-

Warnings, finger pointing, and political infighting have consumed talks around a continuing resolution, but the details of the upcoming funding package are expected to be ironed out over the weekend for a likely vote early next week.

September 20 -

Canadian asset-backed commercial paper issuers eye chance to narrow massive financing gap created by the CDOR benchmark cessation.

August 28 -

Economists are also forecasting faster and deeper cuts to borrowing costs over the next year, and see the central bank reducing the policy rate from the current 4.5% to 3% by next July.

August 26 -

KeyCorp wasn't seeking capital but saw the benefits of Scotiabank's minority stake. The deal would enable the Canadian lender to step into the U.S. consumer market.

August 12 -

The existing notes, known as non-standard debt and held by insurers, were swapped this month into newly issued commercial mortgage-backed securities in equal proportions.

May 24 -

Capital Community Bank of Provo has purchased Security Home Mortgage, headquartered in nearby Orem.

May 6 -

First National has agreed to buy Touchstone Bankshares. The combined company would have more than $500 million each of deposits and loans.

March 26 -

C$14.1 billion in purchases of federal government debt led the foreign inflows, as well as a C$6.6 billion investment in securities of government corporations and business enterprises.

March 15 -

McConnell has been the last serious bulwark within the party against Donald Trump's animosity toward US international commitments, including in Ukraine.

February 28 -

CEO Scott Thomson has said that changes to the bank's operations may include "end-to-end digitization" as well as centralization of its international unit, rather than running it on a "country by country by country" basis.

October 20 -

The class action case, first brought up in 2020, accused Lakeview Loan Servicing and LoanCare of violating the Texas Debt Collection Act by charging "junk" fees.

October 2 -

Decreased availability of bank capital for new commercial construction helped slow activity from the previous nine quarters, according to a new report.

September 8 -

Canada's banking regulator is proposing to make it more costly for lenders to accommodate mortgage borrowers who stretch out their loans in an effort to limit housing-market risks in the financial system.

July 11 -

Prime Minister Justin Trudeau's government is considering winding down the Canada Mortgage Bond program in a bid to reduce borrowing costs.

July 6 -

The two states' combined plans amount to over $1.5 billion of the Homeowner Assistance Fund included within the American Rescue Plan Act , which was passed a year ago.

March 4 -

With resources provided through the Homeowner Assistance Fund, the $1 billion plan will help cover homeowners’ past-due payments and comes after New York unveiled a similar assistance package earlier this month.

December 21 -

Canada’s national pension fund struck its first partnership to build and rent out single-family homes in the U.S., joining a rush to capitalize on a housing shortage.

December 8 -

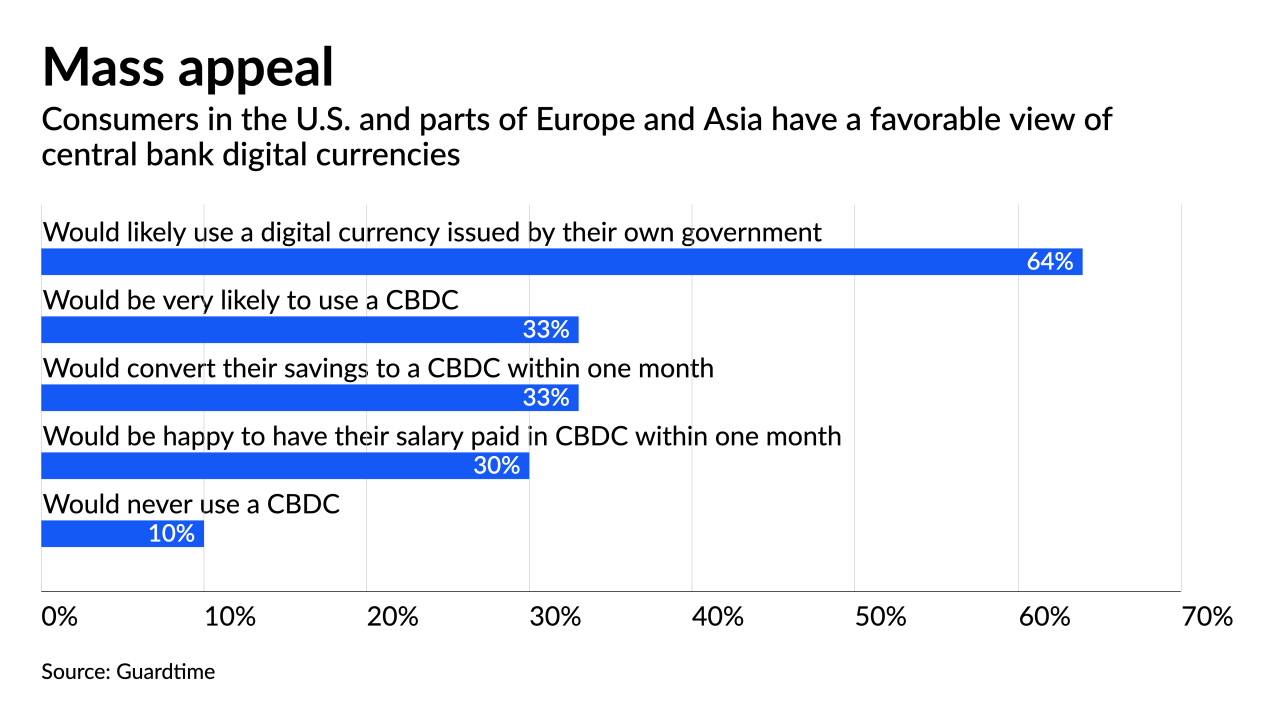

Western central banks trying to develop sovereign cryptocurrency models face pushback from lawmakers and other obstacles, while the digital yuan has a much clearer path.

July 27 -

Goeasy would join the likes of Canadian non-prime lender Fairstone Financial Inc., which sold its inaugural ABS transaction in 2019. Also that year, Home Capital Group Inc. priced the first deal pooling non-prime Canadian home loans since 2007.

May 5 -

The 2021 deal tally is split between $37 billion in new-issue transactions along with $68 billion in refis/resets, according to S&P Global Ratings.

March 29