-

Mortgage rates continued their slide, with the conforming 30-year fixed at its closest point ever to breaching the 3% mark, according to Freddie Mac.

July 9 -

Mortgage rates reached their lowest level this week since Freddie Mac began its Primary Mortgage Market Survey in 1971, but they might not have yet gotten to their floor.

July 2 -

Potential sales last month rose compared with April as homes became more affordable due to low mortgage rates.

June 18 -

Mortgage rates increased slightly for the second consecutive week, buoyed early on by positive economic news such as the jobs report that came out last Friday, according to Freddie Mac.

June 11 -

Mortgage rates fell to their lowest level since Freddie Mac started reporting this data in 1971, as the coronavirus shutdown continued to play havoc with the economy.

April 30 -

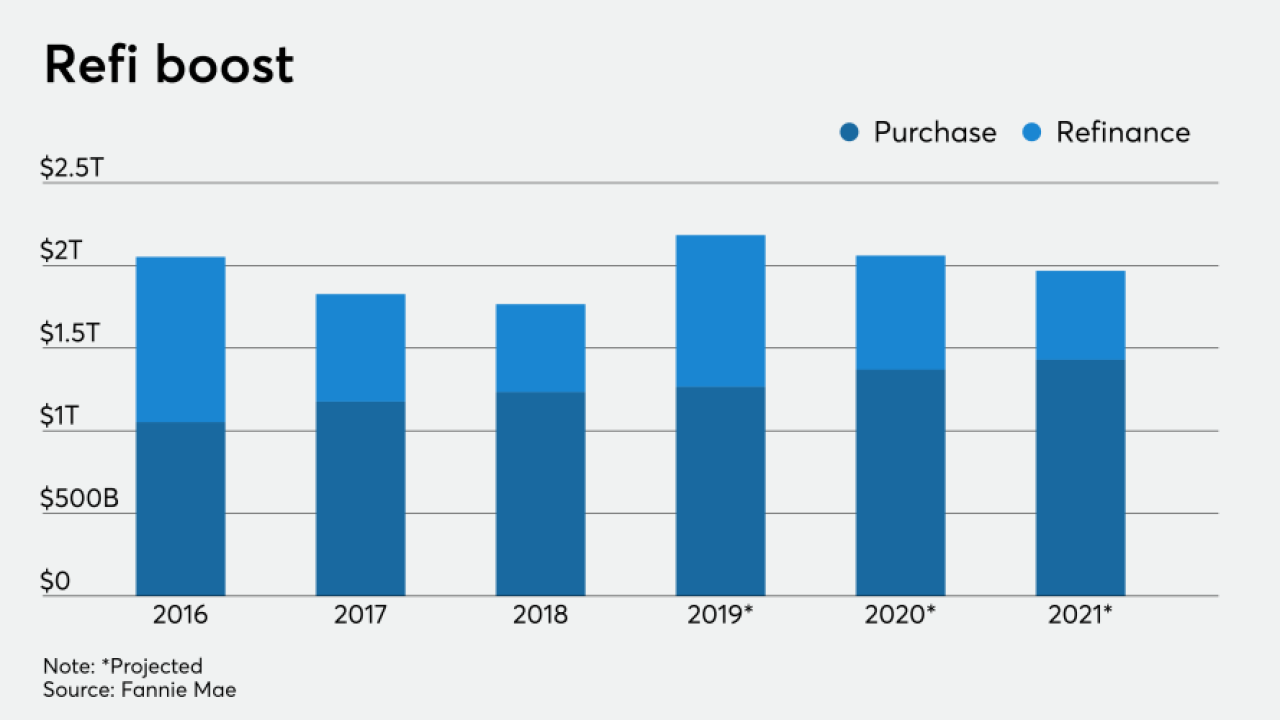

Increased refinancing volume led Fannie Mae to raise its 2020 estimate by $300 billion and 2021 projection by $280 billion.

March 12 -

Mortgage lenders could benefit from the surge in refinancing due to widening market spreads, and that could help offset damage to servicing rights portfolio valuations, according to Keefe, Bruyette & Woods.

March 9 -

For the first time since the start of the housing crisis, mortgage origination volume could top $2 trillion for three consecutive years, according to Fannie Mae.

February 18 -

Consumer sentiment about purchasing a home nears its record high as almost half of those surveyed said mortgage rates will stay at the current low levels, according to Fannie Mae.

February 10 -

With interest rates expected to stay low while wages and the overall economy grow in conjunction, Fannie Mae again boosted its single-family mortgage origination outlook for 2019, 2020 and 2021.

January 22 -

Mortgage rates ended the week little changed from the previous seven-day period and near historic lows for the year, according to Freddie Mac.

December 26 -

More than half of the third quarter refinance activity was the cash-out variety, with borrowers removing the most total equity from their homes in nearly 12 years, according to Black Knight.

December 9 -

With economic expansion expected to keep churning through at least the first half of next year, Fannie Mae upwardly revised its single-family mortgage origination outlook for 2019 and 2020.

November 18 -

Fannie Mae increased its mortgage origination forecast as lower interest rates, driven by economic uncertainty, will lead to more refinance activity, but other factors will continue to hold back home purchases.

July 16 -

While mortgage rate optimism kept consumer confidence about the home purchase market high in June, affordability worries pulled overall sentiment lower, a Fannie Mae survey said.

July 8 -

Slower growth to interest rates and home prices will boost housing affordability in 2019, according to Fannie Mae.

January 22 -

Mortgage servicing assets are poised for gains in 2019. But as higher average mortgage rates spur lenders to sell servicing rights and diversify their loan offerings, servicers' work will also get more complicated and costly.

December 24 -

Average mortgage rates plunged after the United Kingdom first voted to leave the European Union. With uncertainty now growing about how Brexit will actually happen, here's a look at the implications for the housing market and mortgage lending.

December 12