel, Silverstein said, adding "we saw locks of $35 million in April with a goal to get back to our pre-COVID levels of $125 million per month."

The rollout of non-QM was slow largely due to capacity, not pricing, Nierenberg said later on the call. The Caliber acquisition is expected to solve that particular problem at NewRez.

"The other thing is, when you think about the nature of the origination market in 2020 with so much production on the agency side, there [were] not enough folks, quite frankly, to process non-QM loans," Nierenberg said. "As you think about refinancing volumes coming off and the need for what I would call non-QM product, a non-government-guaranteed product, we expect it to be a pretty significant part of our business."

On the servicing side, New Residential had net income of $23.7 million, compared with $36.2 million in the fourth quarter and first quarter 2020 income of $24.4 million. Its mortgage servicing rights portfolio at the end of the quarter totaled $304.6 billion, compared with $297.8 billion as of Dec. 31, 2020, and $275.8 billion on March 31, 2020.

The MSR investment and servicer advances segment had a net income of $292.1 million, compared with a fourth quarter loss of $179 million and a first quarter 2020 loss of $440.3 million.

But its residential securities and call rights segment had a first quarter loss of $234.9 million, despite New Residential having its highest level of activity in this area since the fourth quarter of 2019. It had brought back $636 million of mortgage-backed securities in Q1 2021, Nierenberg said. For the first quarter of 2020, this business line lost $941 million.

Going forward in 2021, look for New Residential to be a buyer of servicing packages.

"MSR asset sales are likely to rise as gain on sale margins continue to contract," Nierenberg said. "And if you think back to our history, we're poised to take advantage of MSR sales in the marketplace."

New Residential has the capital to participate in these bulk sales transactions "as some originators potentially look to offload more thinly capitalized MSRs if origination volume slows more meaningfully," Eric Hagen, an analyst at BTIG, said in a report.

Regarding the Caliber deal, "integration costs weren't addressed in detail on the earnings call, but it remains a focus of ours, especially considering the potential upside to the MSR from further strengthening its recapture rate as the companies integrate and unlock some synergies," he added.