The Palmer House Hilton, a 24-story building with 1,641 guestrooms in Chicago’s central business district, is the latest luxury hotel to be refinanced in the mortgage bond market.

In June, the owner, an affiliate of Thor Equities, obtained a $333.2 million first mortgage and a $94.3 million mezzanine loan from JPMorgan Chase, according to Moody’s Investors Service. The first loan is being securitized in a transaction called J.P. Morgan Chase Commercial Mortgage Securities Trust 2018-PHH. Moody’s expects to assign an Aaa to the senior tranche of notes to be issued. It is also assigning ratings ranging from Aa3 to B3 to seven subordinate tranches of notes.

The presale report does not indicate what kind of financing previously encumbered the property. However, the borrower still has implied equity of $132.2 million, based on the “as-is” appraised value of $560.0 million, according to Moody’s.

The rating agency puts the loan-to-value ratio of the first mortgage at 123.3%; however, the additional subordinate financing increases the LTV ratio, as measured by Moody’s, to 158.2%.

Palmer House Hilton is a nationally recognized historical hotel with landmark designation by the city of Chicago. It opened in 1871 and is the oldest continuously operating hotel in the nation. "We believe that in the event the asset were to go to market for sale, the Property would be attractive to a large pool of investors both nationally and internationally," Moody's states in its presale report.

Thor spent $168.6 million (or $102,719 per room) since acquiring the property in 2005. However, most of this was spent on a comprehensive renovation 10 years ago, between 2008 and 2009. The owner plans to spend an additional $28.5 million over the next five years to upgrade guestroom, food and beverage outlets, meeting space, as well as the lobby and other public areas. None of the proceeds from the refinancing will be reserved for the renovations upfront, however.

Net cash flow from the Palmer was fairly stable from 2014 through 2017, according to Moody’s, and rose 2% for the 12 months ended June 30, 2018.

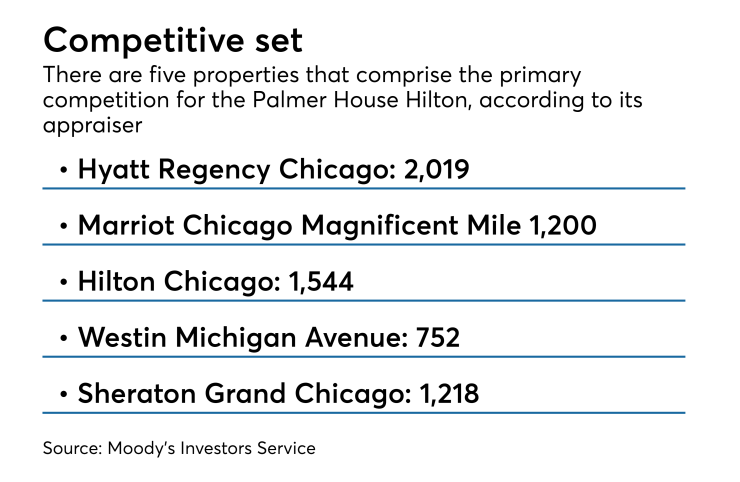

It has maintained its market position despite recent increases in room supply in the Chicago market. Revenue per available room penetration rates for 2014, 2015, 2016 and 2017 were 103%, 105.2%, 107.7%, and 107.2%, respectively.

There is additional supply in the works, however. The hotel's appraiser notes a total of 2,918 keys of potential new rooms across 13 properties within the next 18 months and another 1,043 recently announced development proposals across seven more properties.