Bank of America said it has agreed to allow 50,000 mortgage customers to defer payments for three months because they've lost income as a result of the pandemic.

Federal Housing Finance Agency Director Mark Calabria said a virus-induced financial crisis might give rise to more delinquencies and foreclosures than the 2007 subprime mortgage meltdown.

The collapse of dine-in revenues for restaurant chains during the outbreak is placing whole biz deals under the ratings microscope.

After budget cuts and a strategic transition, the interagency body conceived by Dodd-Frank to identify systemic threats has largely been silent as the pandemic roils the economy.

Mortgage servicers need direction from federal agencies on how to implement the forbearance plans called for in the CARES Act, according to the Community Home Lenders Association.

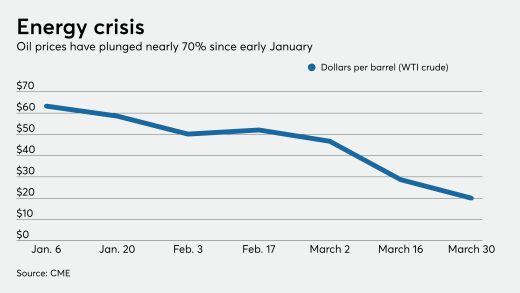

Weak demand for oil and gas, brought on by the economic fallout of the coronavirus outbreak, has raised concerns of energy firms missing loan payments or even going bankrupt. Here’s how banks and regulators are trying to get ahead of potential problems.

The 2008 package proved some banks were too big to fail. But the rushed $2.2 billion stimulus shows now any company can be bailed out.

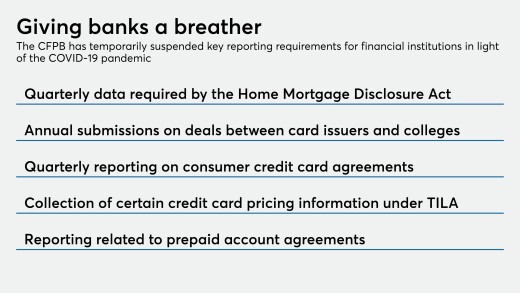

The agency has relaxed some reporting requirements and joined other regulators in encouraging banks to help borrowers, but pressure is building on the bureau to do more to aid consumers suffering financial hardship.

-

Bank of America said it has agreed to allow 50,000 mortgage customers to defer payments for three months because they've lost income as a result of the pandemic.

April 1 -

Federal Housing Finance Agency Director Mark Calabria said a virus-induced financial crisis might give rise to more delinquencies and foreclosures than the 2007 subprime mortgage meltdown.

April 1 -

The collapse of dine-in revenues for restaurant chains during the outbreak is placing whole biz deals under the ratings microscope.

April 1 -

After budget cuts and a strategic transition, the interagency body conceived by Dodd-Frank to identify systemic threats has largely been silent as the pandemic roils the economy.

March 31 -

Mortgage servicers need direction from federal agencies on how to implement the forbearance plans called for in the CARES Act, according to the Community Home Lenders Association.

March 31 -

Weak demand for oil and gas, brought on by the economic fallout of the coronavirus outbreak, has raised concerns of energy firms missing loan payments or even going bankrupt. Here’s how banks and regulators are trying to get ahead of potential problems.

March 31 -

The 2008 package proved some banks were too big to fail. But the rushed $2.2 billion stimulus shows now any company can be bailed out.

March 31 Polyient Labs

Polyient Labs