-

Just a week after commenting that the bottom on mortgage rates was possibly reached, Freddie Mac reported that they fell 6 basis points to another record low.

October 15 -

Mortgage rates remained flat this week, a sign that the bottom has possibly been reached, but the housing market looks to remain strong for the near future, according to Freddie Mac.

October 8 -

Mortgage rates fell back toward their all-time low this week, increasing purchasing power for homebuyers. But the lack of homes for sale drives up prices and reduces affordability, according to Freddie Mac.

October 1 -

Mortgage rates experienced a marginal uptick this week, rising three basis points. But they remained near record lows and possibly soon could track down again, according to Freddie Mac.

September 24 -

Mortgage rates remained relatively flat, rising a single basis point off of last week's record low, according to Freddie Mac.

September 17 -

Low rates, along with increased new and existing home sales activity drives the latest forecast.

September 16 -

But the 30-year fixed remains below 3%, which should continue to support increased demand.

August 13 -

Rates are forecasted to remain at the current low levels for the rest of 2020, driving steady refinance volume.

August 5 -

Mortgage rates fell 2 basis points this week, remaining near their historic lows as they have for the past month with the markets roiled by uncertainty, according to Freddie Mac.

July 30 -

Mortgage rates rose for the first time in six weeks, going back the above the 3% mark, as spreads to the 10-year Treasury yield widened again, according to Freddie Mac.

July 23 -

Mortgage rates continued their slide, with the conforming 30-year fixed at its closest point ever to breaching the 3% mark, according to Freddie Mac.

July 9 -

Mortgage rates reached their lowest level this week since Freddie Mac began its Primary Mortgage Market Survey in 1971, but they might not have yet gotten to their floor.

July 2 -

Potential sales last month rose compared with April as homes became more affordable due to low mortgage rates.

June 18 -

Mortgage rates increased slightly for the second consecutive week, buoyed early on by positive economic news such as the jobs report that came out last Friday, according to Freddie Mac.

June 11 -

Mortgage rates fell to their lowest level since Freddie Mac started reporting this data in 1971, as the coronavirus shutdown continued to play havoc with the economy.

April 30 -

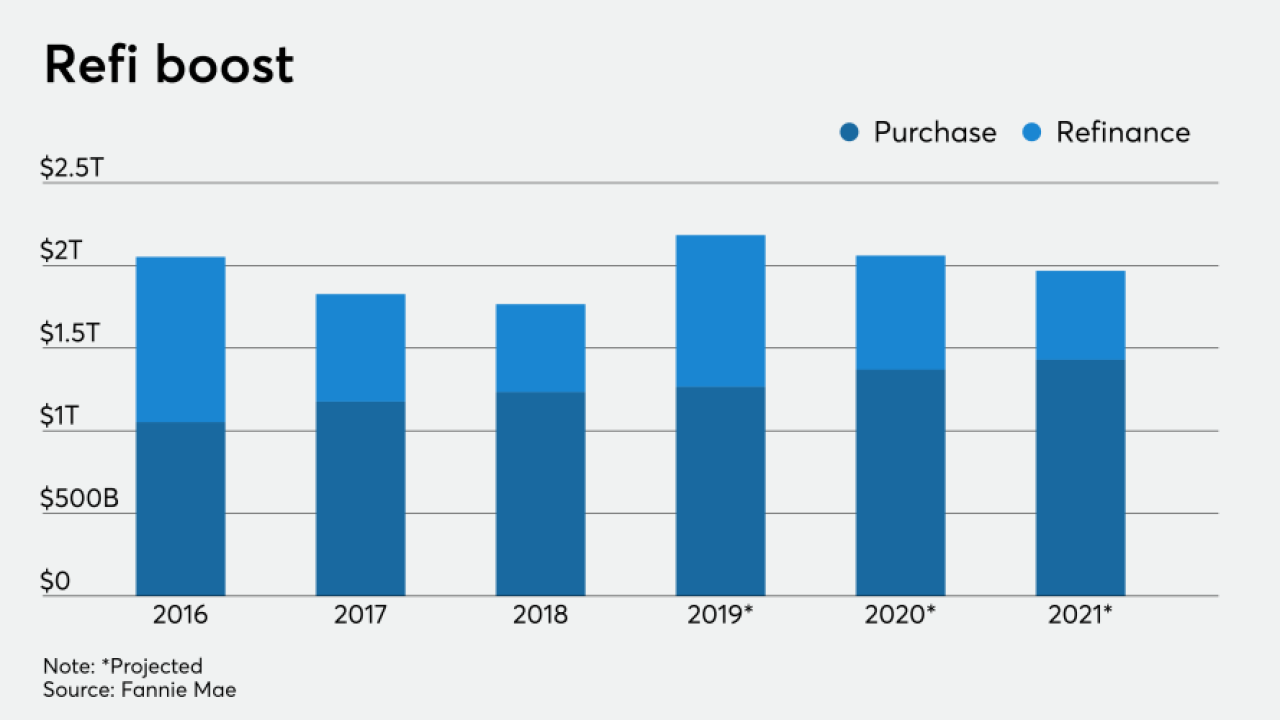

Increased refinancing volume led Fannie Mae to raise its 2020 estimate by $300 billion and 2021 projection by $280 billion.

March 12 -

Mortgage lenders could benefit from the surge in refinancing due to widening market spreads, and that could help offset damage to servicing rights portfolio valuations, according to Keefe, Bruyette & Woods.

March 9 -

For the first time since the start of the housing crisis, mortgage origination volume could top $2 trillion for three consecutive years, according to Fannie Mae.

February 18 -

Consumer sentiment about purchasing a home nears its record high as almost half of those surveyed said mortgage rates will stay at the current low levels, according to Fannie Mae.

February 10 -

With interest rates expected to stay low while wages and the overall economy grow in conjunction, Fannie Mae again boosted its single-family mortgage origination outlook for 2019, 2020 and 2021.

January 22