-

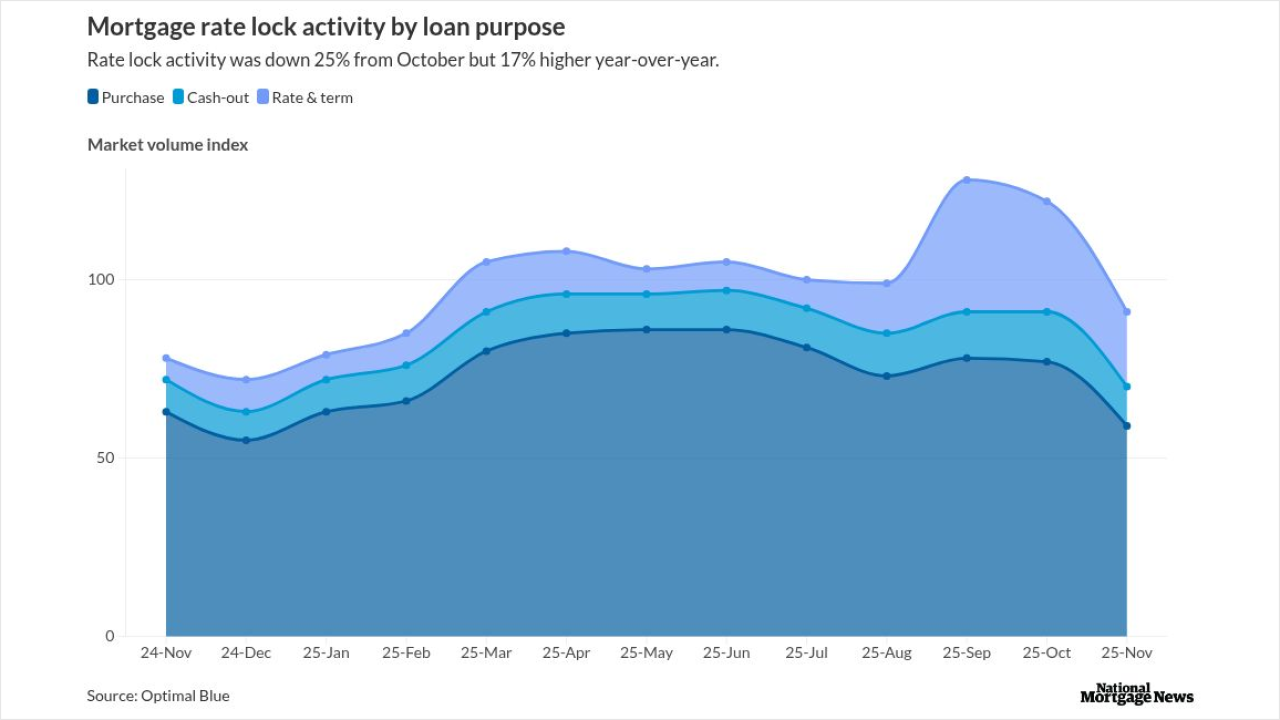

November rate locks fell seasonally but hit their strongest level since 2021, led by refis, while lenders shifted more loans to the GSE cash window.

December 10 -

Few doubt the deal will draw solid demand from local buyers. Argentina could receive between $2 billion and $4 billion in orders, largely from real-money funds and overseas banks.

December 10 -

The home equity investment provider first approached the securitization market in July 2024 to raise $217 million.

December 9 -

A dayslong slump in US government bonds has curbed risk appetite as traders grow cautious about the pace of monetary easing beyond Wednesday's meeting.

December 9 -

Aside from employment numbers that are still fluctuating, year-over-year inflation rates could remain persistent, sending Fed base rates north of 3%.

December 9 -

A federal court cannot modify a preliminary injunction to compel the acting director of the Consumer Financial Protection Bureau to request funding for the agency, the Department of Justice said.

December 9 -

Forty percent of Americans planning to buy or sell a home in 2026 worry about a potential market crash, according to a new report from Clever Offers.

December 9 -

Hahn's experience includes innovative retail structures for conglomerates, holding companies, private funds and private real estate investment trusts.

December 8 -

Hildene, which partners with Crosscountry Mortgage for non-QM securitizations, is doing this deal as part of its buy of an annuity provider, SILAC.

December 8 -

Dext ABS 2025-2 includes a prefunding account with an amount of $65 million, or 15.0% of the collateral's total combined balance.

December 8