-

Members of the House Financial Services Committee cited leveraged lending, cybersecurity and the switch to a new interest rate benchmark among potential systemic risks that keep them up at night.

September 25 -

Digital loan underwriting has taken the lion's share of the volume of unsecured consumer lending, a sector with plenty of room for growth, according to DBRS.

September 23 -

The third issuance from the master trust has a higher average interest rate and greater expected losses than previous pools due to the inclusion of more higher-risk marketplace loans.

September 16 -

SoFi's fourth issuance of marketplace loans includes more contracts in the pool with terms of 24 months, 48 months and 60 months, and fewer 36- and 84-month loans.

September 13 -

It hasn't stimulated loan demand in ways banks hoped it might, and some CEOs fear future rate cuts might cause companies to hunker down.

September 10 -

The bureau issued three policies removing the threat of legal liability for approved companies that test new products.

September 10 -

The acquisition of Radius Intelligence fits with the online lender's existing focus on small commercial borrowers.

September 3 -

A year after the major credit bureaus agreed to strip tax liens and civil judgments from consumers' credit files, a new study says it is hampering lenders' credit decisions. But proponents of the move insist it was the right call.

September 3 -

Nonbank lenders Monroe Capital and MGG Investment Group have made a combined $115 million of loans to firms that make cannabidoil and supply products to the cannabis and hemp industries.

August 26 -

Blooma has developed a software product that combs databases to create property profiles for commercial real estate lenders. It can drastically cut origination costs and approval times and help banks identify safer loans, the company says.

August 23 -

The tech-driven asset management firm announced it had closed a $115 million asset-backed securities deal led by Cantor Fitzgerald, with unsecured consumer loans acquired from Prosper Marketplace.

August 22 -

The LendingPoint 2019-1 trust will market $169.4 million in notes backed by 18,760 loans with a collective balance of $178.3 million.

August 20 -

The LendingClubs and SoFis of the world have a big head start, but HSBC's U.S. unit says its partnership with the fintech Avant will help it close the gap in online personal loans.

August 14 -

Behind strong job markets, the shortage in housing supply and more millennials moving out, 2019 projects to be a record year for multifamily originations.

August 12 -

The increases are mostly at the junior debt levels of deals, according to the Refinitiv research unit.

August 12 -

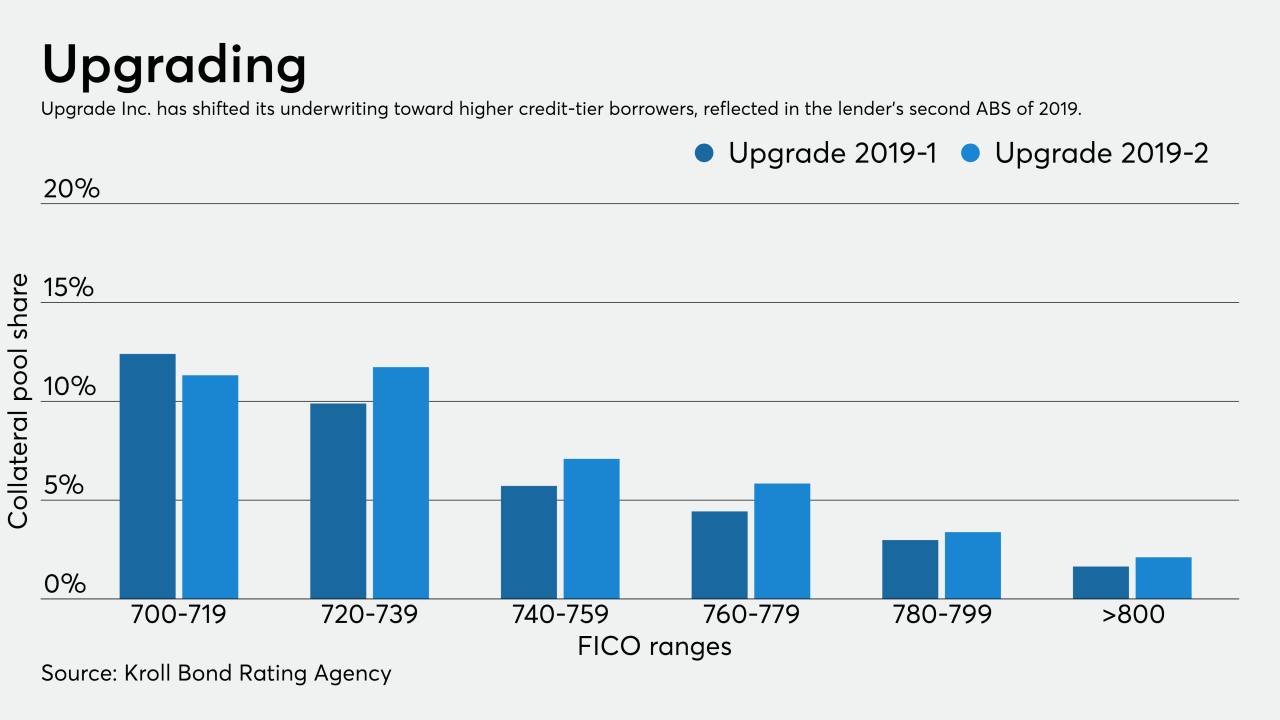

Online consumer lender Upgrade Inc. is including more higher-credit tier borrowers in its next securitization, reflecting the company’s focus this year on reducing lending to non-prime credit segments.

August 12 -

President Trump is expected to sign legislation soon that would expand the number of farmers who could file under the more lenient Chapter 12. Ag lenders are worried because farm bankruptcies recently rose and the trade war with China could worsen.

August 11 -

Regional Toyota captive finance lender World Omni has its highest-ever average FICO for a securitization of prime auto-lease receivables. But it also is pooling a portfolio of contracts that have a highly concentrated mix of lease maturities.

August 8 -

Fresh data from the Fed, FDIC and Bank of England shows that, directly or indirectly, banks are taking on more leveraged loans. But whether this puts their loan and securities portfolios at risk remains open for debate.

August 8 -

The online SME lender is marketing $198.45 million in notes backed by U.S. originations. Funding Circle has previously issued ABS deals backed by small-business loans in its native UK.

August 7