-

Apartment buildings account for 78.8% of the $341 million balance of the deal; that's up from 58% of a $304 million deal completed in March.

September 14 -

The $300 million transaction has a six-month prefunding period during with the last $50 million of loans will be acquired; it can be actively managed for three years.

September 10 -

The real estate investment trust is securitizing a $225 million mortgage on a portfolio of 10 hotels owned by Taylor Woods and Howard Wu, founders of Urban Commons.

September 6 -

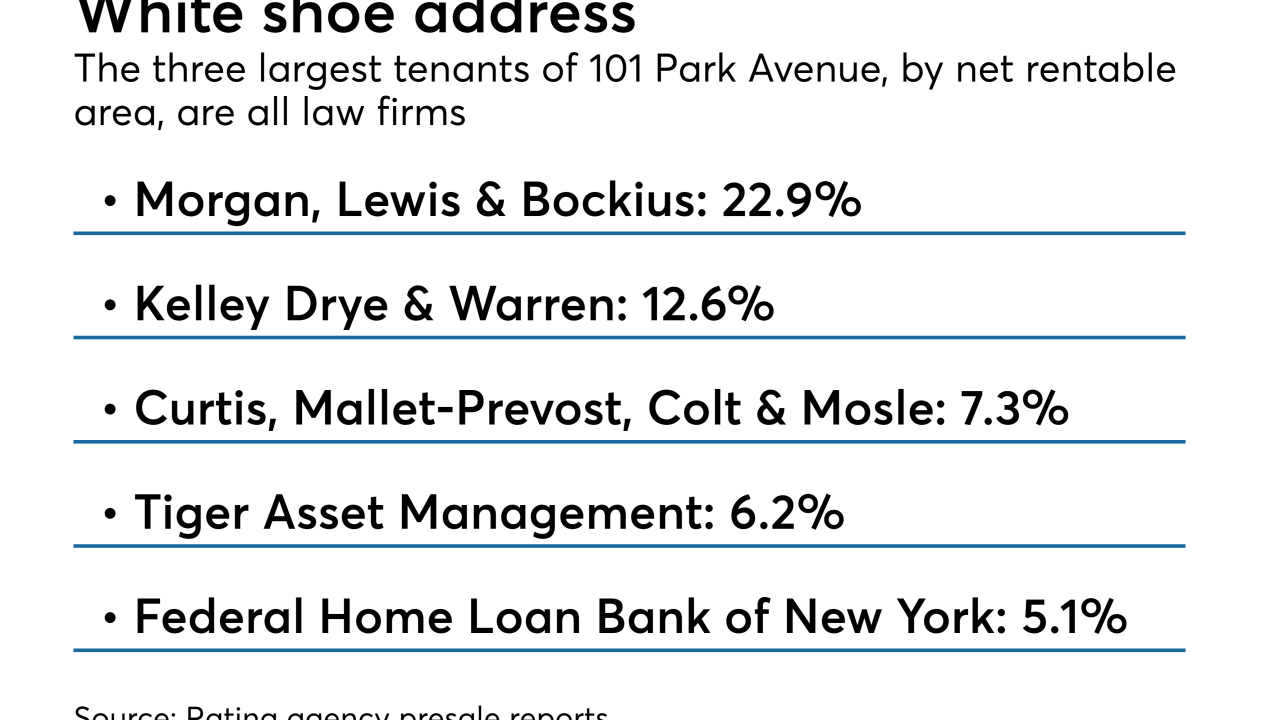

Peter S. Kalikow, a leading New York City real estate investor, is tapping the securitization market for a cash-out refinancing of a 1.3 million-square-foot, 48-story building at 101 Park Ave.

August 22 -

The single-loan securitization is through Morgan Stanley on suburban properties mostly concentrated in the Washington, D.C., area.

August 14 -

TPG Capital is including its newly acquired first-lien interest in a Microsoft-leased office campus in Redmond, Wash., in a portfolio of suburban office properties it is financing through a new two-year commercial loan.

August 13 -

Though not heavily indebted, the 1.5 million-square-foot Fair Oaks Mall has anchored by department stores that have announced store closures, and has below-average inline sales.

August 7 -

The eligibility criteria for loans that can be acquired are “more liberal” than recent CRE CLOs rated by Kroll; they are also more liberal than those of Hunt’s initial CRE CLO, completed last year.

August 3 -

A joint venture between an investment vehicle for Michael Dell's family and Lake Avenue Investments obtained a $450 million mortgage on the Four Seasons Hualalai from Goldman Sachs.

August 1 -

The bank is balancing that exposure with a greater amount of property diversity and the the inclusion of three large investment-grade-type loans for UBS Commercial Mortgage Trust 2018-C12.

July 31