-

A $333 million first mortgage on the Palmer House Hilton, a 24-story building with 1,641 guestrooms in Chicago’s central business district, is being securitized by JPMorgan Chase.

July 27 -

A $100.3 million sliver of the $1.7 billion loan is being used as collateral for a conduit securitization called Benchmark 2018-B5 Mortgage Trust, according to DBRS. It represents 9.9% of the $1.04 billion transaction.

July 25 -

Extell Development obtained a 119-month, $110 million mortgage and two mezzanine loans totaling $140 million from Natixis; proceeds repaid existing debt of $209.2 million and funded closing costs as well as a rent step-up reserve.

July 24 -

The transaction, Shelter Growth CRE 2018-FL1, is backed by 22 properties with a total balance of $415.1 million; it is static, meaning the only new loans to be added to the trust will be "companion” interest in loans secured by existing assets.

July 23 -

The owner of Casa del Mar and Shutters on the beach obtained $430 million of loans from Morgan Stanley; it is putting down $792,815 of equity and paying a prepayment penalty to refinance.

July 18 -

Unusually for a debut transaction, the $329.7 million M360 2018-CRE1 will be actively managed: For the first 12 months after the closing date, funds from repaid principal can be used to purchase new loans, subject to eligibility criteria.

July 17 -

The private equity firm recently obtained a $415 million first mortgage from Barclays and Morgan Stanley; proceeds, along with $125 million of mezzanine loans, will be used to repay existing debt of $512 million that was securitized in two prior deals.

July 16 -

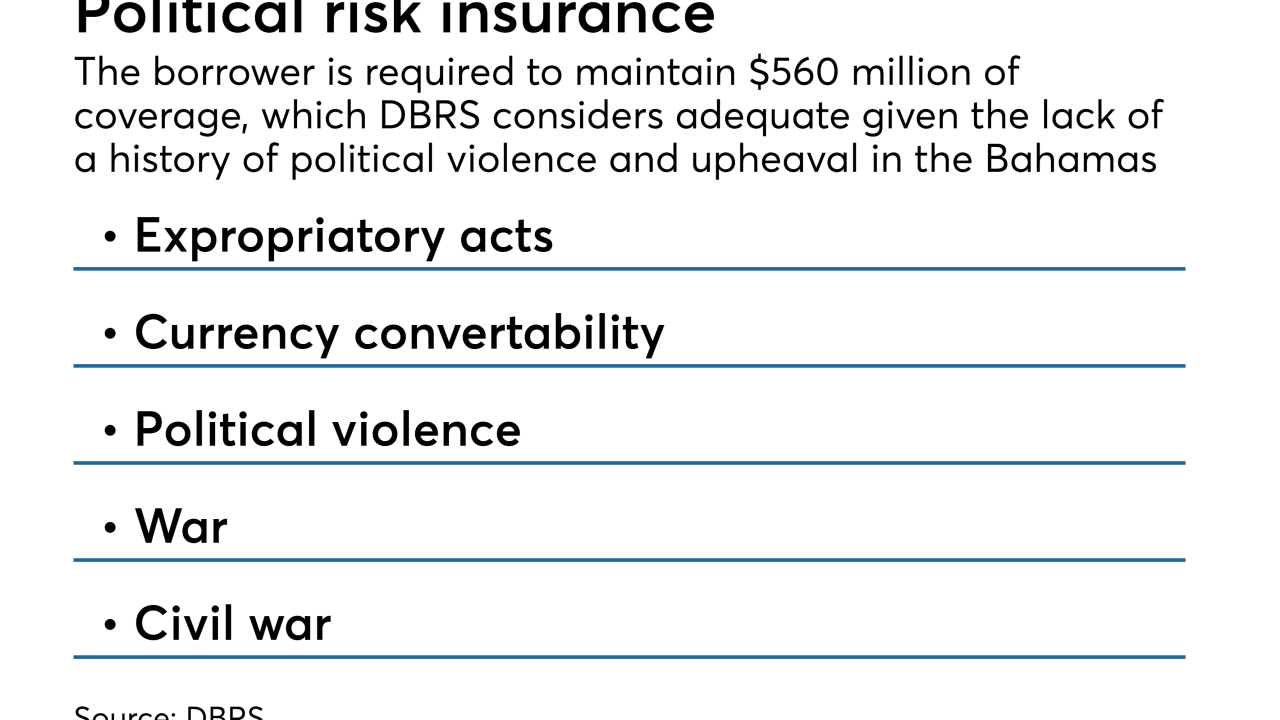

It has obtained a $1.2 billion loan on Atlantis Paradise from Citigroup and Goldman Sachs that will be used as collateral for an offering of mortgage bonds; proceeds will be used to repay existing debt and cash out $149 million of equity.

July 9 -

Aluko counsels clients on legal aspects of investment management, private investment funds including real estate funds, private equity funds, and hedge funds, derivatives, and regulatory matters; he joins the firm from SECOR Asset Management.

July 2 -

Commercial and multifamily mortgage debt outstanding grew $44.3 billion during the first three months of 2018, the largest first-quarter gain since before the Great Recession, according to the Mortgage Bankers Association.

July 2