HSBC USA’s digital lending platform went online this week, and the bank did so with an acknowledgment that the market has long been dominated by the likes of LendingClub and Social Finance.

“Fintechs were quicker to recognize that consumer lending niche and improve the customer experience with pre-approvals and quicker funding of the loans, and that spurred the growth in this area,” said Marcos Meneguzzi, head of cards and unsecured lending for retail banking and Wealth Management at HSBC USA.

The $177 billion-asset unit of the global giant HSBC Holdings is attempting to follow suit, offering personal loans either online or through a mobile device for up to $30,000 with terms ranging from two to five years. Interest rates will range from 5.99% to just over 20%.

“As we’re looking to expand our presence in the U.S., it made a lot of sense for us to look into that space and be able to participate in the marketplace with a modern approach for our customers,” Meneguzzi said.

The bank partnered with Chicago-based fintech Amount, a spinoff company from the online lender Avant, which itself has originated over $6 billion in loans for some 800,000 consumers since 2012. HSBC is utilizing Amount's loan origination technology.

Meneguzzi said the bank’s decision to enter the competitive digital personal lending market arises from a product gap it saw between its credit card and mortgage businesses. It also hopes the added digital offering will attract new customers and appeal to existing customers.

Amount’s technology is expected to reduce the bank's approval and funding times. HSBC USA said approved customers will receive funds as quickly as the next day. Kevin Lewis, senior vice president and head of sales and partnership strategy for Avant, said in some instances consumers can receive funding the same day.

“The speed of approval is based on the verification policy that’s dictated by the banks,” Lewis said. “The customer is ultimately going to determine the speed in which they’re funded because they need to complete certain verification requirements.”

Amount’s technology also addresses personal loan risk management, which helps with issues such as fraud. The fintech earlier this year spun off that portion of its technology into a platform called AmountVerify.

Amount supplies its technology to other banks besides HSBC, including Banco Popular, TD Bank and Regions Bank.

“One of the benefits that we saw in partnering with Avant is that we can customize the platform to our specifications,” Meneguzzi said.

HSBC's relationship with Amount is one of several third-party partnerships the bank has announced in recent months.

Its most attention-grabbing partnership is with SoftBank Robotics Group for its robot greeter “Pepper,” and it launched a digital mortgage platform with Roostify in June. It has also used Avoka’s (since acquired by Temenos) technology for digital customer acquisition and onboarding for credit cards.

HSBC also has a robo-adviser partnership with Marstone. The bank and Marstone developed HSBC Wealth Track, a software-based investment advice platform that gives clients the ability to create a portfolio for both retirement and non-retirement accounts.

Meneguzzi said the partnerships have helped to give HSBC more access to consumers who do not live in the markets where it has branches.

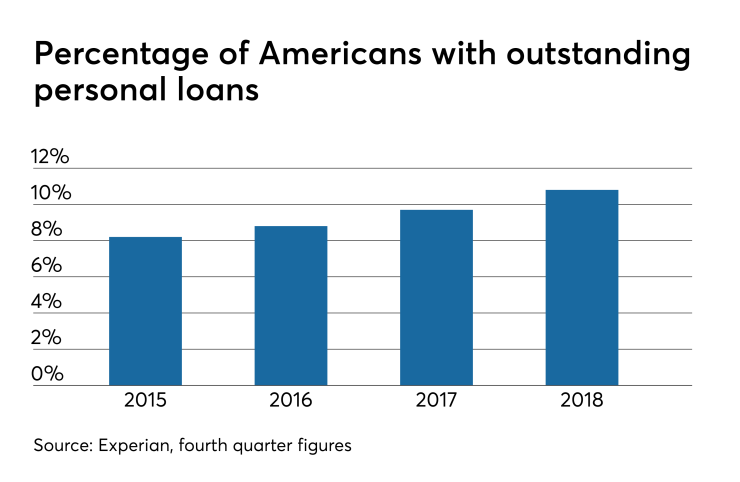

With the Amount partnership, HSBC now is more connected to a personal lending market that continues to grow each quarter. Unsecured personal loans hit an all-time high last year at $138 billion, according to TransUnion. While TransUnion says fintechs serve 38% of that market, there is opportunity for banks to get more involved.

“The personal loans area is perhaps the easiest one for banks to get into with smaller loan amounts compared with auto loans and mortgages,” said Craig Focardi, a senior analyst for banking at Celent.

“From a long-term perspective, personal lending is usually a small but important part of the overall balance sheet for revenue growth,” he added. “But I think it’s more important that institutions have that capability so they can manage how much personal lending they want to do and defend themselves against the intense competition in the digital personal lending market.”