Earnings

Earnings

-

The Hammond, Louisiana, company, which announced changes to its business strategy, cut 71 jobs and reduced its dividend to 8 cents per share.

July 30 -

First Foundation in Dallas recently got a $228 million capital injection led by Fortress Investment Group. Now it's announced plans to pivot away from its heavy focus on multifamily loans, which lost value as interest rates rose.

July 26 -

ACNB is acquiring Traditions Bancorp in an in-market deal where the latter's mortgage ops will add to its insurance and wealth management units.

July 24 -

For at least the fifth consecutive quarter, the Providence, Rhode Island, company increased its allowance for credit losses on general office loans, which continue to be a problem area for banks.

July 17 -

The Charlotte, North Carolina-based bank saw profits and net interest income dip in the second quarter, but made up lost revenue through investment banking fees.

July 16 -

The investment banking giant said that it will "moderate" its pace of share repurchases as it continues to talk to the Federal Reserve, which recently increased its stress capital buffer from 5.5% to 6.4%.

July 15 -

Investment banking fees shot up at the nation's largest bank, thanks to rebounds in M&A and the equity capital markets segment. And despite higher credit costs in the company's card business, a top bank executive expressed confidence in the health of U.S. consumers.

July 12 -

Finance of America has $350 million of notes coming due next year and wants to trade them for $200 million of secured debt coming due in 2026 and $150 million maturing in 2029.

June 27 -

Proceeds could be used to support the company's loan originations as well pay down existing debt coming due in the next three years.

June 14 -

Executives at the Toronto-based bank said last year that they planned to add 150 branches in the United States. But when pressed on Thursday, they could not say how much they'll scale back their ambitions due to investigations over TD's anti-money laundering practices.

May 23 -

After several quarters of slumping investment banking and trading fees, the Charlotte, North Carolina-based company reported a big uptick from that division, which helped compensate for a large decline in net interest income.

April 22 -

Net charge-offs at the Charlotte, North Carolina-based bank increased by more than 80% in the first quarter compared with a year earlier. BofA executives say that the rising losses were in line with the bank's risk appetite.

April 16 -

First-quarter results at the companies were promising for other banks looking to reel in fees from capital markets activities as deposit costs put pressure on net interest income.

April 12 -

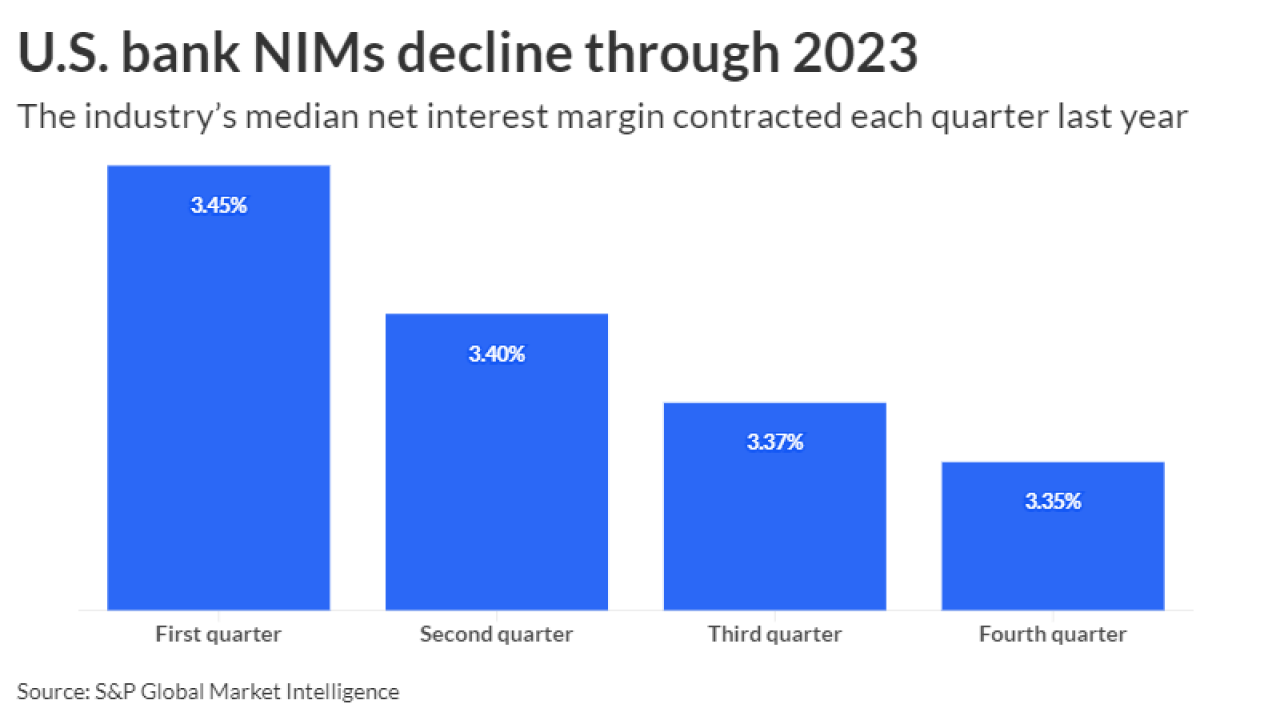

With high deposit and borrowing costs persisting amid the Federal Reserve's campaign against inflation, lenders face stress on their net interest margins and the potential of troubled loans ticking up.

April 2 -

Audited financials, proof of fidelity bonds and errors and omissions insurance must be provided on Ginnie Mae Central after May 13.

March 27 -

The increase in production revenues was canceled out by higher expenses, a sign that too much capacity remains in the system, the Mortgage Bankers Association said.

March 15 -

A rate drop was a common concern for some servicers during the quarter, and Ocwen recently took a step aimed at better addressing this risk in the future.

February 27 -

The company was able release credit reserves because of actual and forecasted prices that boosted net income, CEO Priscilla Almodovar said.

February 15 -

The government-sponsored enterprise financed 955,000 mortgages last year, down from the 1.8 million loans it backed in 2022.

February 14 -

Large and regional banks are taking different approaches to buybacks in light of the proposed new capital rules. Some plan to buy back stock at moderate levels this year, while others say they will to remain on the sidelines until there is more clarity about the reforms.

January 31