A joint venture between MSD Capital, an investment vehicle for Michael Dell and family (50% interest), and Lake Avenue Investments (50%), is tapping the commercial mortgage bond market to refinance an “ultra-luxury” resort on the Big Island of Hawaii.

The owners have obtained a $450 million mortgage on a portion of the Four Seasons Resort Hualalai from Goldman Sachs. Proceeds were used to repay a exiting debt of $373.3 million (including a $300 million loan securitized in a transaction called GSMS 2015- HULA), return $62.2 million of equity to the sponsor and cover reserves and closing costs.

The new loan has been split into a senior $350 million A-note and a subordinate $100.0 million B-note; the senior note is being securitized in a transaction called GS Mortgage Securities Corporation Trust 2018-HULA, according to rating agency presale reports.

In addition to a full range of amenities, the hotel and resort benefit from 725 acres of prime frontage along the Kohala Coast (west coast) of the Big Island.

The hotel component of the collateral consists of 243 rooms spread across approximately 39 acres, which includes four pools; 37,000 sf of indoor and outdoor event space; and five food and beverage outlets. The resort component includes a private membership club (currently with 337 members); two 18-hole golf courses and clubhouses; the 30,700-square-foot sports club and spa; a beach club and watersports program; three additional pools; eight tennis courts; three retail outlets; five food and beverage outlets.

Unusually, the collateral also includes a rental management department and realty brokerage group, two utility companies, and approximately 55 acres of fee-simple residential land consisting of single-family lots and three unimproved commercial parcels.

The property has performed very well over the past several years; for the trailing 12 months ending in April, it had an occupancy rate of 86.7% and an average daily rate of $1,242.13, resulting in revenue per available room of $1,077.54; that’s up 3.6% over the year-earlier period and up 11.8% increase since DBRS last saw the hotel in the 2015 transaction.

The hotel, which has achieved AAA Five Diamond and Forbes Five-Star ratings for over 10 years, has also outperformed its peers, maintaining the highest revenue per available room among all hotels within the islands for the past several years.

“A key differentiator for the subject and support for the consistent positive revenue growth is its extremely high quality, diverse amenities and connection to the greater master-planned community that caters to and draws in the ultra-high-end target demographic,” DBRS states in its presale report.

Historically, however, club/resort operations have been operating in the red, only recently breaking even in 2014.

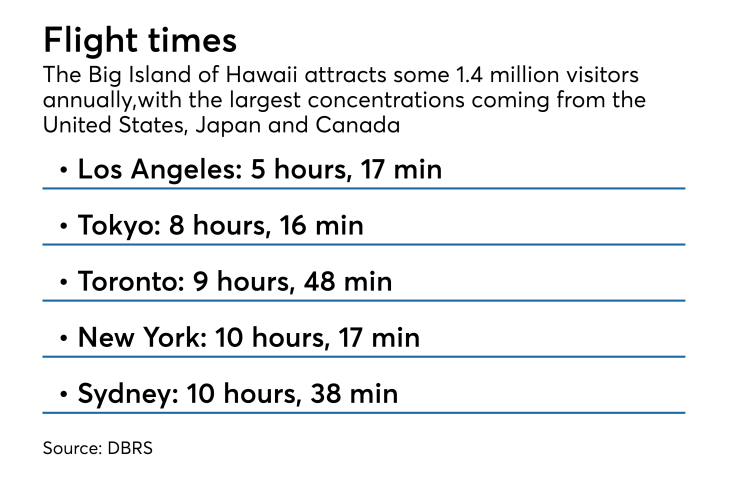

Both DBRS and Fitch Ratings cite the property’s susceptibility to natural disasters as an important ratings consideration. Located on the west coast of the Big Island of Hawaii, it is subject to windstorm, earthquake, tsunami and flood risks; the 2011 tsunami caused over $17 million in damage.

While the hotel has not directly incurred any damage from the Kīlauea Volcano that began to erupt on May 3, cancellations increased during May and July to 25-35 rooms a day from the normal average of five to 10 a day.

At 76.5% break-even occupancy, however, the hotel can withstand a relatively large 9% drop in vacancy and still cover debt service, assuming no paydowns from lots sales occur and relatively flat performance in all other aspects, according to DBRS.

The collateral is also highly leveraged; DBRS puts the loan-to-value ratio on the A-note along at 104.5%, which it said represents an “elevated refinance risk.” This is calculated using the rating agency’s “stressed cap rate,” which is likely over 400 basis points higher than the current market rate. By the appraiser’s as-is estimate of current market value, the leverage is much lower at 50.6% LTV.

Fitch Ratings puts the “stressed” LTV even higher, at 117.1%.

The joint owners, MSD Capital and Lake Avenue Investments serve as non-recourse carve-out guarantors must maintain minimum net worth and liquidity of $125. million and $12.5 million, respectively, throughout the loan term.

Both DBRS and Fitch Ratings expect to assign an AAA to the senior tranche of notes to be issued, which benefits from 64.9% credit enhancement.