A portion of a $1.7 billion loan refinancing Florida’s Aventura Mall is being used as collateral for yet another offering of commercial mortgage bonds.

A $100.3 million sliver is being used as collateral for a conduit securitization called Benchmark 2018-B5 Mortgage Trust, according to DBRS. It represents 9.9% of the $1.04 billion transaction.

The Aventura Mall is one of five loans representing a combined 27.6% of the collateral pool for the conduit, that, while not rated, exhibits characteristics consistent with investment-grade ratings, according to DBRS. The other loans are secured by eBay North First Commons, Workspace, AON Center and 181 Fremont Street. The Aventura Mall exhibits credit characteristics consistent with a BBB (high) shadow rating, eBay North First Commons exhibits credit characteristics consistent with an A (low) shadow rating, Workspace exhibits credit characteristics consistent with an AA (low) shadow rating, AON Center exhibits credit characteristics consistent with an A (high) shadow rating and 181 Fremont Street exhibits credit characteristics consistent with an AA shadow rating.

They help reduce the overall leverage in the transaction, which is backed by a total of 53 loans secured by 219 properties and has a weighted average debt service coverage ratio, as measured by DBRS, of 1.98x.

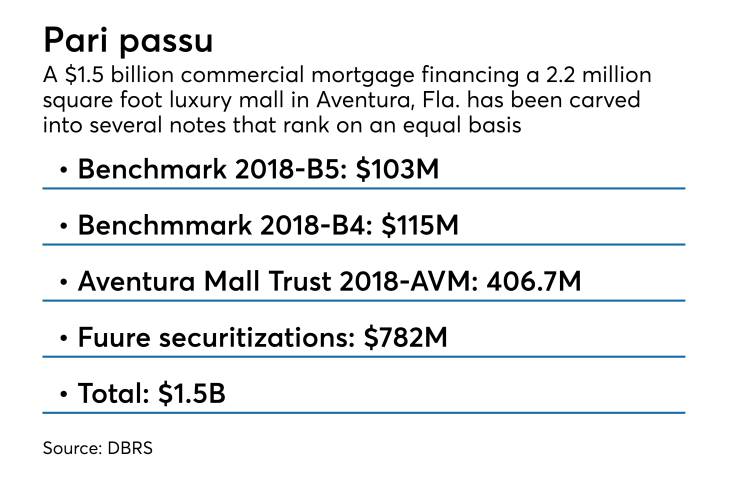

The Aventura Mall has to date been used as collateral in two other transactions. On June 7, its owners, a joint venture between Turnberry Retail Holding and Simon Property Group, obtained a $1.7 billion loan from four banks: JPMorgan Chase, Deutsche Bank, Morgan Stanley and Wells Fargo. The same month, $750 million portion was securitized in a transaction called Aventura Mall Trust 2018-AVM; another $115 million portion backs a transaction called Benchmark 2018-B4; the remaining $782 million has yet to be securitized.