-

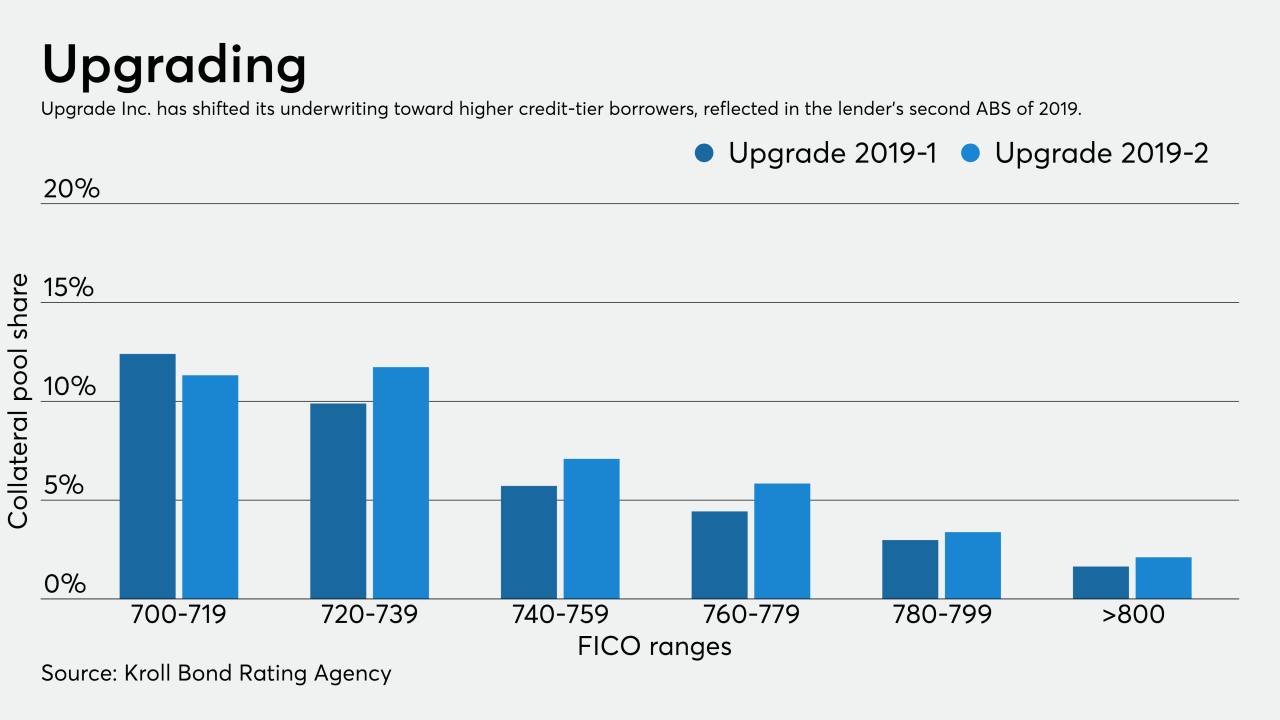

Online consumer lender Upgrade Inc. is including more higher-credit tier borrowers in its next securitization, reflecting the company’s focus this year on reducing lending to non-prime credit segments.

August 12 -

President Trump is expected to sign legislation soon that would expand the number of farmers who could file under the more lenient Chapter 12. Ag lenders are worried because farm bankruptcies recently rose and the trade war with China could worsen.

August 11 -

Regional Toyota captive finance lender World Omni has its highest-ever average FICO for a securitization of prime auto-lease receivables. But it also is pooling a portfolio of contracts that have a highly concentrated mix of lease maturities.

August 8 -

Fresh data from the Fed, FDIC and Bank of England shows that, directly or indirectly, banks are taking on more leveraged loans. But whether this puts their loan and securities portfolios at risk remains open for debate.

August 8 -

The online SME lender is marketing $198.45 million in notes backed by U.S. originations. Funding Circle has previously issued ABS deals backed by small-business loans in its native UK.

August 7 -

Mall landlords accustomed to offering rent reductions to ailing retailers are mulling a new strategy to forestall the industry's collapse: positioning themselves as lenders to tenants struggling to stay afloat.

August 7 -

The San Francisco company forecast a modest profit in the third quarter because its cost-cutting plans are ahead of schedule. It's also starting a program to sell riskier loans to sophisticated investors.

August 6 -

The Upstart Network, the first and only startup to participate in the bureau’s program for promising digital platforms, claims that using nontraditional credit data items has helped loan volume and affordability.

August 6 -

The Atlanta fintech, whose shares have plummeted since it went public last year, also said it will stop providing financial guidance to its investors.

August 6 -

Though the use of alternative data in lending is seen by some as untested, several fintechs say they couldn't function without it.

August 5