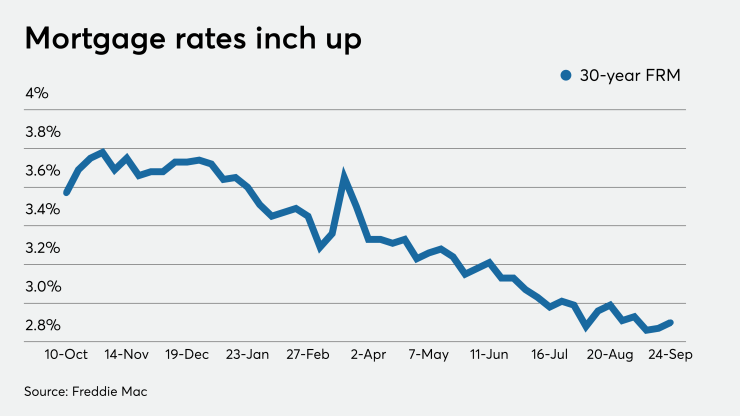

Mortgage rates experienced a marginal uptick this week, rising three basis points. But they remained near record lows and possibly soon could track down again, according to Freddie Mac.

"Mortgage rates set several record lows over the last few months and have remained low into September," Sam Khater, Freddie Mac's chief economist, said in a press release. "While there is room for rates to decrease even more,

The 30-year fixed-rate mortgage averaged 2.9% for the week ending Sept. 24,

Meanwhile, the 15-year fixed-rate mortgage averaged 2.4%, up from last week when it averaged 2.35%. A year ago at this time, the 15-year fixed-rate mortgage averaged 3.16%.

On the other hand, the five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 2.9% with an average 0.2 point, down from last week when it averaged 2.96%. A year ago at this time, the five-year adjustable-rate mortgage averaged 3.38%.

Zillow's own mortgage rate tracker was flat over the last seven days, Matthew Speakman, Zillow economist, said in a commentary accompanying its release on Wednesday, "despite a healthy dose of news, economic data and central bank statements that prompted a whirlwind week in stock markets.

"Pandemic-related uncertainty and muted inflation expectations have helped keep Treasury yields — which generally dictate mortgage rates — at very low levels and in a historically tight range for the last month, even as other financial markets have seen significant ups and downs. Unsurprisingly, mortgage rates have followed a similar pattern lately," he said, remaining flat during that time frame.

And Speakman agreed that there is room for mortgage rates to move even lower, even after what he termed "a couple of sharp moves" related to the upcoming implementation of the Federal Housing Finance Agency's

"With the Fed likely