-

The $462.3 million VMC 2018-FL2 will be backed by 25 properties, two of which will be acquired after the deal closes.

October 16 -

The rating agency feels that “late-cycle credit behavior” is allowing less established issuers to rely on the securitization market more heavily for funding.

October 15 -

Two of the three largest loans in the $951 million deal are $50 million slices of loans on the Aventura Mall in Florida and the Christiana Mall in Delaware.

October 3 -

Blackstone Real Estate Income Trust obtained a $257 million mortgage from Barclays on 17 hotels with a total of 2,189 rooms across seven states; it still has $177 million of equity in the properties.

October 1 -

First Foundation sold loans to Freddie Mac to free up space for higher-yielding credits. It then bought the securities that were formed to replace other, lower-yielding assets through an often overlooked program.

October 1 -

Similar to estimates published by Moody's and Morningstar, the data provider reckons that more than half of the loans are securitized by Fannie, Freddie or Ginnie.

October 1 -

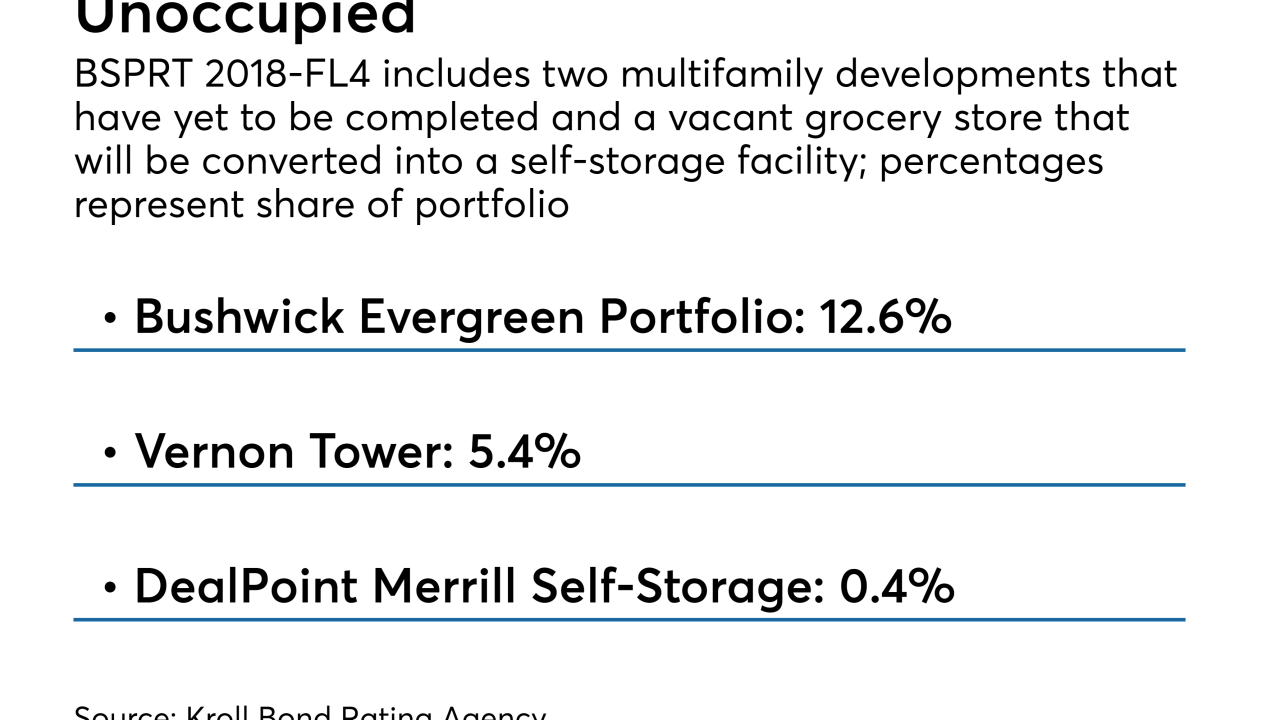

Three of the loans backing the $868.4 million BSPRT 2018-FL4 representing 18.4% of the collateral are either still under construction or have yet to be redeveloped, according to Kroll Bond Rating Agency.

September 24 -

Moody's sees $10.7 billion of securitized commercial mortgages at risk, Morningstar just $1.49 billion; both say loans in Freddie Mac K-deals account for a significant portion of exposure.

September 21 -

The sponsor acquired all three, Riverchase Galleria in Hoover, Ala., Columbiana Centre in Columbia, S.C.. and Apache Mall in Rochester, Minn., through its purchase of GGB Nimbus in August.

September 18 -

Commercial mortgage-backed securities delinquency rates are likely to continue to decrease for the rest of the year, as new issuances outpace maturing loans and precrisis loans continued to get resolved by special servicers, Fitch Ratings said.

September 17